Weather: Winter wheat weather conditions are mixed globally. The US Central and Southern Plains have seen improved moisture, though the south-west remains dry. The Delta and Midwest are too wet, which may impact SRW wheat. In the Black Sea region, needed rain arrived, but frost could cause some localised damage. Europe is generally seeing favorable conditions, though the north-west still needs more rain. North Africa remains in drought, despite some beneficial showers. China’s winter wheat is under stress due to a lack of rain. Canada’s Prairies received helpful moisture but face delayed planting. In Argentina, flooding in central regions may limit wheat planting, though other areas have good soil moisture.

Markets: Three up, one down – that’s how Chicago wheat is rolling at the moment. Sentiment swings are brutal; nothing kills a bullish idea like reports that Russian frost areas could be below last year. Weather spot fires are not enough to bust out the short.

Australian day ahead: Southern NSW rainfall ranged from 10mm to 30mm – something is better than nothing – but it will be interesting to see what the market thinks.

Offshore

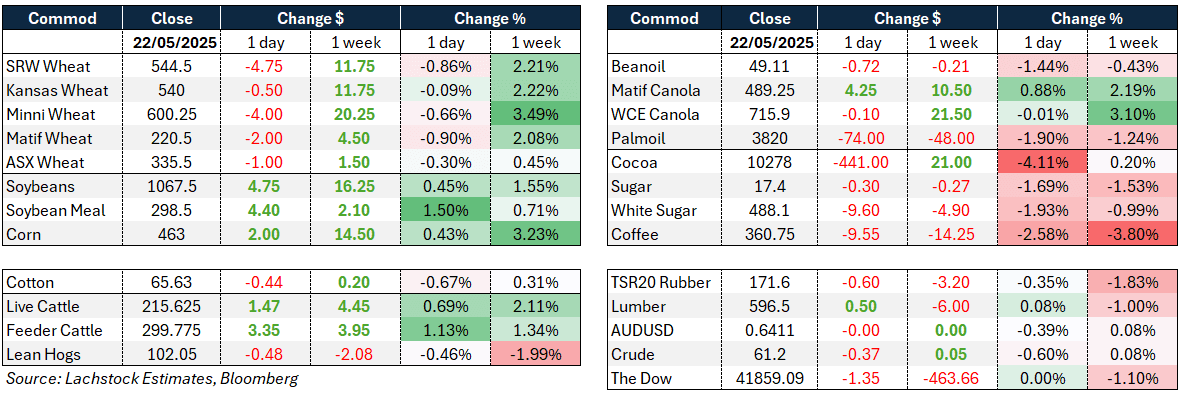

Wheat futures weakened despite strong new crop US sales at 882,000t vs 500,000t expected as early rallies attracted selling.

Current-crop sales were disappointing at -13,400 and Chicago spreads deteriorated sharply, with July-December hitting -39.25c.

Paris wheat dropped €2.75/t, and Russian cash values remained at $245-$250/t.

Russian wheat exports for May 1-20 were sharply down year on year at 1.2 million tonnes (Mt) vs 3.3Mt, with fewer exporters and ports involved.

Exports from France’s Rouen port also slowed. Egypt and Bulgaria discussed expanding bilateral wheat trade.

The IGC raised its global wheat stock estimate by 2Mt to 262Mt on improved supply outlooks, although overall trade volumes remain subdued.

US SRW weather threats are being monitored, but spreads reflect little concern. Russia reported frost damage on 136,000ha, substantially less than last year.

Other grains and oilseeds

Corn was mixed with Chicago Jly up 2c and Dec down 2.25c; current-crop US sales came in at 1.19Mt vs 1.15Mt expected. Japan, Mexico, and Colombia were key buyers. There is no confirmed Chinese activity, but the market still expects eventual demand.

Argentine flooding has not changed BAGE’s crop estimate of 49Mt, while Brazil is targeting a 28-day HPAI resolution.

The IGC lifted global corn stock forecasts by 3Mt to 284Mt.

Soybeans saw modest gains on meal short covering, but bean oil sold off amid rumours of SRE waivers, later denied. SN rose 4.75c, SX up 3c, SMN up $4.40, and BON down 72 pts.

US sales at 308,000 beat expectations for soybeans of 250,000, meal was 360,000 vs 250,000 and bean oil was 14,000 vs 11,000.

BAGE left the Argentine soy crop at 50Mt, although muddy fields could prompt downward revisions.

US drought impact remained steady: 22 percent in corn, 16pc in soybeans, 21pc in winter wheat, 29pc in spring wheat.

Macro

The European Parliament voted for steep tariffs on Russian and Belarusian fertilisers and farm produce to secure EU food supply and reduce Russian revenues; nitrogen-based fertiliser tariffs will rise from 6.5pc to near 100pc by 2027.

The RBA cut rates by 25bp in May and indicated a dovish stance, with Governor Bullock acknowledging a 50bp cut was also considered. Further easing may come in July, though improving global trade relations, especially US-China, could reduce the need.

Australia

Canola bids were off in the west yesterday, down $10-$20/t, with current crop at $810 and new crop at $850. Wheat was firm, with new crop at $369 and barley at $335.

In the east, canola losses were smaller at $3-$5, with current crop at $800 and new crop at $820. Wheat was $348 and barley $342.

Pulses are scarce throughout the east coast. Faba bids are at $600 ex-farm New South Wales, lentils are at $900 delivered port, and lupins are at $700 delivered into SA homes.

Lamb prices are strong, with over-the-hooks prices now at $9.50/kg. Finished lambs are in short supply, providing good margins for feedlotters. Barley remains well supported through eastern states.

HAVE YOUR SAY