Weather: So far so good. The global focus for the next few months will be US row crop conditions which, for the moment at least, look good. There are some signs of developing mid season dryness but models are not aligned. Russia and Germany are set to get a drink, China still needs more and Argy is looking better. Overall, slightly bearish.

Markets: It really is amazing that we are only seeing weather led market volatility now. This winter wheat growing season is full of records. Windiest spring on record, close to a record for tornadoes, a bunch of hail – high temp records, low temp records – just nuts. However, spring wheat has really been the only sign that the crop has faced a challenge.

Australian Day Ahead: WA forecast is hanging in there, feels similar to last season in Gero. Vic is only looking at 5mm for the next 10 days according to most models. Same same.

Offshore

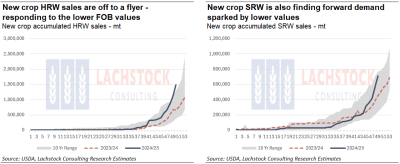

Wheat

Spring wheat in the US is showing signs of stress, with the USDA rating the crop at just 45pc good-to-excellent — tied with 2021 as the second-lowest initial rating in 40 years.

North Dakota, which produces half the crop, is particularly poor at just 37pc GE and 26pc poor/very poor, due to cold, wet weather.

US spring wheat plantings are also at a 55-year low. Despite minimal weather issues elsewhere, a short squeeze in Minneapolis wheat has triggered price rallies, with managed money heavily short (over 70pc of open interest in MWN).

SovEcon raised its 2025–26 Russian wheat export forecast by 1.1 million tonnes (Mt) due to better expected production but still sees a slow start to exports on high ruble domestic prices and average crops in the south.

Argentina’s wheat planting is off to a delayed start — just 3.4pc of the estimated 6.7 million hectares had been sown by May 21, which is 10 points behind last year and 4 points behind the five-year average. Heavy rain in Buenos Aires province and dry soils in the northeast are limiting early planting.

In Brazil, wheat planting is underway with production forecast at 8.3 million tonnes, up 4.6pc year-on-year, though Paraná’s expected planted area has been cut by 22pc due to weak farmer interest.

Other grains and oilseeds

US corn is off to a below-average start, rated 68pc GE versus analyst expectations of 73pc and a recent-year average of 72pc. North Dakota (48pc) and Ohio (41pc) are well below normal.

Cool, wet weather has slowed emergence (only two-thirds emerged nationally), but improving conditions could lift crop ratings in early June.

Corn futures are under pressure from aggressive South American FOB competition, slowing US export momentum.

In Argentina, persistent rain in northern Buenos Aires stalled corn harvest progress, which reached only 38.8pc (~50pc normal) by May 21. BAGE held its crop forecast at 49Mt, with average yields at 8.1t/ha.

In Brazil, the first corn crop is nearly finished at 77.6pc harvested (24.7Mt expected), and the second safrinha crop is developing well with favourable weather and high yield expectations (99.8Mt forecast).

Corn exports are projected at 34Mt, and domestic consumption is rising due to growing ethanol demand.

US soybean markets remain listless as traders await clarity on RVOs, SREs, and 45Z credits. There are expectations that final planted area in the Eastern Corn Belt may exceed initial intentions.

In Argentina, soybean harvest progress slowed sharply to 74.3pc by May 21 due to rain. Yields remain solid nationally (3.1t/ha), but flood damage in northwest Buenos Aires could force revisions to BAGE’s 50Mt production forecast.

Brazil has completed 98.5pc of its record 168.3Mt soybean harvest. Exports are projected near 106Mt. Conditions were mostly favourable, though Rio Grande do Sul underperformed due to weather.

Macro

A federal appeals court offered President Donald Trump a temporary reprieve from a ruling threatening to throw out the bulk of his sweeping tariff agenda, offering at least some hope to a White House now facing substantial new restrictions on its effort to rewrite the global trading order.

The original ruling deemed that Trump overstepped by using the International Emergency Economic Powers Act (IEEPA) to impose sweeping tariffs. Affected levies include those on Canada, Mexico, and China, as well as broad import duties. The decision has triggered legal wrangling likely to escalate to the Supreme Court, injecting further uncertainty into global trade negotiations.

Trump’s team is exploring alternative paths using Section 232, Section 122, and Section 301 — though these are slower and face legal limits or narrow applicability. The uncertainty comes at a time when tariff policy is still central to US trade leverage, but legal challenges are eroding the administration’s options.

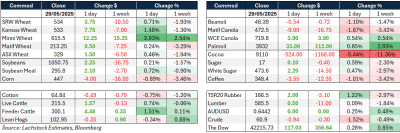

The ruble has strengthened to a calendar-year high, rising 3.7 percent in a day, which could affect Russia’s grain export competitiveness. Markets remain heavily positioning-driven, with sentiment in wheat (especially spring) vulnerable to any weather shocks. Corn and beans are quieter but watching forecasts and policy headlines closely.

Australia

Canola was softer in the west yesterday, with bids around A$810 for current crop and $850 for new. Wheat was steady, with APW at $349 for current and barley at $342.

In the east, canola was softer at $785 for current and $809 for new. Wheat was unchanged to slightly firmer at $350, and barley was $348.

Straw and hay are scarce, with values now close to $500/t. This has seen dairy farms across SA and Vic struggling to find the fibre they need, with almond hulls, cottonseed, and meal in strong demand.

Cropping continues to displace wool production in Australia, with crop area expanding from 12 million hectares in the 1970s to 23–24 million hectares today. In Western Australia, wool receivals are down over 20pc year-on-year following the live sheep export ban, as more farmers shift focus away from sheep towards cropping.

The forecast hasn’t backed off for WA, with nearly all growing regions now set to receive 50mm over the next week. Some improvement is also expected for SA and Vic, with 15mm likely for southern regions.

HAVE YOUR SAY