Weather: Nothing to see here. Rain throughout the needed areas of the US, some rain through the EU and China. All in all, no need for risk premium due to weather.

Markets: Wheat gets you on board, then slaps you in the face. The ease with which US futures roll over is impressive. The spec managed to buy back around 18 percent of the short last observation period which helped lift the market 5pc. Then, after a long weekend, one session gives back half of the gain. The Russian tax regime and subsequent uncertainty about deferred levels means transparency in Russian FOB down the curve is difficult. As the market rolls over to new crop pricing we have been looking for a US$235 type FOB level, however, markets are showing levels below this which will pressure Aussie levels a touch.

Australian Day Ahead: Pretty diverse. Northern markets, have found levels that both sides of the coin seem comfortable with while southern NSW has softened post the recent rain. SA and western Vic are still looking for the soaker and feeders are struggling with fodder costs, skewing rations. more of the same today.

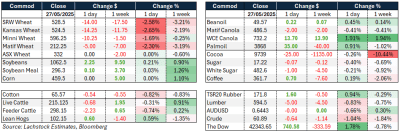

Offshore

Wheat

- Wheat futures fell over 2pc with Chicago, KC, and Minneapolis all weaker amid improving global weather and weak demand.

- Rains in the US Southern Plains are expected to boost winter wheat prospects, though conditions remain variable with spring wheat ratings debuting well below expectations (45pc vs 71pc).

- Russian FOB values fell to $225/t as pricing shifts from old crop to new crop. Russia’s 2025 grain harvest is anticipated to be higher than last year, despite some drought threats in regions like Rostov and Krasnodar. Additionally, IKAR cut May wheat export estimates slightly.

- Australian wheat is under pressure due to a drop in Chinese imports and aggressive Russian competition.

- Egypt is in talks with Bulgaria for direct wheat purchases and aims to significantly reduce its wheat imports this year, with domestic procurement expected to reach up to 5 million metric tons.

- EU soft wheat exports are down 34pc y/y.

- China’s wheat belt saw relief from drought last week, with more rain forecast. However, weather models are mixed.

- Canadian Prairies remain the key dry spot globally.

Other grains and oilseeds

- Corn futures were mixed. Old crop held up on solid export inspections and tight domestic basis, but new crop fell as US conditions were better than expected and Brazilian production ideas expanded.

- After the close, US corn condition scores came in lower than expected at 68pc good to excellent, below the 73pc anticipated. Planting progress was at 87pc, slightly behind the 88pc market idea.

- Brazilian corn harvest has started slowly but production remains strong. Datagro and Cordonnier held or slightly raised Brazilian corn and soybean output estimates.

- Argentine soybeans were trimmed by 1.5Mt due to flooding, but corn was largely unaffected.

- Bean oil saw gains on rumours that the RVO (Renewable Volume Obligation) would exceed 5.25 and that the EPA would confirm it this week.

- In specialty crops, Australian almond exports are booming due to China’s tariffs on US product. Local prices hit decade highs above $12/kg, supported by a weak AUD and reduced global supply. Macadamia exports are also surging, especially into China and Vietnam. However, water access remains a major concern due to the Australian government’s water buyback policy, which threatens permanent crops like almonds.

Macro

- US-EU tariff tensions eased as both sides agreed to fast-track negotiations, delaying a potential 50pc US tariff.

- A zero-for-zero industrial goods offer from the EU is being weighed against a US preference for a 10pc baseline tariff.

- Markets are pricing in reduced trade risks, which could support growth.

- Broader risk sentiment was constructive with FX markets showing AUD/USD probing resistance near 0.6515–0.6550. While the Australian dollar trades below spot at 0.6486, technicals point to a bullish bias if resistance is cleared.

- On the political side, concerns remain over trade talks with the EU and dairy market liberalisation in India as part of US negotiations.

Australia

- In the west, canola bids were steady to slightly stronger with new crop bids A$865 and $780 for GM. Wheat was $363 for new crop with barley $330.

- Through the east of the country there was little change with canola bid $824, wheat was $370 and barley $335 for 25/26.

- Some rainfall building for WA over the next week with most parts set to record 25–50mm, which will see southern PZs continue with a good start and get things under way through Geraldton and Northern Kwinana.

- Barley bids have softened over the last 3–4 days on the back of some rainfall through the east and consumers happy to slow down — expect the market to find some strength again given how far through the export program we are and the underlying feed demand still present.

HAVE YOUR SAY