Weather: Recent rains in the Central and Southern Plains have boosted soil moisture for winter wheat, with more precipitation expected. However, parts of the Delta and Midwest remain overly wet, hampering SRW wheat. The Black Sea region remains too dry with only scattered showers, while Europe’s dryness isn’t yet problematic. North Africa’s drought persists with limited rainfall, and China’s winter wheat is stressed under continued dryness. Western Australia has improved soil moisture, but eastern areas remain dry as planting starts. Conditions in the Canadian Prairies are mostly favorable for early sowing.

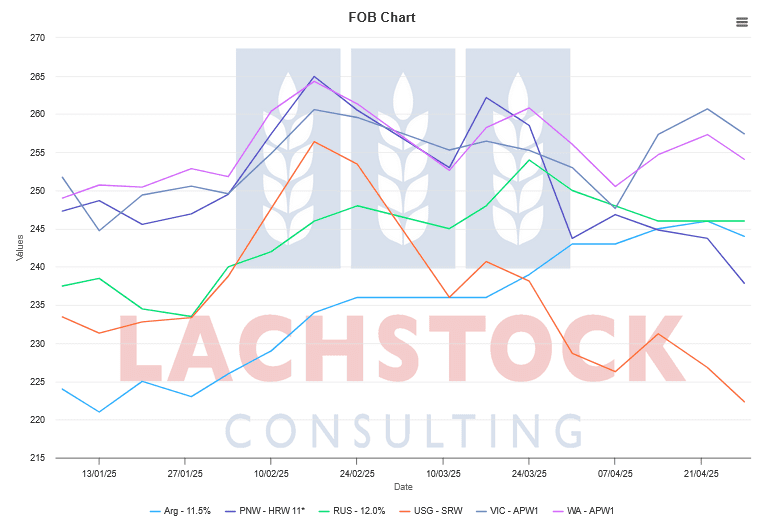

Markets: Chicago wheat is heading to zero. Every day there is another reason to bleed lower – back to being a market purist – the function of the market is finding a level that encourages demand. It does feel like we have unearthed some US wheat demand, which is good as its almost free. At the same time, Russian cash has largely been unchanged.

Australian Day Ahead: Rainfall is the main driver it would seem at the moment given we are now toe to toe into the Asian CNF market. AUD is a function of Donalds soundbites and largely difficult to predict. It feels like the prospect for the AUD hinge off Trumps tariff negotiations. Should he start to tick off a few countries and provide the US market with an indication this sideshow was productive, the USD probably firms a little. The alternative is the data continues to get worse and the rate curve in the US implodes. AUD would test the rock solid 0.6450 resistance again.

Offshore

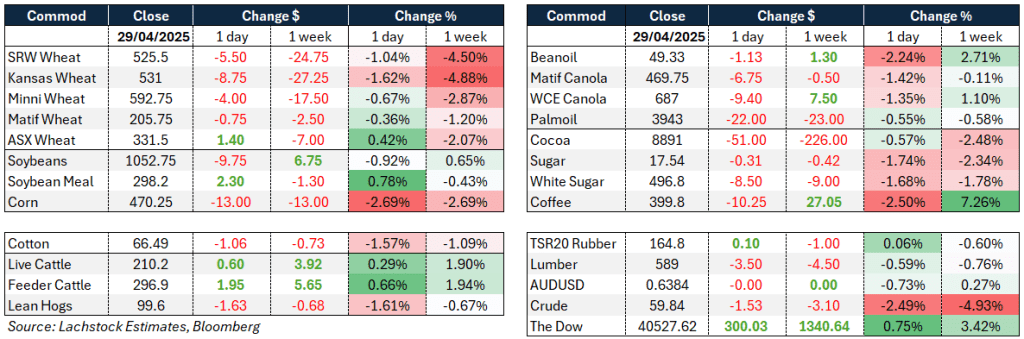

Wheat – Wheat futures continued their decline with Chicago, Kansas, and Minneapolis contracts all weaker, while Paris Matif also slipped.

