Weather: Recent showers in the Central and Southern Plains are improving soil moisture for winter wheat, with more rain expected this week. In the Delta and Midwest, excessive rainfall is creating unfavorable conditions for some SRW wheat areas. The Black Sea region remains too dry despite limited showers. Europe is generally dry but not yet concerning, with some rain expected in the northeast. North Africa’s drought persists as showers diminish again. China’s winter wheat is stressed by dryness with little rain forecast. Western Australia’s soil moisture has improved, but eastern areas remain dry as planting starts, with limited rain ahead. Early planting conditions in the Canadian Prairies are mostly favorable.

Markets: It’s difficult to unravel what’s driving markets at the moment – how much of the defensive price action in Commod markets is related to Donald and the pending negotiations. If China and the US came to an agreement, would it look similar to the Phase One deal last time round which mandated min purchase levels of US goods by China – or are we simply in a perpetual negotiation that never gets a resolution? Whatever the reason – demand is horrific and, until that improves, frost in Russia doesn’t matter.

Australian Day Ahead: The push-pull between conditions in Australia and export parity continue. With a chunk of SA and Vic heading to 30 degrees this weekend, it’s hard to see any premium coming out of the old crop southern market – meanwhile, some areas of southern Qld jagged 100mm over the weekend.

Offshore

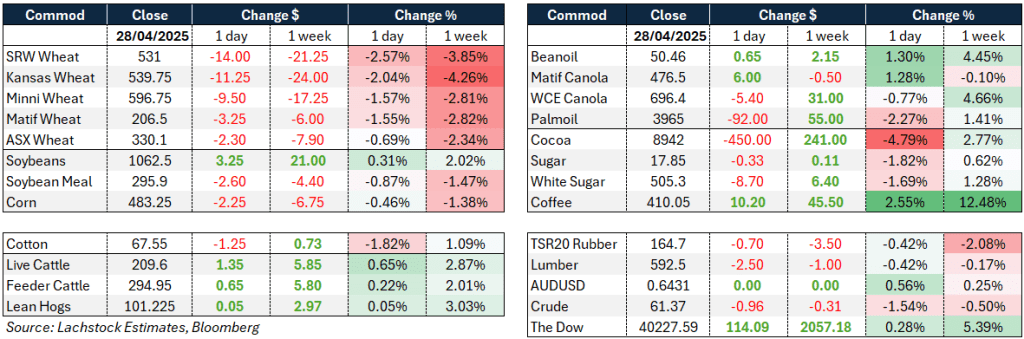

Wheat – Wheat markets continued to slide sharply, with Chicago SRW (WN) falling 14c, Kansas HRW (KWN) down 11.25c, and Minneapolis spring wheat (MWN) off 9.5c.

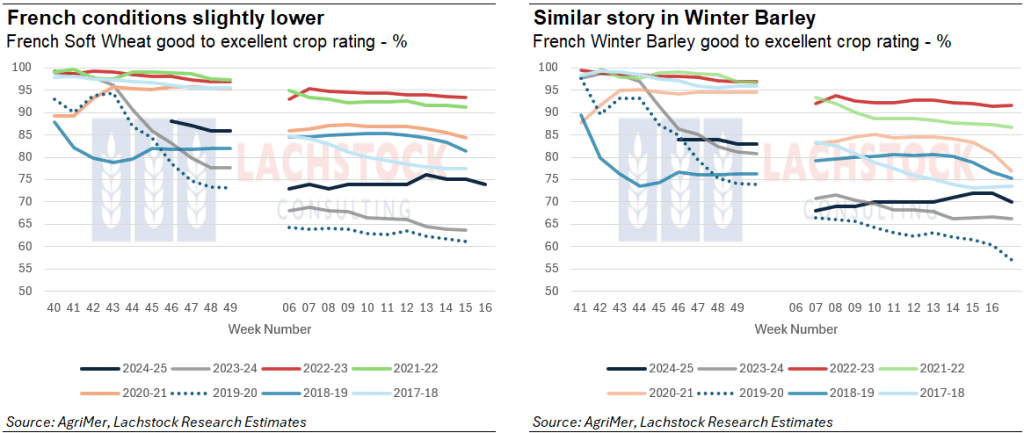

Paris Matif wheat also weakened, while Russian cash wheat prices rose slightly.

