Weather: Rainfall in areas where its needed – but spring wheat conditions show how its not all about rain. Germany is another example with rainfall lagging but production going up.

Markets: A less than convincing performance by wheat given the size of the miss by spring wheat conditions. Russian cash is reflecting a 80+ million tonnes crop but the escalation in military activity is seemingly being ignored.

Australian Day Ahead: Really good rainfall forecast for all 4 ports zones in WA but SA and Vic still only being drip fed. Fine if we get 5-10mm per week but the reliance on these forecasts will become increasingly important.

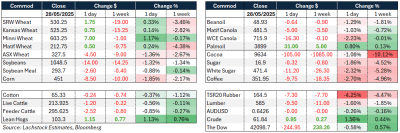

Offshore

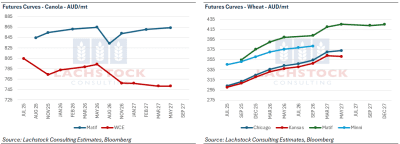

Wheat

Spring wheat in the US led gains on the week, with Minneapolis July (MWN) up US7c/bu at one point as traders reacted to deteriorating crop conditions in North Dakota. Emergence sits at just 50pc, with cool, damp soils slowing growth — though not due to moisture deficits.

Canadian Prairie conditions have improved with recent rainfall, but pockets remain dry, and the outlook includes beneficial moisture and rising temperatures.

The large short position in MWN (over 70pc of total Open Interest) continues to fuel volatility and amplify price response to incremental news, especially with only partial crop emergence visible.

Chicago (July-25) and Kansas (July-25) were more subdued, rising only modestly as spring wheat pulled them higher.

Paris Matif wheat gained €0.50/t while Russian cash values fell US$1.75/t to $232/t, keeping a lid on global price momentum.

Market talk points to Russian production slipping closer to 80 million tonnes (Mt), but there’s no consensus yet — and without a concurrent demand shock (e.g. from China), upside remains capped.

India’s stronger-than-expected harvest has weighed on global sentiment. The Food Corporation of India has already procured 29.7Mt and could exceed 32Mt, effectively removing India from the import market in 2025 and easing global demand fears.

In China, rain is expected to ease drought in major wheat regions, though prior heat damage may have triggered the purchases of 400–500kt from Australia and Canada. However, the volume has been modest relative to last year’s flurry, and the market is watching for further import signals post-harvest.

Germany’s crop outlook added to the bearish tone, with forecasts for 2025 wheat production rising 13.6pc to 21Mt. Got to be honest – this one baffles me. German rainfall is significantly behind last year.

Other grains and oilseeds

Corn futures weakened sharply amid rumours of US old crop cancellations and confirmation of Brazilian sales to South Korea.

Brazil’s safrinha corn crop is advancing well in Mato Grosso, though parts of Paraná and Bahia remain moisture-stressed. The USDA’s high production forecast has been echoed by some private analysts.

In Argentina, both corn and soybean harvests have faced delays from heavy rainfall, especially in northwestern Buenos Aires, but yields are generally outperforming expectations in Cordoba and other core zones. Drier weather in the coming week will be crucial for completing harvest.

US soybeans fell alongside products. July crush margins held, but sentiment remains poor amid unclear US/China demand and limited news ahead of the Renewable Volume Obligation.

In Brazil, the soybean harvest is essentially complete, with high productivity in Mato Grosso but drought-reduced output in Rio Grande do Sul.

Malaysian palm oil futures rose for the fourth consecutive session on short-covering and strength in Dalian oils.

Brazil reported fresh outbreaks of Highly Pathogenic Avian Influenza, with two cases in commercial poultry flocks. The government is negotiating to limit trade bans to affected zones.

Macro

Geopolitical risk remains elevated. The Russia–Ukraine conflict is intensifying, with 50,000 Russian troops massed near a Ukrainian region and both sides escalating drone attacks. Trump warned Putin was “playing with fire,” while Medvedev referenced WWIII in response.

Global trade tensions are flaring. India is negotiating to avoid a 26pc US tariff by offering selective cuts, though foodgrains and dairy remain protected. It seeks reciprocal US tariff reductions and exemptions for Indian workers abroad.

The EU is fast-tracking trade talks with the US after Trump threatened 50pc tariffs.

Japan responded to similar threats with a ¥900bn stimulus and strategic trade concessions to ease pressure before the G7.

Ethanol production rose to 1.05m b/d; stocks declined slightly.

A US federal court blocked President Donald Trump’s proposed “Liberation Day” tariffs, ruling he exceeded his authority by imposing broad import taxes. The Court of International Trade in Manhattan found that only Congress has the constitutional power to regulate international commerce, even during economic emergencies. The ruling came in response to a lawsuit filed by the Liberty Justice Centre on behalf of five small US importers. The plaintiffs include a New York wine and spirits importer and a Virginia-based educational kit and instrument maker, who argued the tariffs would harm their businesses. This is the first major legal challenge to the tariffs and one of seven court cases against Trump’s trade policies, including suits from 13 states and various small business groups.

Australia

- WA canola bids held firm with new crop A$870 and $785 for GM. Wheat was off on the back of yesterday’s softening in global futures, with current crop APW $348 and new crop $361. Barley was firm at $348 for the current season.

- A similar story in the east, with wheat back $5 — current crop $344 and new $365. Canola was firm at $790 and $818, with barley $344.

- New crop chickpea bids are softer, after first being published at around $880 in late April, now being bid $820 delivered Brisbane, with the production outlook solid through NNSW and SQLD.

- Lamb price records are being broken through SA and Vic, with a merino lamb record of $340 at Dublin SA on Tuesday, and at Ballarat a record of $400 was seen yesterday for a couple of pens of lambs. This highlights the short supply, which isn’t expected to improve anytime soon, and makes the $750 pulses delivered from NSW work.

- Rainfall is building for WA over the next 8 days, with 25–50mm forecast for all growing regions.

HAVE YOUR SAY