Russian cash wheat remained steady at $250.50. Russia faces another round of cold weather, Chinese wheat regions are dry, and Europe is drier than normal, adding production concerns.

Demand is starting to emerge with Brazil buying HRW, Egypt sourcing French wheat, and inquiries surfacing for US wheat.

SovEcon slightly increased its forecasts for Russian wheat exports for both the 2024-25 and 2025-26 seasons, but noted margins remain negative and buyers are shifting to new-crop purchases.

According to the USDA, Australian wheat production is forecast to fall by 3.1 million tons to 31 million tons due to drought in South Australia and western Victoria.

EU wheat exports are down sharply year-on-year, with Morocco, Nigeria, and Algeria as the top destinations.

CME is planning to launch a new Black Sea wheat futures contract tied to Romanian and Bulgarian ports, replacing the suspended Russian-based contract.

Overall, wheat markets are seen as oversold, US wheat is competitively priced, and any sign of stronger demand or geopolitical disruption could trigger a rebound.

Other Grains and Oilseeds – Corn futures fell sharply with July-25 down 13 cents and Dec-25 losing 5.75 cents, driven by favorable US planting conditions, good Brazilian safrinha prospects, and higher Argentine production estimates.

US corn remains the cheapest globally, with Spain purchasing 120,000 tons in a daily sale, while South Korea and Taiwan also booked significant volumes.

Chinese corn planting is being hampered by dry conditions.

Soybeans were also weaker with SN and SX down nearly 10 cents each, pressured by concerns over large deliveries, rapid planting, and China’s plans to slash soymeal use in livestock feed, aiming to cut overall grain use to 60%.

According to Dr. Cordonnier, South American soybean production estimates were raised slightly, with Argentina at 50 million tons and Brazil unchanged but with a bias higher.

The soybean crush margin rose modestly despite weakness in bean oil. Ethanol production was slightly lower week-on-week, with stockpiles rising.

CME recently launched new European rapeseed oil futures, adding to its broader push to diversify grain and oilseed contract offerings.

Macro – US economic indicators continue to deteriorate under the pressure of tariffs and rising uncertainty. April imports surged 5% month-on-month as companies rushed to beat tariff increases, pushing the trade deficit to a record $162 billion.

Job openings fell to the lowest level since early in the post-pandemic recovery, lowering the ratio of openings to unemployed and easing labor market pressures.

Consumer confidence dropped sharply to a near five-year low, with expectations hitting levels typically seen before recessions. Inflation expectations are climbing sharply, raising concerns for the Fed.

Although tariffs are causing downside growth risks, rising inflation expectations will likely keep the Fed cautious on cutting interest rates, assuming layoffs stay low.

President Trump continues to champion his tariff and economic policies, despite approval ratings sinking to historic lows, and has criticized Fed Chair Jerome Powell, claiming to know more about interest rates. Trump’s tariff policies remain popular among some manufacturing communities but face growing criticism from automakers and economists worried about inflation and recession risks.

Meanwhile, China is rallying BRICS nations to resist US tariff pressure, while legal challenges to Trump’s tariffs are growing within the US.

Treasury Secretary Scott Bessent emphasized the difficulty of US-China negotiations, while progress with India, Japan, and South Korea is seen as more promising.

Australia – Yesterday saw bids slightly firmer for canola in WA, with current crop $805 and new crop $845. Cereal worked lower, with current crop wheat $355 and barley $345, and new crop $370 and $336.

In the east of the country, canola bids were improved, with current crop $771 and new crop $804. Wheat was softer at $342, with barley largely unchanged at $333.

Solid barley demand in the east, with a strong export program out of VIC and NSW, with around 80% of the export program for the 24/25 market year to be completed by the end of May. Delivered bids are $365 Geelong/Melbourne and $350 GV mills, with these consumers wary about supply into the back end of the year.

The next two weeks look set to remain largely dry for southern parts, which will see hay/grain continue to be fed, with old crop cereal bids likely to strengthen as stagnant liquidity continues.

HAVE YOUR SAY