Weather: Too much of a good thing. Rain continues to hinder winter crop harvest pace in the US – particularly in OK which received another soaking over the weekend. Rain forecast is pointing more to the SRW growing regions for the next 7 days but it’s difficult to ascertain damage potential.

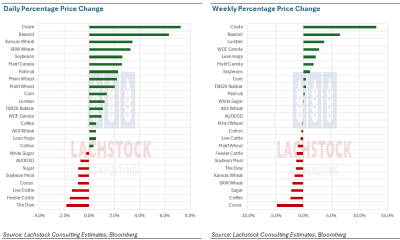

Markets: Ag markets rallied on Friday night as the world tries to extrapolate the impact of the increasing military activity in Iran and Israel. Both countries are net importers of wheat but the main impact will be on the energy sector. Impossible to predict how this plays out – but I’m amazed that our markets are able to largely ignore the several conflicts that are taking place.

Australian Day Ahead: Bunge and Viterra merger looks like is a go – not sure how quickly things happen subsequent to the Chinese giving the nod. Chicago strength and lower AUD will help bids, however, it’s all about Russia FOB levels which remain unchanged into the end of last week.

Offshore

Offshore

Wheat

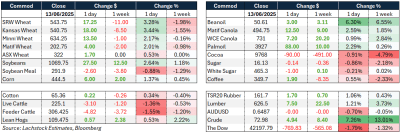

Wheat markets have shown renewed strength with rallies in key US contracts: Chicago wheat (WN) gained 9.25 cents, Kansas City (KWN) up 6.75 cents, and Minneapolis (MWN) led with a 10-cent rise.

This bullishness followed a couple of closes above the 50-day moving average, encouraging buyers and sparking short covering, particularly in Minneapolis where managed money (MM) short positions were reduced significantly.

The main driver remains concerns about dryness and weather stress in the Northern Plains and Canadian Prairies, with some relief expected after June 12. However, too much rain poses risks for Hard Red Winter (HRW) and Soft Red Winter (SRW) wheat areas.

In Europe, northern regions are forecast to receive decent rains while the Black Sea region faces hot and dry conditions next week, potentially stressing crops.

Russian wheat cash prices hover around $227, and Paris Matif futures also gained €2.00 for September delivery.

Ukraine’s grain exports, including wheat, are forecast to fall due to a reduced harvest, while France’s soft wheat conditions remain stable but slightly down compared to the prior week.

Romania expects a record wheat harvest due to favourable spring rains, while Crimea has started harvesting ahead of schedule.

Iraq has procured 3.4 million tonnes (Mt) of local wheat this season.

The United Nations Food and Agriculture Organisation expects global wheat stocks to decline to the lowest level since 2021-22, down to 310Mt in 2025-26, despite a slight increase in world wheat production to about 800Mt.

The European Union is engaging in trade talks with the US on fertiliser tariffs which could impact input costs for wheat growers.

Other grains and oilseeds

Corn markets have shifted from weak to firmer as old crop sales emerge from the Pacific Northwest and a large speculative long in corn was reportedly closed out.

US corn production for 2025-26 is forecast to rebound 3.8pc to a record 1.26 billion tons, led by gains in the US, Brazil, China, the EU, South Africa, and Ukraine.

Weather in the US southern belt is becoming more favourable with warming temperatures as summer approaches.

Managed money shorts in corn increased to 154,000 contracts from 101,000, reflecting mixed market sentiment.

Soybean markets are supported by rumours around the Renewable Volume Obligations (RVO) and biofuel policy impacts on soybean oil, although uncertainty remains high over US soybean production and demand.

Brazil’s 2024/25 soybean sales are tracking at 64pc complete, slightly behind last year’s pace.

Argentina’s soybean yields continue higher than expected despite a slower-than-normal harvest.

China has allowed imports of rapeseed and soybean meal from Uruguay to diversify food supplies, while Latin American currencies benefit from a weak US dollar, boosting local agricultural trade.

The US Environmental Protection Agency is under intense industry pressure regarding biofuel mandates, indicating regulatory developments may soon influence soybean and corn markets.

Macro

Global macroeconomic conditions are being affected by rising geopolitical tensions in the Middle East, particularly the escalation of conflict between Israel and Iran.

Recent Israeli strikes on Iranian nuclear and military sites have triggered Iranian missile and drone attacks on Israel, causing casualties on both sides and raising concerns about wider regional instability.

The conflict has intensified risks to global energy markets, with attacks on Iran’s critical energy infrastructure near the Persian Gulf raising fears of disruptions in oil supply.

The Strait of Hormuz, a strategic chokepoint for about 20pc of global oil shipments, faces increased risk, contributing to a 7pc surge in oil prices amid the conflict’s onset. This volatility has prompted investors to seek safe-haven assets such as gold and caused declines in global equity markets.

Meanwhile, the US economy continues to show resilience despite these external shocks, with strong labour markets and steady consumer spending supporting growth. However, rising energy prices and global uncertainty could pose headwinds to inflation and economic stability if the conflict escalates or prolongs.

Australia

In WA new crop canola bids firmed late in the day on Friday to A$870/t fis, with GM moving up to $795 fis. Current season wheat & barley remained steady at $355 and $340 respectively in Kwinana.

Across in the east, canola was slightly firmer at $800 for 24/25 and $825 for 25/26. Current season wheat was unchanged at $348 and barley at $340.

Lamb prices continued to soar across the week, heavy cross-bred lambs reached $431 per head at Griffith.

On the rainfall front, over the weekend 1-10mm fell across Albany/Sth Kwi zone and the same falls for the majority of SA. 1-5mm fell across the Vic Mallee, and similar either fallen or expected to fall today across Vic.

HAVE YOUR SAY