Weather: It’s been that sort of year internationally. The massive heat wave in the US was largely in the areas that needed to dry out a little. Poor growing conditions in parts of the Russian belt have been offset by others. Combined with all the discussion around demand and it feels like weather simply doesn’t matter today.

Markets: Donald is going to meet with “Iran” next week – not sure what that looks like but, like him or hate him, he is on the front foot. Markets debated the success of the US strikes – CNN and Fox used the same picture with one saying it was a failure and one saying it was a success – go figure. The Stocks and Acreage report out Monday tends to be a biggy – Wheat needs a ‘Hail Mary’ right now.

Australian Day Ahead: the differences in prospect from north to south are increasing. Damage on already struggling crops in South Australia and Vic due to massive winds are, in some areas, nothing short of horrific. Meanwhile, “perfect conditions” can be applied to a bunch of the north.

Offshore

Offshore

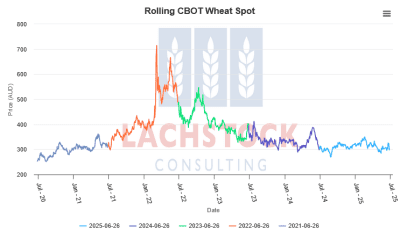

Wheat

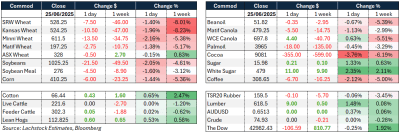

Wheat markets continue to face harvest pressure and weak demand. WU fell US7.5c/bu, KWU 10.5c, and MWU 13.75c, with spreads in Chicago and KC flat to firm, while Minny softened. Matif Sep dropped €2.75/t, and Russian cash values held around US$226–$228/t.

Good yields are being reported in the US, though quality and protein content vary.

Buyers remain absent, including China, and global stockpiles look set to rise as harvest progresses across Europe, the Baltics, BSEA, and India.

Egypt, the world’s largest wheat buyer, has resumed activity with Mostakbal Misr purchasing Russian wheat for August–September shipment under 270-day terms, as well as earlier French purchases. This is the first known Black Sea origin trade for the new season, marking a shift in procurement strategy away from the GASC tender system. Egypt is forecast to import 13Mt in 2025/26, with 3Mt booked so far.

SovEcon raised Russia’s wheat crop forecast to 83Mt, though reductions in Siberia and the Urals partially offset central region gains.

Canadian wheat planted area is expected at 27.7 million acres, up slightly from March.

Ukrainian drone attacks damaged a grain storage site in Russia’s Rostov region. Meanwhile, Russia plans to expand grain exports to Iran via the Caspian as part of deeper trade ties.

Other grains and oilseeds

Corn remains pressured by Brazil’s bumper crop and weak US ethanol demand. AgroConsult pegged Brazil’s total corn crop at 150Mt, with the safrinha crop alone over 123Mt.

South Korea’s MFG is tendering for up to 280k feed corn.

US ethanol production fell to 1.081m b/d for the week ended June 20, down 28k b/d from the prior week and below expectations, while stocks rose to 24.4m barrels.

US corn sales estimates are 850k old crop + 225k new.

Traders are focused on the upcoming USDA Acreage Report, with some expecting downside risks already priced in unless a bullish surprise emerges.

Soybeans continue to decline on weak Chinese demand and excessive meal supply due to crush economics. SX fell from a high of 1074.25 to 1018.50.

Bean oil has struggled to hold gains despite Brazil’s move to B-15 starting August 1, while Malaysian palm oil futures edged higher, supported by export optimism.

US bean sales are seen at 400k old crop + 75k new, meal at 250k old + 75k new, and oil at 6k old + 6k new.

Canadian canola planting rose to 21.9 million acres.

Weather in the US Corn Belt is shifting cooler and wetter, especially in Iowa, Minnesota, and Wisconsin, relieving earlier heat stress and reinforcing bearish pressure on futures.

Macro

Fed policy developments dominated headlines as the central bank proposed easing capital requirements for large US banks, reducing the enhanced supplementary leverage ratio from 5–6pc to 3.5–4.5pc.

Critics, including Fed Governor Michael Barr and Senator Elizabeth Warren, warned this could increase financial system risk by weakening safeguards.

Michelle Bowman, Trump’s newly appointed Fed Vice Chair for Supervision, supports the move.

On housing, US new home sales fell 13.7pc m/m in May, with regional weakness in the South, Midwest, and West offset by gains in the Northeast. Prices rose 3.7pc m/m to $426,600.

NATO agreed to boost defence spending to 5pc of GDP, though Spain is resisting, prompting tariff threats from President Trump.

Fed officials, including Boston Fed President Collins, expressed cautious patience on policy changes, pointing to gradual price rises tied to tariffs and modest labour market deceleration.

The US dollar is down ~10pc YTD and could weaken further in July as economic data softens and expectations build for a dovish Fed pivot.

Crude oil rose 55c as markets monitored the Israel-Iran ceasefire, with elevated risk in the Strait of Hormuz keeping shipping alerts high.

China moved to tighten controls on two fentanyl precursor chemicals in a gesture to improve US relations.

Australia

Yesterday’s WA canola bids were softer, down around A$10/t, with current crop at $855 and new crop at $885. Wheat bids were down $3 to $351 for current and $366 for new crop, while barley was a little firmer at $337 for new crop.

In the east of the country, canola was also lower, with current crop bids at $812 and new crop at $845. Wheat was softer at $348, and barley was $342, both for current season.

Sorghum bids are currently around $352 delivered Downs and $372 delivered Brisbane for July delivery.

Australian sheep meat prices have hit record highs, with heavy lambs reaching A$11/kg—up 50pc year-on-year—as exports climb 10pc amid strong demand from China, the US, and other markets. With New Zealand’s flock in steady decline and 2024 Australian exports valued at $3.6 billion, Australia is well positioned to dominate global supply.

Chickpea bids delivered Darling Downs are currently $680 for new crop.

HAVE YOUR SAY