Weather: The heat is ripping through EU – not really an issue for wheat but corn is certainly being affected. 1-2 inches through NB over the last few days may have some impact, OK is really behind harvest – although it looks pretty clear for the next little while.

Markets: Welcome to the suck. I hate to say this but wheat is doing what wheat does. There are a few that will understand this reference but its hard to differentiate Chicago wheat and Carlton Football Club.

Australian Day Ahead: Lacklustre day ahead probably – weather forecasts are not really giving us what we want so the maybe some basis strength throughout the southern east coast markets.

Offshore

Offshore

Wheat

Wheat markets remain under pressure, with broad-based weakness across major contracts.

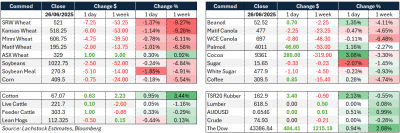

On the day, SRW Wheat fell 7.25¢/bu (-1.37pc), Kansas Wheat dropped 6.00¢ (-1.14pc), and Minni Wheat eased 4.75¢ (-0.78pc). Matif Wheat declined €2.00/t (-1.01pc), while ASX Wheat edged higher by A$1.00/t (+0.30pc).

This is a race to the bottom – the May low for the Dec-25 Chicago wheat contract was UD$5.4375/bu – last night the market closed at USD$5.5975/bu

The decline reflects a bearish combination of favourable US weather conditions, improved crop prospects, and tepid global demand.

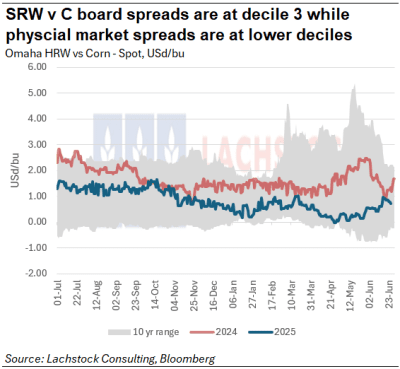

Meanwhile, in Europe, wheat’s relative stability versus a heat-stressed corn crop saw prices briefly converge, highlighting corns vulnerable position. Speculators are positioning accordingly, rotating out of wheat and into long corn as a weather hedge.

It’s really all about Mondays Stocks and Acreage report now – and, honestly, I struggle to see what the USDA can through up that saves wheat right now.

Other grains and oilseeds

Corn traded lower again, down 0.75¢ (-0.18pc) on the day and -5.5pc for the week, reflecting highly favourable crop weather across the US Midwest.

However, in Europe, corn markets have been jolted by an intense heatwave threatening yield potential, which has driven Matif corn to parity with milling wheat. Weather in the next 10–14 days is seen as critical.

Soybeans continued to weaken, falling 2.50¢ (-0.24pc) on the day and -4.8pc on the week, despite decent support from improved moisture conditions.

Soybean meal slid sharply by $5.10 (-1.85pc) as favourable weather and soft demand weighed.

Meanwhile, soybean oil rebounded 1.35pc on the day but remains volatile after last week’s rally on Middle East tensions and US biofuel policy.

In trade developments, China booked a rare 30,000-ton soybean meal cargo from Argentina, its first since approving imports in 2019. This reflects China’s intent to diversify supply chains amid ongoing tensions with the US It also follows record Brazilian soybean imports in May and signals that China may shift sourcing heading into the US harvest window.

Macro

Equity markets pushed higher with the Dow gaining 404 points (+0.94pc) and the S&P 500 nearing record territory.

Risk sentiment improved on hopes for US Fed rate cuts, with Treasury yields falling and the dollar easing. Swaps now price in two full rate cuts, with speculation rising around a potential third. Data showing weak consumer spending and rising unemployment claims added weight to the case for policy easing. Fed officials remain cautious, citing tariff-related inflation risks.

San Francisco Fed President Mary Daly noted she’s open to a rate cut in the fall, while others called for more clarity before acting. Markets await May’s core PCE data for confirmation that inflation is cooling.

In commodities, China announced a partial loosening of its urea export restrictions, lifting near-term supply constraints and pressuring global fertiliser prices. Urea had rallied recently on production disruptions in the Middle East. The move is seen as balancing farmer affordability and export profitability, with India still excluded from receiving Chinese shipments.

Crude held flat, and AUD/USD firmed modestly on broad US dollar softness. Risk appetite is back, but Goldman Sachs cautioned that volatility could resurface in H2 as macro and policy uncertainties persist, including trade friction and potential stagflationary shocks.

Australia

Yesterday’s WA canola bids were steady with current crop at A$845 and new crop at $886. Wheat was slightly softer with current crop at $349, and barley held at $340.

Through the east, old crop wheat bids were slightly softer, with APW at $344 and BAR1 at $340. Canola was also softer, with old crop at $805 and new crop at $838.

Despite old crop bids easing on the east coast this week, basis has strengthened as grower selling has dried up, while the feed market continues to provide a strong floor.

The week ahead is unlikely to bring significant rainfall to cropping regions. Northern SA and the Mallee in both SA and Vic need a decent rain, with strong winds this week damaging emerged crops and insufficient moisture to bring up the remainder.

HAVE YOUR SAY