Weather: Seems strange talking about weather given what is going on. A distinct line on the US map – northern corn belt is expecting a bunch of rain while the southern belt will have a very warm, dry spell.

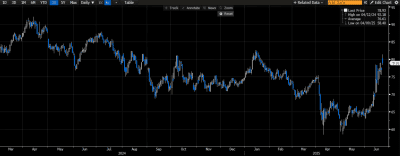

Markets: When Russia and the Ukraine kicked off there was an expectation that Russia would run over the top of the Ukraine and it would be all wrapped up in 5 minutes. Obviously that wasn’t the case, but there is a very similar feeling today. It’s not about what the US did now, its about what happens next. The closure of the Strait of Hormuz is a significant turn in events and something the market will digest in the Southern hemisphere day session will trade.

Australian Day Ahead: Who knows!. the AUD is trading around 0.6430 at the time of writing, and crude is up $2.20/bbl after opening $5/bbl higher. Vegoil should go along for the ride but it will be interesting to see what the grains do. Logic would suggest that Asian wheat consumers should have some length bought from Australia to ensure supply – but logic and market activity rarely collide.

STOP PRESS: Weekend oil futures have spiked about 4 percent since offshore markets closed on Friday.

Offshore

Offshore

Wheat

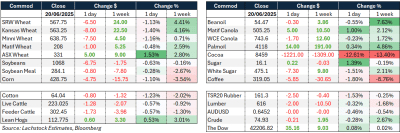

Friday seems like a lifetime ago. US futures weakened with WN down 6.5c, KWN down 8c, and MWN off 7.75c. Implied vol in WU rose to 29.10pc. Chicago spreads were mixed.

Weather was the main driver, with drier conditions aiding harvest in the US Plains and improved spring wheat moisture in Minnesota and northern Montana.

French crop ratings declined 2pts to 68pc good/excellent, with heat stress adding pressure, though large carryout and limited export programs (China and Algeria largely absent) dull the impact.

Algeria reportedly purchased 570–630kt at ~$244.50/t for August shipment.

Russia reiterated expectations of a 90 million tonnes (Mt) wheat crop and 45Mt of exports in 2025–26, aiming to retain its global export lead.

Ukraine’s wheat harvest is forecast at 22Mt.

US weekly sales came in at 427kt, within expectations

Other grains and oilseeds

Corn gave back early gains with CN down 4.75c and CZ off 2.75c.

Weather remains a swing factor, with upcoming heat likely brief and followed by rainfall, limiting yield concerns. Some areas are being described as greenhouse-like, and stocks are expected to increase by month-end.

Argentina’s corn yields are exceeding expectations in places despite wet conditions. US export sales were 904kt, toward the middle of the range.

Soybean markets slipped after recent gains, with SN down 6.75c and SX down 7.5c. Bean oil softened 30pts while meal lost $0.80.

China remains a strong buyer: May soybean imports reached 13.92Mt, with Brazil providing over 12Mt. Weekly US bean sales were 540kt, well above expectations.

Ukraine forecasts 14.2Mt of sunflower seed, 6.1Mt of soybeans, and 2.9Mt of rapeseed for 2025.

Brazilian authorities declared the country free of Highly Pathogenic Avian Influenza in commercial flocks.

Macro

Geopolitical tensions escalated dramatically after President Trump ordered strikes on Iranian nuclear facilities, drawing the US directly into the Israel-Iran conflict.

Iran responded with missile attacks on Israeli cities and warned of harsh retaliation, prompting Trump to threaten even greater force.

The heightened risk has global markets bracing for further disruption, particularly in energy markets. A key concern is the potential threat to the Strait of Hormuz, a critical passageway for around 20 million barrels per day of oil and a fifth of global LNG trade. While a full closure remains unlikely, analysts expect increased harassment of vessels, which could lift shipping costs and spark crude price rallies.

Some estimates suggest a worst-case scenario could see oil spike to US$130/barrel and cut global GDP by nearly 1pc.

The US Fifth Fleet’s presence limits Iran’s room to manoeuvre, but any escalation risks a significant supply shock.

Meanwhile, the Philly Fed index held at -4.0 with weaker forward expectations and falling prices received, adding to signs of softening activity.

UK May retail sales dropped 2.8pc m/m, missing expectations.

Member of the US Federal Reserve Board of Governors Christopher Waller suggested rate cuts could begin as early as July, diverging from chair Jerome Powell’s more patient stance. With over 15 Fed speakers this week and Powell’s policy testimony ahead, markets will closely watch how central bank rhetoric evolves, especially considering potential energy price shocks and conflict spillovers.

Japan’s inflation accelerated sharply, led by food price surges, adding further tension to global policy narratives

Australia

WA canola bids ended the week stronger with new crop reaching A$900 for conventional and $820 for GM. Wheat was slightly firmer on new crop with bids at $377, and barley at $336.

Through the east of the country, canola was also stronger with new crop bids at $855, and GM at $792. Wheat was unchanged with new crop at $370, and barley at $320.

Expect canola bids to be firmer again today as energy markets react to the US bombing. The effect on the grain/pulse markets is harder to predict, as for the most part it is fundamentally bearish for demand.

The next week looks set to bring some welcome follow-up rain for most of the south, with an inch forecast for the Yorke Peninsula, Mid North, and Southeast of SA, and Victoria’s Western Districts, Gippsland, and Goulburn regions, with 10–15mm expected across other cropping areas in these states.

HAVE YOUR SAY