Weather: It still feels like we are seeing some extreme swings in global weather – the US a clear example. Oklahoma and Kansas will potentially see temps fall below freezing post a week of high 20’s. Some talk about dryness in parts of China, along with the recent focus in Germany and Russia.

Markets: Hard to detach the macro, Donald-Trump-inspired market noise from Ags – yes there are plenty of fundamentals to trade, but it seems Ags are driven more by currency moves and capital flow rather than production prospects – it also feels like this is just the beginning. I think US futures actually performed pretty well last night, all things considered.

Australian Day Ahead: Hard to build massive positions if you are a trader today. Add in the increasing divergence between the north and south in Australia and things should be slightly defensive.

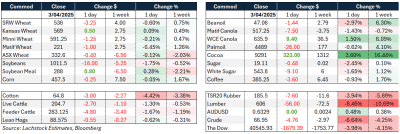

Offshore

- Wheat markets have been volatile, with SRW remaining historically cheap and HRW is priced to sell, as seen in recent sales to Nigeria. HRS is competitively priced, occasionally discounted to mid-pro origins. Despite weak calendar spreads in Chicago, KC wheat continued to show strength, highlighted by recent export performance.

- Total US wheat sales this week totalled 340k old crop and 95.2k new, with HRW leading the way. Globally, BSEA wheat areas have improved, while dryness in the EU and China has become a growing concern. The dominant theme, however, is the aggressive short positioning in Matif, particularly in the May contract, which is inverted versus September. Given the size of the spec short, the May roll will be super interesting – however, we had a similar situation in Dec-24 which rolled without fanfare.

- Paris milling wheat futures experienced their sharpest daily drop in a week, pressured by weaker Chicago futures and a stronger euro.

- Meanwhile, US weather outlooks remain supportive overall, with frost risk in HRW and SRW areas and continued dryness in parts of the southern Plains. Russian wheat values slipped $2, continuing a slightly softer tone. Overall, the wheat market hints that short-side opportunities may be drying up, especially as weather begins to matter more.

- Other Grains & Oilseeds Corn showed resilience amid broader market weakness. While CK and CZ both ended slightly lower, there were intraday recoveries — CK bouncing 10 cents off lows. US corn remains the cheapest FOB offer globally, likely until August, with no aggressive sellers emerging due to tight old crop stocks. Export sales printed at 1.17 million tonnes, slightly below expectations, with South Korea, Japan, and Mexico leading demand.

- In oilseeds, soybeans slid as oilshare share corrected and the market reacted to a 54 percent total tariff burden on China. Brazil remains strong in export demand, and Argentina’s harvest is slow, according to BAGE. Soybean sales reached 410.2k vs. 525k expected, meal hit just 93.5k vs. 200k ideas, and oil came in at 13.8k. While old crop soybeans look vulnerable, new crop appears fundamentally tight, discouraging aggressive forward sales. Political uncertainty and mixed trade signals continue to hang over the complex. Still, the Trump administration seems favourable toward biofuels, which may offer some policy support down the line.

- Macro conditions remain shaky under the weight of Trump’s escalating tariff policies. The dollar fell 1.5pc, wiping out all post-election gains and sending the Bloomberg Dollar Spot Index to a six-month low. Bond yields and equities dropped sharply, with the S&P 500 losing $2.5 trillion in value and the Russell 2000 entering a bear market.

- Safe-haven flows pushed the yen and Swiss franc higher. Trump, meanwhile, defended the tariffs as a negotiating tool but opened the door to potential relief if other countries offer “phenomenal” concessions. His remarks hinted at ongoing talks, including a possible resolution involving China and the US operations of TikTok. Despite signs of stress, Trump pointed to lower energy prices and interest rates as positive developments.

- European leaders, however, struck a confrontational tone. French President Macron urged EU companies to pause US investments and called for a strong bloc-level response using trade retaliation tools. Germany likened Trump’s economic strategy to an act of aggression, demanding a response proportional in scale. As tensions rise, ags may yet find themselves at the center of broader negotiations, with Commerce Secretary Lutnick openly linking tariff relief to agricultural purchases.

Australia

WA canola bids were improved yesterday bid around A$815 for current crop and $864 new crop FIS. Wheat was steady around $370 for both old and new crop, current crop barley $355 and new crop $335.

Through the east canola bids in were $790 for current and around $800 for new crop. Wheat was $343 and barley was $322.

New crop delivered SA wheat bids are indicated to be around $365-$375 for Jan+, with Griffith/Hanwood indicated to be around $340 for new crop.

Expect the GM spread domestically to close further today on the back on improving canola prices in Canada and the US biofuel mandates set to see strong demand to continue for Canadian oil and seed, something that had been up in the air in recent times.

Latest tariffs might help turn on some more Australian wheat demand in the short term with big tariffs slapped onto the top 4 importers of US wheat, Philippines, Japan, South Korea, and China.

HAVE YOUR SAY