Weather: Back to groundhog day – some question marks exist, but nothing that should rattle the short.

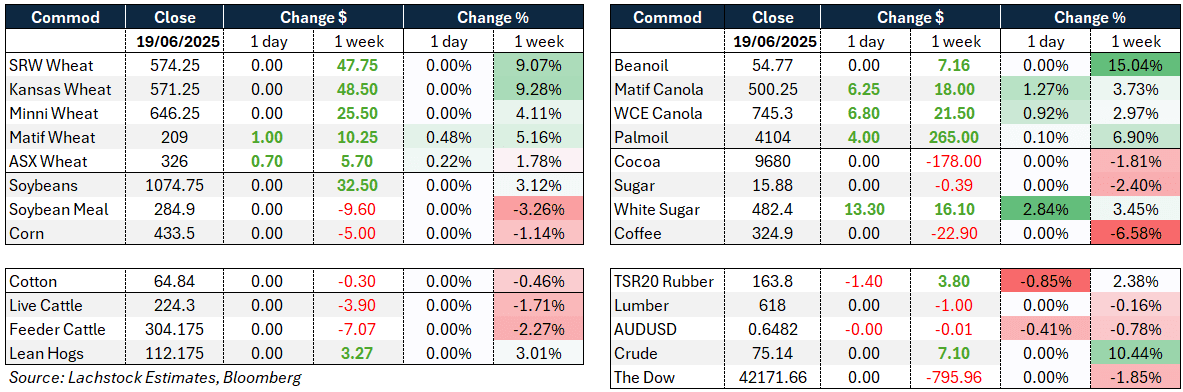

Markets: Recent wheat futures strength has been attributed to a combination of weather spot fires and increasing tension in the Middle East; on face value, it seems more about capital flow, unless the consumer rocks up in style.

Australian day ahead: Some strength yesterday probably moved some grain from the grower to the trade. Offshore markets will be fascinating tonight post a mid-week holiday. Trump’s indication that he will decide in two weeks if he will unleash the kraken keeps global markets on edge.

Offshore

Russia’s key wheat-producing region of Krasnodar has declared an agricultural emergency across eight districts due to drought, with 15 percent of winter crops reported in poor condition. The northern part of the region, where much of the winter wheat is sown, is the most affected. Rostov, another large grain-growing region, had already declared a similar emergency in 10 districts. Despite last year being weather-challenged for Russian crops, Krasnodar had led national production with 13.5 million tonnes of grain and legumes.

Australia

A positive day for wheat in the west of the country, with the global rally somewhat reflected in domestic prices. New-crop wheat bids rose A$7/t to $373, while current-crop bids increased $5 to $360. Canola was also stronger, with new-crop bids at $890 and barley at $336.

In the east, it was a similar story, though price gains were more modest. Current-crop wheat bids rose $3 to $352, and new-crop bids increased $3–$5 to $365. Canola remained largely unchanged at $840 for new crop and $822 for current crop, with barley at $343 for the current season.

Yesterday’s uplift in wheat bids gave growers an opportunity to sell some current-crop stocks ahead of the end of the month, when storage costs come into effect.

Dry conditions have driven destocking to the point where lamb numbers are heavily reduced, leading to a strong price rally fuelled by robust export demand and processors competing to secure enough supply. Australia exported a record 360,000t of lamb in 2024, and export numbers for this year are 2pc higher, led despite tariffs by the US, China with expanded abattoir access, and Papua New Guinea emerging as a key market, with prices expected to remain strong through winter and early spring.

HAVE YOUR SAY