Weather: Nothing of major concern today. Europe remains hot & dry, but wheat is “all but” ready for harvest. Canada received rain over past week which will stabilise things for now, follow-up is needed. In the US, over past week the dry regions got rain and the wet regions were mostly dry, should assist the winter wheat harvest progress percentage later today.

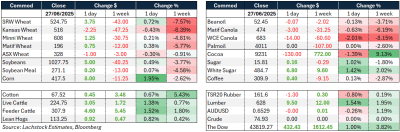

Markets: Wheat markets were slightly firmer to end the week but with no conviction, corn was stronger on the back some fund short covering and a lower US dollar. Winnipeg canola closed lower on the back of tariff tensions with the US. Tonight’s USDA stocks and area report is expected to show lower corn stocks year-on-year and steady acreage, higher wheat stocks with flat area, and soybean stocks largely unchanged with a slight uptick in planting.

Australian Day Ahead: More of the same for today for cereals, canola lower on the back of Winnipeg slide. No rainfall of note this week for Northern parts of SA and the Vic/SA Mallee where it is desperately needed. Last day of the FY might see some growers quit system stock before they start paying carry.

Offshore

Wheat

Wheat markets steadied to finish the week, with Chicago wheat (WU) up 4c to US$5.39/bu, Minneapolis (MWU) up 2.5c, and Kansas (KWU) flat. MATIF September futures rose €0.75/t, and Russian cash values remain steady around US$225/t.

The International Grains Council raised its 2025–26 global wheat production forecast by 2Mt to 808Mt.

In Canada, StatsCan reported all-wheat acreage at 26.93 million acres, below the trade estimate of 27.7m and slightly up from 26.8m last year.

In France, soft wheat harvest has begun with 1pc of the crop harvested and 68pc rated good/excellent, up from 60pc last year. Durum harvest reached 4pc, slightly below the 5-year average.

Argentina extended reduced export tariffs for wheat and barley through March 2026, and dry conditions in recent weeks have improved planting conditions there following May’s excessive rainfall.

Ukraine announced plans to ask the EU to sanction Bangladeshi buyers sourcing wheat from Russian-occupied territories.

South Korea booked 50,000t of US milling wheat for August–September delivery.

Rouen port weekly grain exports fell to 39,039t, sharply down from 160,242t previous. Despite a brief bounce in futures, traders remain cautious as Chinese buying interest remains absent and no compelling demand story is forming without it. Weather remains favourable, and crop development is mostly uneventful across the northern hemisphere.

Other grains and oilseeds

Soybeans remained near 11-week lows at $10.17/bu, under pressure from ideal Midwest weather, with widespread rainfall further improving soil moisture conditions.

Argentine farmers accelerated sales ahead of an expected July 1 export tax hike, moving 4.71Mt in the first 18 days of June — double the pace of last year. US soymeal and soyoil markets were mixed, with SMQ up $0.40 and BOQ down 8 pts, leading to a weaker August crush margin.

Corn rebounded slightly, with CN gaining 8c and CZ up 6c, though still near multi-month lows around $4.06/bu. Corn had come into the day down nearly 20c on the week but recovered more than wheat on a percentage basis.

Managed money remains heavily short corn, with 182k contracts reported, and Friday’s USDA acreage and stocks reports could introduce volatility. US continues to sell old-crop corn for export as Brazil’s harvest struggles to gain momentum.

Estimates for Brazil’s safrinha crop range widely from CONAB’s 128.2Mt to Agroconsult’s 150Mt, making reliable forecasting difficult. South Africa lifted its 2025 corn output estimate by 1pc to 14.8Mt.

India’s monsoon is ahead of schedule and expected to deliver a second consecutive above-average year in 2025. India also faces potential rice storage issues, with current stocks at a two-decade high.

Brazil’s corn ethanol sector has tripled in size over the past decade and is playing an increasing role in meeting domestic blending mandates, as sugarcane-based ethanol output stagnates.

Macro

Markets finished the week in a strong risk-on tone, supported by soft US May PCE inflation data and easing geopolitical concerns. US equities rallied, with the S&P 500 and Nasdaq both up 0.5pc to record highs and the Dow rising 1.0pc.

European markets followed, with the Euro Stoxx 50 up 1.6pc and the FTSE 100 gaining 0.7pc. US 10-year bond yields rose slightly to 4.28pc.

Headline PCE inflation rose 0.1pc m/m and core PCE by 0.2pc, keeping the annual core rate at 2.7pc. While these figures were higher than what Fed Chair Powell had referenced previously, Fed officials continued to strike a patient tone, suggesting more data is needed before adjusting rates.

Minneapolis Fed President Kashkari indicated two rate cuts are still likely this year, with the first possible in September.

Commodities diverged, with oil falling over 13pc on the week as ceasefire talks between Iran and Israel reduced near-term supply risk, and OPEC+ discussed a possible 411kb/d production increase for August. WTI finished around $65.50/bbl.

China-US framework deal was reached for rare earth shipments, prompting both sides to scale back trade threats. Despite positive signals, trade tensions linger, particularly with Canada, after President Trump abruptly cut off trade discussions in response to a digital services tax.

Australia

Friday’s WA canola ended the week slightly softer, with current crop bid at A$835 and new crop at $875. Cereals were firm, with wheat bid at $349 and barley at $338, both for the current season.

Through the east of the country, canola was also slightly softer, with bids at $800 and $834 for new crop. Wheat was $340 and barley $335, both for the current season.

Truckie traders are chasing work with freight coming off, as slowing exports see delivered port jobs dry up. Expect freight rates to slide as they look to keep assets spinning.

Delivered markets remain steady through Victoria after falling $10–$15 since the first decent rain of the season, with wheat around $365 in the Western Districts and barley at $370.

HAVE YOUR SAY