Weather: Increasing reports of frost damage from the March cold snap in Russia are gaining momentum and, with US crop conditions slipping a little, the debate around global production is driving order flow.

Markets: With speculative positioning in ag markets as extreme as we are currently experiencing, it makes sense that there should be some swings from time to time. It really is as simple as uncovering a level where the demand side of the equation feels some discomfort – something that has been lacking in our markets.

Australian day ahead: Rainfall forecasts are a little less today but there is still decent moisture in southern New South Wales. Rain forecast for Western and South Australia looks pretty coastal, and old and new-crop values should be relatively unchanged.

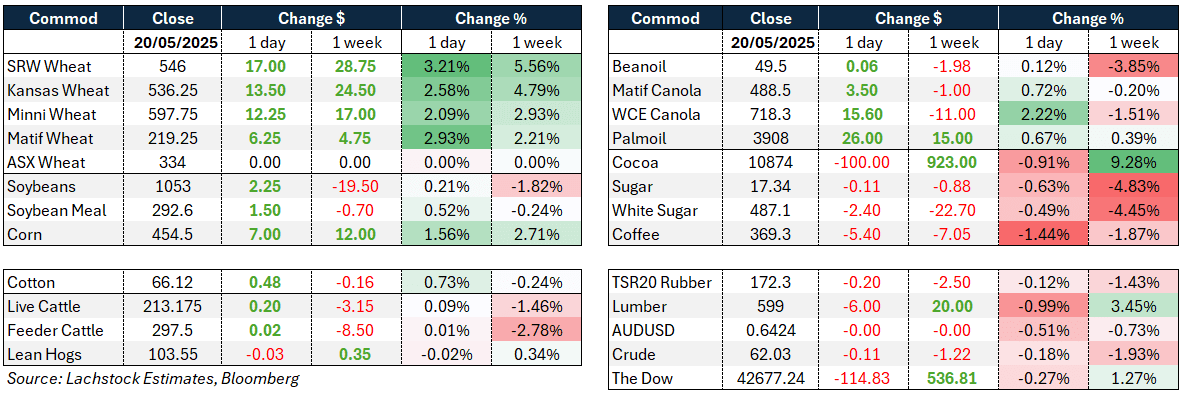

Offshore

Wheat futures rallied strongly, led by short covering and renewed production concerns. July contract jumped 17c per bushel in Chicago, 13.5c in Kansas, and 12.25c in Minneapolis. Key drivers included frost damage in southern Russia and parts of Ukraine, extreme heat in China’s Henan and Shandong provinces, dryness across northern Europe and Australia, and a continued retreat in US crop conditions. The global speculative short position, estimated at over 500,000 contracts, remains a risk catalyst.

Syrian wheat output may fail by 75 percent due to severe drought, threatening food security. Meanwhile, Argentina extended its wheat export tax cut until March 2026, and EU soft wheat exports for the 2023-24 marketing year from July 1 to May 18 totaled 18.5 million tonnes (Mt), sharply down from 27.9Mt over the same period last year, a drop of more than 33pc. The leading destinations were Morocco on 2.66Mt, Nigeria on 2.54Mt, and Algeria on 1.56Mt.

Global demand sentiment improved, with China and Turkiye possibly returning to the market.

Spring wheat planting in the US is 82pc complete, slightly ahead of expectations.

Other grains and oilseeds

Corn was supported by talk of Chinese reserve purchases and Argentine flooding, with the Chicago July contrauct up 7c and December up 6.75c. US corn planting slowed, now at 78pc, slightly behind trader expectations.

Dr Cordonnier’s Brazilian corn estimates were raised by 2Mt to 129 Mt, driven by record yields across key safrinha-producing states.

Argentine flooding could reduce soybean output in key provinces, although crop consultant Cordonnier kept his soy and corn forecasts unchanged at 50Mt each.

Soybeans were mixed; July gained 2.25c and November 4c.

The market lacked clarity, with Chinese demand outlooks highly variable and bean oil policy uncertain. China imported 1.38Mt of soybeans from the US in April, a 43.7pc decline compared to the same month last year. Imports from Brazil also fell in April, down 22.2pc to 4.6Mt. However, over the first four months of 2024, total US soybean shipments to China reached 12.95Mt, up 35.2pc year on year. In contrast, Brazil’s cumulative exports to China over the same period totaled 9.14Mt, a 42.5pc drop from the previous year.

Ethanol production was up week on week, and palm oil gained on hopes of stronger demand from India and China.

Macro

In Australia, the Reserve Bank cut interest rates by 25 basis points to 3.85pc, striking a more dovish tone than expected. Markets now expect another cut in August and potentially one more in Q1 2026.

In the US, commodity market volatility was attributed to “uncertainty overload” surrounding spring planting and policy risk.

The upcoming report from the Make America Healthy Again political action committee is expected to raise concerns about several conventional farming practices, including the use of vegetable oils, chemical fertilisers, and growth hormones in livestock, positions that have alarmed the US agricultural industry due to their potential to influence future regulatory policy.

In the US, seed oils make up around 85-90pc of total edible oil consumption. The main contributors are soybean oil at around 55-60pc of total US edible-oil use, canola oil at roughly 12-15pc, and corn, sunflower, cottonseed, and other oils, collectively another 10-15pc.

Non-seed oils like olive oil, palm oil, coconut oil, and animal fats make up the remaining 10-15pc, with olive oil comprising a small but growing share, particularly in higher-income households or health-conscious segments.

Australia

Bids were steady yesterday in WA, with canola slightly firmer, and new crop up $5/t to $855. Wheat was at $361 and barley at $333.

In eastern Australia, bids were unchanged across the board, with new-crop canola at $818, wheat at $370, and barley at $335.

Delivered bids have taken a breather over the past week after rallying $10. Wheat is currently bid at $365 into Victoria’s Goulburn Valley, $350 on to southern Queensland’s Downs, $375 into Vic’s Western District, and $385 into Murray Bridge, SA.

Some welcome rainfall is forecast for parts of southern Australia over the coming week, with around 25mm expected across most of SA’s South East and Vic’s Western District, and 25-50mm for central and southern NSW.

VIC FOB APW replacement values remain elevated compared to WA values, but this is what’s needed to switch off Victorian exports.

HAVE YOUR SAY