Weather: The rain centered on the SRW belt moves into the heart of the HRW growing states. KS and NE are set to get 2-6 inches over the next 2 days. OK and KS harvest actually made some decent progress last week despite the rain. .

Markets: How do you navigate the unrest. Close to impossible. It might sound cold but our markets have actually been pretty resilient over the last 3 or 4 trading sessions. The lesson from the Russian/Ukraine conflict is the markets trade war for 2 days then give back the risk premium. However,

Australian Day Ahead: G7 is another source of trading fodder. Feels like we are not at the negotiation table just yet and Israel is seemingly putting the hammer down – Trumps announcement that the people of Tehran should evacuate is significant. AUD mid 0.6500 and weakness in Russia cash should keep bids on the defensive.

Offshore

Offshore

Wheat

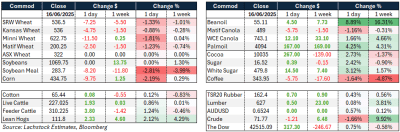

Wheat eased with WN down 7.25c, KWN off 4.75c, MWN -11.5c, and Matif Sep -€2.50.

Russian cash dipped near $223. Weak spreads and muted volatility reflect a market adjusting to harvest nearing with minimal production threats.

US inspections were 389k, 16.8pc behind last year.

Winter wheat ratings fell to 52pc good/excellent (vs 54pc prior and expected), while spring wheat improved to 57pc (vs 54pc expected).

Romania is forecast to harvest a record 12.2Mt in 2025/26, up 2Mt YoY, making it a key EU exporter. MARS cut Ukraine’s soft wheat yield to 4.28t/ha (vs 4.43 LY, 5yr avg 4.22).

Russia’s May seaborne grain exports plunged 63pc YoY due to export quotas.

Algeria tendered for soft wheat. Heavy rains in the US Southern Plains will delay harvest and have raised quality concerns. Depending the level of impact, this can actually weigh on futures as high vomitoxin wheat finds its way into the futures delivery system.

Other grains and oilseeds

Corn declined on benign US weather: CN -9.75c, CU -8.75c, CZ -8c. Inspections were solid at 1.67Mt, +28.5pc YoY.

Crop ratings ticked up to 72pc g/e (vs 71pc expected), matching last year.

Brazil’s winter corn harvest reached just 5.2pc, well behind 21pc last year, potentially keeping the US competitive in exports.

Beans were mixed: SN flat, SX +5.75c.

New-crop interest rose as cash weakened and the expanding RVO drew focus to Nov-25 Soybeans.

NOPA crush came in slightly light at 192.8M bu (vs 193.5M expected), still above last May. Oil stocks were tight at 1.373B lbs (vs 1.495B expected).

July-25 soybean oil rallied up limit while July-25 soybean meal fell $8.20. July crush surged 31.25c to 160.5.

Soybean conditions slipped 2pc to 66pc g/e (vs 68pc expected, 70pc LY).

Ukrainian sunflower seed output was cut to 14.7Mt (from 15.2Mt), oil production and exports also revised lower.

Malaysian palm oil gained nearly 4pc on rising soyoil and Middle East tensions.

Macro

Geopolitical risk remains high. President Trump called for the evacuation of Tehran, escalating rhetoric as Israel continues strikes and claims to have damaged Iranian nuclear and missile infrastructure.

Iran signalled openness to talks, but Israeli PM Netanyahu insisted military operations would continue.

Markets are balancing between ceasefire hopes and fears of wider conflict. Trump and Putin discussed the conflict and Ukraine in a 50-minute call.

Empire Manufacturing Index showed weakness (-16.0) with declining new orders and shipments but a rise in employment and improved 6-month outlook.

Trade discussions continue: Trump is pushing for deals with Japan, India, and Vietnam while the UK’s Ensus ethanol facility faces closure due to US tariff-free access.

The Fed is expected to hold rates steady, with markets watching for updated projections and any shift in Powell’s guidance.

BoE likely to pause amid slow wage disinflation; BoJ expected to hold after cutting growth forecasts.

G7 summit in Alberta clouded by global trade friction and geopolitical uncertainty.

Australia

WA canola started the week strongly with new crop bids pushing up towards A$890. Cereals didn’t see the same support, remaining unchanged from Friday, with wheat at $363 and barley at $330.

Through the east, canola was also firm with new crop bids at $840. Current season wheat and barley were bid at $345 and $342, respectively.

Delivered new crop canola bids reached $865 into Footscray yesterday. New crop lentil bids are at $775 delivered into Melbourne/Geelong, compared to $860 for current crop.

ABARES forecasts a strong pulse season, with chickpea production at 1.877Mt and lentils at 1.492Mt, supported by Indian market access (through Mar ’26) and strong returns—though South Australia continues to face dryness concerns.

HAVE YOUR SAY