Weather: From a global perspective, you would say the weather is benign. Pockets of concern are not balance sheet impactful – in fact, Argus is still increasing its Russian estimates. Row crops weather is a little mixed but, honestly, weather doesn’t matter right now given what is going on.

Markets: A war trade synopsis. Buy at the first sign of military action. Sell when CNN and Fox news start talking about WW3. Markets are more inclined to sell the resolution than buy the conflict – war trading fatigue is a thing. Grains were always along for the ride on this one – initially, this was demand erosion and hasn’t lasted long enough for sovereign buying to kick in. Canola came into this with a fundamental tail wind so it made sense it was one of the better performers.

Australian Day Ahead: Is it really over? Hard to imagine that was it but markets suggest that exactly the case. Russian cash didn’t bat an eyelid through this latest dispute so any Australian strength was more around the Asian consumer looking for a safe supplier. To some extent, this is still a theme but with global balance sheets getting more comfortable its a supporting element rather than a reason to rally.

Offshore

Wheat

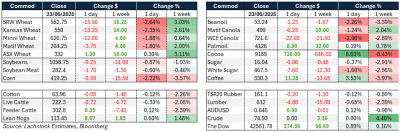

Wheat markets pulled back sharply after last week’s short-covering rally faded and geopolitical fears subsided.

WU lost 14c/bu, KWU fell 13.75c/bu, and MWU dropped 11.5c/bu. Spreads were mostly flat, and implied volatility in WU edged up to 28.73 percent. Paris Matif September wheat declined €3.75/t, with Russian wheat described as under pressure.

The US winter wheat harvest is advancing slowly — 19pc complete vs the 28pc five-year average — but is expected to pick up speed this week. Crop conditions dropped to 49pc good/excellent from 52pc, falling short of market expectations for unchanged. Spring wheat ratings also deteriorated, falling to 54pc from 57pc, with South Dakota conditions down 18pts, reinforcing concerns about yield potential in key northern areas.

Russian production prospects remain firm. Argus raised its 2025/26 wheat crop forecast to 84.8Mt, up from 80.3Mt previously, citing favourable spring conditions and improved soil moisture, although dry weather remains a concern in parts of the Rostov region and northern Krasnodar. Some delays are possible in southern Russia due to rainfall, with central region harvests set to begin in 30–40 days. Despite regional dryness, yield prospects remain above earlier projections.

On the demand side, export activity remains sluggish. US weekly wheat inspections came in at 254kt, at the low end of expectations, with total shipments now running 20pc behind last year.

Egypt’s wheat imports have dropped 30pc YoY, while Iraq stated it has six months of strategic cover.

Oman secured 110kt of Russian wheat amid growing regional insecurity.

Russia also announced plans to establish a wheat trading hub in Bahrain, expanding its influence in the Gulf.

Meanwhile, Bangladesh closed a 50kt wheat tender, receiving a lowest offer of $275/t CIF, but no purchase has yet been confirmed.

Other grains and oilseeds

Corn followed wheat lower, pressured by improving weather, harvest momentum in Brazil, and demand uncertainty ahead of the US stocks report.

CZ settled at 433.75 (–7.5c) and CN lost 9.5c. Corn inspections were solid at 1.48Mt (+28.5pc YoY), but crop conditions dropped to 70pc (–2 pts vs expectations of unchanged).

Brazil’s second corn crop is 13pc harvested, ahead of pace, with strong yields. Beans struggled under the weight of weather risks, weak inspections (193k), and trade uncertainty with China after the US-Iran escalation. SQ fell 9.5c, SMQ dropped $1.30, and BOQ lost 125 pts, dragging August crush margins 7.25c lower.

Bean conditions held at 66pc, slightly below expectations.

Indian soyoil imports fell due to port congestion, and Malaysian palm oil futures eased despite a softer ringgit and higher crude.

US consideration of poultry vaccination for HPAI is ongoing, with potential trade implications.

Macro

The US-Iran-Israel conflict escalated with US strikes on Iranian nuclear sites followed by a symbolic missile response from Iran targeting a US base in Qatar.

The strike was well-telegraphed and caused no damage, prompting hopes of de-escalation. Trump described Iran’s response as “very weak” and later announced a tentative ceasefire agreement, calling it “The 12-Day War.”

Oil markets responded swiftly, dropping 7pc as tensions appeared to ease and infrastructure remained unaffected. Iran stated the missile count matched the US bombing runs and insisted Qatar, a “brotherly country,” was not at risk.

Gulf neighbours briefly closed airspace as a precaution.

Trump’s decision triggered domestic backlash, with critics questioning its legality and strategic merit. Despite the ceasefire announcement, Iran’s Foreign Minister reaffirmed readiness to retaliate if necessary. Negotiations to re-enter a nuclear deal remain stalled, though some back-channel contact continues. The situation remains volatile but currently leans toward de-escalation.

Australia

WA canola bids ended the week stronger with new crop reaching A$900 for conventional and $820 for GM. Wheat was slightly firmer on new crop with bids at $377, and barley at $336.

Through the east of the country, canola was also stronger with new crop bids at $855, and GM at $792. Wheat was unchanged with new crop at $370, and barley at $320.

Expect canola bids to be firmer again today as energy markets react to the US bombing. The effect on the grain/pulse markets is harder to predict, as for the most part it is fundamentally bearish for demand.

The next week looks set to bring some welcome follow-up rain for most of the south, with an inch forecast for the Yorke Peninsula, Mid North, and Southeast of SA, and Victoria’s Western Districts, Gippsland, and Goulburn regions, with 10–15mm expected across other cropping areas in these states.

HAVE YOUR SAY