Weather: Mixed-to-disappointing result overnight through SA and Vic. Coverage of 5-10mm was a positive but, for most of South Australia, 5mm won’t be noticed this morning. International weather concerns are more of the same with harvest approaching. I have said it a million times but the weather in the US has been nothing short of crazy. Record wind, near record tornado count, huge rains through the SRW belt.

Markets: US equity futures markets are happy about President Trump’s deferral of his EU 50 percent tariff. AUD slightly softer post the USD catching a bid.

Australian Day Ahead: Aussie markets will digest rain and forecast. The more extreme forecasts have another 15-20mm in the back end of the 15 day but models are very divergent. More if the same for mine.

Offshore – Memorial Day Holiday in the US

- Ukraine war and U.S.-Russia dynamics: Donald Trump has stepped up criticism of Vladimir Putin following renewed Russian attacks on Ukraine, calling him “absolutely CRAZY.” While Trump has floated the idea of new sanctions, including secondary measures on Russian oil, he hasn’t acted on them.

- Meanwhile, a bipartisan Senate bill proposing aggressive sanctions on Russia is gaining support but would also hit key trade partners like China, India, and the EU.

- Gaza ceasefire negotiations: U.S. envoy Steve Witkoff outlined a proposal offering a temporary ceasefire in exchange for the release of half the remaining hostages (both living and deceased), with a pathway to a permanent truce. Hamas has not officially accepted this version. The offer comes amid Israeli evacuation orders and plans for a major military operation in southern Gaza, particularly Khan Younis.

2. U.S. domestic policy and higher education Trump vs. Harvard:

- Trump has threatened to strip US$3 billion in federal grant funding from Harvard, accusing the university of antisemitism and failure to align with US values. The administration has already frozen $2.6 billion in research funding and is pushing for major reforms to governance, hiring, and admissions. Harvard, which has a large international student population, is resisting in court and has temporarily blocked the government’s attempt to bar foreign students.

3. Financial markets and currency

- AUD/USD and trade policy uncertainty: The Australian dollar held steady at 0.6488 as traders await updates on potential new US tariffs. Trump’s delay on EU import duties has supported the Aussie, but volatility may increase if he announces pharmaceutical tariffs, with the Eurozone being a key exporter. Analysts suggest that further USD weakness could lift AUD/USD above 0.6550. Bond yields in Australia eased slightly, reflecting a cautious market tone.

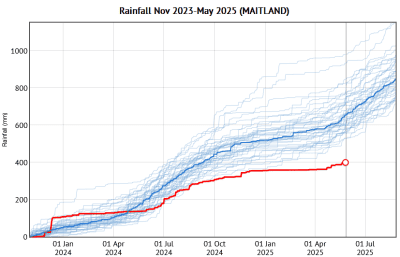

Cumulative rainfall from November 2023 to May 2025, (mm), at Maitland on South Australia’s Yorke Peninsula. Source: CliMate via Lachstock

Australia

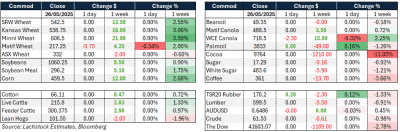

Bids were down across the board to start the week in the west, with canola bids down A$5 to $825 for current crop and $855 for new. Wheat was $351 and $363, with barley at $348 and $330.

Through the east, bids were softer with canola at $800 and $822 for new crop, wheat was $348 with new crop bids at $370, and barley $345 for current crop.

Some welcome rainfall for parts of SA, with 10–20mm for lower parts of the Eyre, Yorke, Mid North and Southeast, but totals remain well behind where they should be for this time of year.

Northern markets have drifted slightly lower over the last week as consumers took some comfort in handy weather forecasts for both northern and southern cropping regions. Wheat is trading around $347 with new crop at $355, and barley $330 and $345.

HAVE YOUR SAY