Weather: Recent showers in the Central and Southern Plains increasing soil moisture for developing winter wheat. More this week as well. More rainfall in the Delta and Midwest SRW wheat areas unfavorably wet for some areas. Winter wheat in the Black Sea region needs more rainfall, but only limited showers have been falling. Drier conditions in Europe this week is not concerning (i keep looking at Germany and wonder why its not concerning, but there you go). Some drier areas in northeast EU getting some rain later this week. Drought still exists in North Africa and showers have become limited again. Winter wheat in China needs more rain. Very little rainfall is forecast this week. Mostly favorable conditions for early planting in the Canadian Prairies.

Markets:Punxsutawney Phil would be bored right now. Feels like we have been waiting for weather volatility for months and, now that we are in the eye of the storm, nothing gets us excited. Wheat balance sheet remain tight but solvable, particularly with sluggish demand. Egypt and China return to the market but even that was ho hum.

Australian Day Ahead: In AUD terms, Chicago wheat is circa Decile 1. Russian cash is anchored to $250/mt FOB and planting conditions for much of the east coast belt are challenging at best. Add in some Donald randomness and it makes sense that direction is less than clear. Old crop is well supported in the south and new crop WA basis is impressive.

Offshore

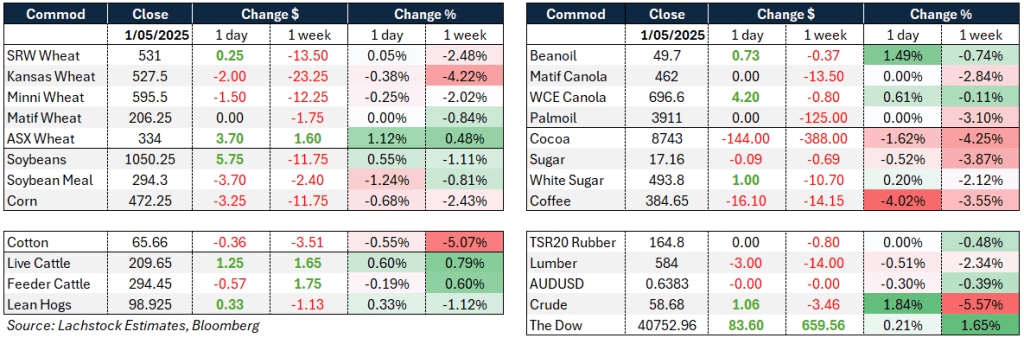

Wheat – Wheat futures were mixed to flat amid low participation due to holidays in Paris and Russia.

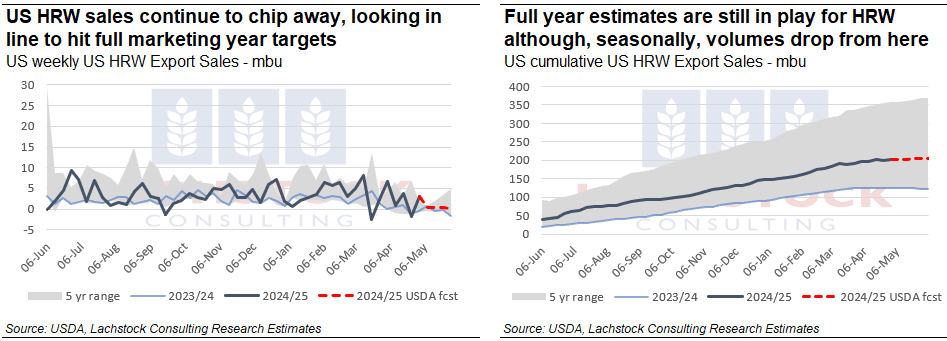

A brief rally was driven by speculation that Morocco purchased U.S. HRW wheat for the first time since 2020, enabled by lower freight and FOB prices.

Weekly export sales were in line with expectations, with key buyers including Nigeria, Colombia, Thailand, and Brazil.

Weather-wise, rain in the U.S. Southern Plains could become excessive, while dryness persists in the EU, Black Sea Eastern Area (BSEA), and China.

However, the wheat market remains sluggish, weighed down by a stronger U.S. dollar and fading early-session support. For futures to rally higher, weather disruptions or sustained demand would be needed.

Other Grains and Oilseeds – Corn futures were weaker, with CN falling to $4.71 1/2 as planting conditions across the Corn Belt remain favorable.

Rapid planting progress and increasing soil moisture are boosting expectations for strong 2025 yields and possibly higher planted acres.

Export sales for the week were slightly below expectations at 1.01 MMT. There’s skepticism about feed demand assumptions and concern that Argentina and Brazil could displace U.S. exports in coming months.

Soybeans rose modestly, driven by a surge in soybean oil on U.S. legislation to extend the $1/gallon blender credit through 2026.

Chinese buying returned, with 139.4k MT booked, helping weekly soybean sales exceed expectations.

Soymeal and soyoil sales were near or below expectations.

July crush margins softened slightly.

The cattle trade, indirectly tied to grain demand, saw developments as the U.S. and Mexico reached a compromise on screwworm pest control, allowing cattle imports to continue.

Macro – Equity markets firmed on upbeat U.S. tech earnings and better-than-feared manufacturing data.

Anticipation of tariff-related announcements added to optimism.

The S&P 500 rose 0.6% and Nasdaq gained 1.5%. Bond yields climbed, with the 10-year U.S. Treasury up 7 basis points to 4.22%.

Oil rebounded 1.6% to $59.20/bbl following reports of lower-than-expected OPEC output and a warning from President Trump about secondary sanctions on buyers of Iranian oil.

Gold edged up 0.1% to $3,239/oz.

Markets are starting to factor in the lagging but potentially material impact of ongoing U.S.-China tariffs.

Australia – Canola was softer in the west, with bids down $10–$15 on both old and new crop. Wheat was slightly firmer, with bids up $3 to around $358, while barley was at $346.

In the east of the country, it was a similar story. New crop canola eased back to $785, while cereals were firm, with wheat at $342 and barley at $335.

Corn has firmed in recent weeks, with end users seeking alternatives to barley and wheat in rations. Bids are around $345 through the Goulburn Valley and Central Victoria areas.

With nearly no rainfall forecast over the next two weeks for any part of southern Australia’s cropping regions, those holding old crop are likely to sit on their hands and wait for a meaningful rain event. China’s return to the market with a 400kmt purchase of Australian/Canadian wheat didn’t spark much excitement this week—but it’s a positive sign nonetheless.

HAVE YOUR SAY