Weather: Large hail is forecast through a large part of the SRW belt over the next 48 hours according to the NOAA in the US but it should also park some moisture in the driest part of the corn belt. Germany finally set to get a small drink, as should southern Russia. Nothing market moving here.

.

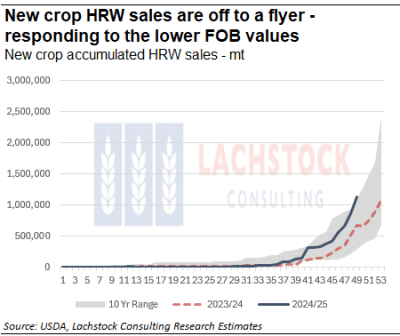

Markets: Big new crop wheat sales and the sustained decile one spread to corn should provide underlying support to US wheat futures. The function of the market is to clear supply – it would seem we are doing that, at least in the US.

Australian Day Ahead: It’s May but the focus on new crop production is captivating. The latest outlooks are mixed to dry but the consensus view of a wet spring makes production outlooks volatile. The southern market has a large percentage of this years expected planted area in the ground so a false break would be the worst outcome. Values should be firm today.

Offshore

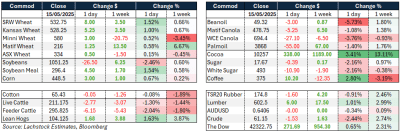

US wheat futures extended gains with WN, KWN and MWN all closing higher, helped by firm spreads, short covering, and strong export sales of 804.8kt, including 183kt to unknown destinations likely in LATAM and West Africa.

Despite ample global supply and competition from exporters like Russia and Europe, there is fresh demand interest from Algeria and Saudi Arabia, while Egypt continues to actively procure domestically and monitor imports from Russia.

The Kansas wheat crop is forecast at 53 bu/acre, higher than USDA’s 50 bu/acre projection and last year’s 46.5, with production seen at 338.5 million bushels. However, drought stress and wheat streak mosaic virus may cap yields in some areas.

The global wheat outlook remains heavy, with the USDA forecasting record production and stockpiles at 265.7Mt for 2025/26.

Stratégie Grains lifted its EU soft wheat estimate to 129.8Mt amid strong yields in southern regions.

Russia’s domestic wheat growers continue to struggle with export duties and subsidy shortfalls, even as soft wheat values recover slightly on the export front.

Other Grains and Oilseeds

Corn futures were mixed with CN up, while CU and CZ declined.

Weekly export sales surprised to the upside with 2.19Mt combined, led by South Korea and Mexico.

Brazil’s CONAB raised its corn output estimate to 126.9Mt, still below the USDA’s 130Mt, creating speculation that Brazilian FOB values may ease. Ethanol demand and internal restocking in Brazil remain influential.

Ukraine maintained its 2025 grain production forecast at 56Mt, despite widespread frost and drought-related crop stress.

Meanwhile, the USDA’s WASDE report projected 2026 red meat output to fall by 1.7pc, largely due to a 4.9pc cut in beef production, the lowest since 2015. Pork output is seen rising marginally, with both beef and pork exports forecast to decline slightly.

Soybeans fell sharply, with SN and SX down over 26c and bean oil plunging the limit as positions unwound ahead of an expanded trading range.

Meal rose modestly on short covering, lifting crush margins.

The NOPA crush for April came in at 190.2 million bushels, above expectations and year-ago levels, with soybean oil stocks at 1.527 billion lbs.

Biofuel policy uncertainty, particularly around the final Renewable Volume Obligation (RVO) levels now sent to the White House, has added volatility to the oil complex.

Palm oil also pulled back on rising Malaysian supply expectations and collapsing soy oil prices.

Macro

US data signals a soft start to Q2. April retail sales control group fell 0.2pc m/m (vs +0.3pc expected), indicating weaker goods consumption.

Manufacturing output declined 0.4pc, and the PPI fell 0.5pc m/m, with broad disinflation across goods and services. The labour market remains firm, but overall, demand growth is cooling. This supports expectations for a Fed rate cut as early as September, with recession risk seen at around 30pc.

Globally, trade dynamics remain fluid. China has suspended rare earth export restrictions on 28 US entities as part of a 90-day de-escalation move.

Meanwhile, the WTO warns US bilateral tariff deals could fracture global trade and reduce volumes by up to 1.5pc.

Trump also claimed India may eliminate all tariffs on US goods, though no formal deal is confirmed.

The broader trend reflects rising geopolitical trade recalibration amid slowing global demand.

Australia

Canola bids in the west were A$850/t for new crop yesterday and $791/t for current crop. Wheat was $350/t and $360/t, while barley was $350/t and $335/t. In the east, bids improved, with current season canola at $785/t, wheat at $357/t, and barley at $350/t.

Corn bids continue to strengthen, with ex-farm MIA prices around $385/t, driven by strong feed demand from mills, dairies, and sheep farmers.

The next 14 days show no widespread rainfall in the forecast, which is expected to push feed values higher and continue pricing grain further north into NSW to meet demand.

The domestic barley market is trading above export parity, with EC track at approximately $345/t versus export parity around $320/t, reflecting strong local demand.

HAVE YOUR SAY