Weather: The USDA pegs the Kansas harvest at 5 percent vs 8pc normal, however, there is 2-4 inches forecast for the next week which will possibly put harvest outside the recent range. Some rain forecast for Russia but it’s getting late to add any benefit.

Markets: Your guess is as good as mine. It’s impossible to disentangle the geopolitical noise from fundamentals. Some genuine fundamental support exists but, it felt like risk on from a capital flow perspective today

Australian Day Ahead: AUD back under 0.65, both oilseeds and grains higher – should see WA wheat new crop get to $380 and canola should be well bid. Higher across the board for me.

Offshore

Offshore

Wheat

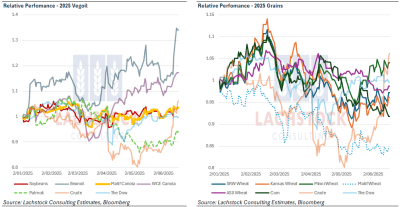

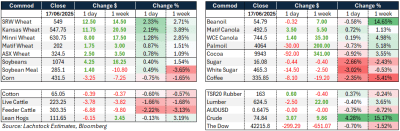

Wheat futures rose in Chicago, with soft and hard red winter contracts gaining over 1pc, as early US winter wheat harvest progress came in behind both last year and analyst expectations.

Heavier rains, particularly in Kansas, have delayed harvesting efforts. The Hightower Report noted that the intense precipitation is “not ideal with harvest starting,” and forecasts suggest more rain is on the way. Despite the delays, crop condition ratings for spring wheat improved, with USDA raising the good-to-excellent rating to 57pc, above the previous week’s 53pc and ahead of market expectations.

There has been renewed international buying interest, with Algeria and Tunisia issuing tenders, likely to secure early-season coverage. This underscores the persistent global demand, even as Black Sea supply remains dominant.

The futures market appears to be supported in part by short covering, as well as by technical buying after pushing to the top end of recent trading ranges. Still, prices remain historically low.

Winter wheat led the rally, reflecting a combination of deteriorating condition scores, harvest delays, and broader geopolitical risk.

Market participants are watching closely for any news from Russia and Ukraine or potential port disruptions in the Black Sea, which could quickly shift the tone. Traders also flagged the potential for volatility in July, as harvest combines ramp up and market focus returns to both physical supply flows and geopolitical flashpoints.

Other grains and oilseeds

Soybeans climbed back above February’s crop insurance price, testing resistance around 1075c.

Continued upside likely hinges on Chinese buying and further positive demand signals. Soybean oil surged limit-up for two straight days before pausing, reflecting strength tied to energy markets and potential upside if crude oil rallies. However, technical resistance and unclear RVO (renewable volume obligations) pricing implications suggest limited room without new drivers.

Corn spreads remain weak, especially July vs. September/December, raising doubts about USDA’s earlier yield cuts.

The market seems unconvinced by official supply estimates, with some suspecting unaccounted 2023 corn still in the system.

Basis strength in the eastern Corn Belt contrasts with weaker western values.

Attention now turns to the June 30 stocks and acreage report, with possible downside revision to corn acres from 96 to ~95 million.

Macro

Rising geopolitical tensions as the Iran-Israel conflict escalates. Trump’s call for Iran’s “unconditional surrender” and threats toward Iran’s Supreme Leader hint at potential US military involvement. This has included moving the USS Nimitz carrier group to the region.

The US economy shows signs of slowing—May data revealed weaker core retail sales and industrial production, while new tariffs (including on pharmaceuticals) loom.

Domestic demand is expected to slow through Q2–Q4, easing inflationary pressure, though some firms still plan to pass costs on.

The Fed is not expected to change rates at its next meeting, but market focus is on any shift in tone from Powell amid service sector disinflation.

Australia

WA canola bids were slightly softer, with new crop bids easing to A$875 for conventional and $805 for GM. Cereals were steady, with wheat at $364 and barley at $330.

Through the east of the country, canola was $7–$10 softer, with new crop bids at $835 for conventional and $767 for GM. New crop wheat bids were $364, and barley was $315.

Delivered wheat markets into Melbourne/Geelong are around $370 for SFW, with H2 bids only $5 higher, highlighting the underlying strength of the domestic feed market.

Follow-up rain is forecast for most of the country, with WA set to receive a good drink—1–2 inches expected across most regions over the next week.

HAVE YOUR SAY