The U.S. HRW crop outlook improved due to favorable rains across the Plains, pushing U.S. wheat further into surplus. However, demand remains weak, and despite cheap pricing (e.g., SRW trading $16–20/t under European values), buyers like China remain absent without a trade deal.

U.S. wheat inspections were better than expected, up 11.3% year-on-year, but after the close crop ratings rose more than forecast, adding further pressure.

Meanwhile, a sudden cold snap in Russia threatens to stress winter wheat crops, possibly exacerbating already lower production forecasts from SovEcon and AgroBrane. The International Grains Council expects tight global wheat stocks into 2025–26.

Nonetheless, markets remain deeply short with little fear of reversal for now.

Other Grains and Oilseeds – Corn initially weakened with CN down 2.25c and CZ down 5.5c, pressured by good U.S. planting progress (24% complete) and wheat undercutting feed demand.

Global corn supply developments were mixed: Brazilian safrinha corn is in good shape, but Ukraine and China face planting delays, and Argentina’s harvest is slow.

Corn exports were strong, with inspections at 1.6 million tons, up 29% year-on-year.

Managed money remains bullish on corn spreads despite the weakness.

Soybeans were more resilient, recovering early losses.

Bean oil led the complex higher, buoyed by biofuel mandate rumors and talk of revived U.S. biofuel credits, with prices rising above 50c.

However, actual export shipments remain soft, and new crop sales are vulnerable unless the U.S.-China relationship improves.

U.S. soybean inspections were low but still up 14.8% year-on-year, and planting was slightly ahead of expectations at 18%.

In palm oil, prices retreated due to expectations of rising Malaysian output and weak demand.

Cargill’s oilseed crush expansion plans in Brazil could face competition pressure from growing Chinese soybean demand for South American supplies.

Macro – The macro backdrop is dominated by deepening U.S.-China trade uncertainty. Despite some quiet easing (China reportedly exempting U.S. semiconductors from retaliatory tariffs), clear signs of a broader deal remain elusive. The Trump administration is preparing a staggered series of trade talks with 18 countries, aiming to finalize preliminary deals by July 8, while South Korea seeks tariff exemptions from the U.S. separately.

Markets await key U.S. economic data this week, with April’s labor market readings (ADP, nonfarm payrolls) and the first Q1 GDP estimate in focus. Consensus sees weak employment growth and near-zero GDP, implying no rush for Fed rate cuts at the upcoming FOMC.

Separately, political tensions remain elevated: Trump demanded “free” American shipping access through the Panama and Suez canals, and U.S. Secretary of State Rubio urged Russia to end the Ukraine war after high-level talks.

The EPA is also under pressure to approve an emergency nationwide E15 fuel waiver for summer 2025, which could affect biofuel demand patterns across the Midwest.

Australia – Reasonably subdued start to the week domestically, with canola in WA off slightly, bid at $800 for current crop and $845 for new crop. Wheat was flat at $360, and barley at $350 for current crop.

In the east of the country, canola was steady at $765, with GM at $662. Wheat was $348, and barley was $333.

With a full moisture profile and ongoing rainfall, chickpea prospects are currently positive. This, coupled with estimates of a domestic supply deficit in India of 1mmt and a low carryout, should see domestic prices remain supported. Current crop is bid around $1000 and new crop at $880 delivered Brisbane.

Barley imports to China reached 845kmt in March, with Australia the dominant origin. Tightening stocks over the last month are reflected in domestic pricing, coupled with strong spot demand locally. The tightness is not isolated to Australia, with Northern Hemisphere stocks also extremely tight as we run to the end of the crop year.

HAVE YOUR SAY