Weather: Some concerns about an April freeze in the US – always tricky working out what this means damage wise so need to watch recorded temps. Russia being drip fed with some moisture but still in deficit. South America will see some falls in Argentina – more about corn at the moment but any rain will help their wheat prospects.

Markets: What next…. 50 percent? Impose a tariff on a country, then get grumpy that they counter? Ag markets have done a fair job of absorbing this madness, especially given that China is deeply involved. The strategy of imposing tariffs to bring countries to the negotiating table is sound, as long as they come to the negotiation table – otherwise it’s just inflationary. US rate curve has five cuts in play by the end of 2025!

Australian Day Ahead: We came out of the gates hard yesterday then took a knee. You can’t blame the trade from wanting to see what happens next, but I have been surprised that the Asian consumer has been so quiet.

Offshore

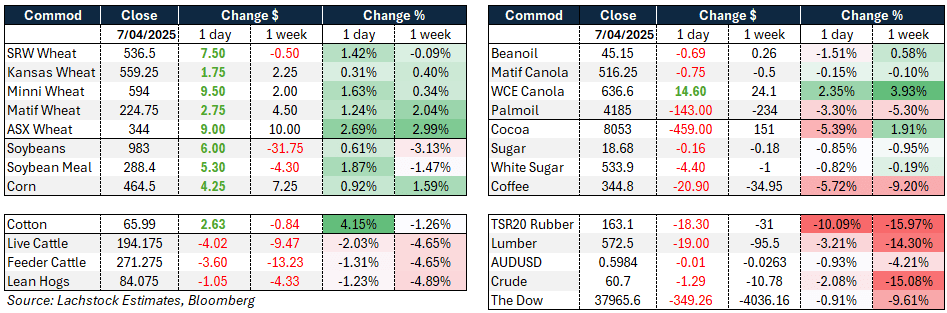

Wheat – Markets opened strong for the week with solid gains across Chicago, Kansas City, and Minneapolis wheat futures. Paris MATIF wheat also firmed while Russian cash held steady. Volatility remains high, and large short positions combined with erratic headlines have created a chaotic atmosphere.

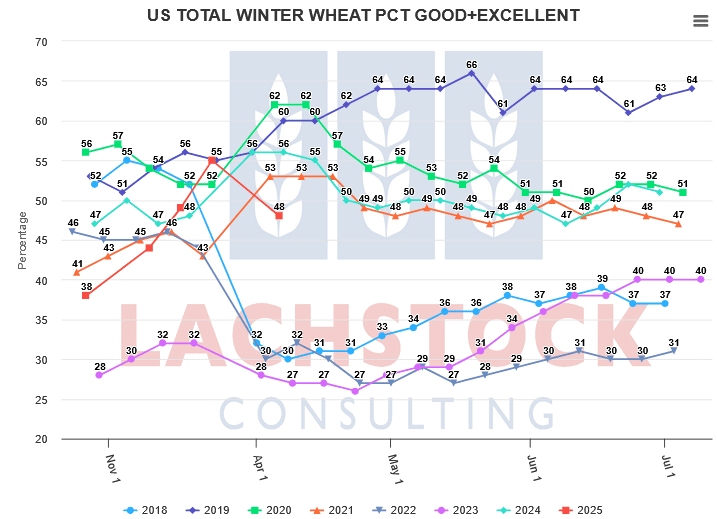

US winter wheat conditions opened slightly better than expected at 48pc good to excellent. However, concerns persist over recent hard freezes in HRW areas and flooding damage in SRW regions.

The Algerian re-engagement with French wheat is significant, especially with tight French stocks and visible short positions in MATIF wheat futures.

Wheat inspections came in on the lower end but remain up over 15pc year on year.

Russia is expected to retain its global wheat export lead with a 22pc share, despite a decrease from last season.

Ukraine’s upcoming wheat crop is forecast to be the best since 2021-22 at 23.7 million tonnes (Mt).

Egypt has fallen short of its planting target but still expects to produce around 10Mt.

Market structure in Europe remains tense, and Chicago storage rates appear steady, while Kansas City rates may expand. Wheat spreads remain firm in many cases, especially with VSR settlement midpoint reached.

Other grains, oilseeds – Corn futures were mixed but showed bullish signals with strong inspection data and firm cash markets, especially in the eastern US. The corn curve was bid as traders speculated USDA may reduce old-crop ending stocks in the upcoming WASDE report due to improved export and ethanol demand. Analysts expect a drop in carryout.

Brazilian safrinha corn conditions are currently average with no signs yet of dry season risks.

In soybeans, non-China buying interest has increased amid high Brazilian premiums and cancelled US certifications. Argentine crushing capacity is under pressure as Vicentin, a big crusher, shuts down due to bankruptcy complications. A looming national strike in Argentina adds further tension to the meal market, already tight on supply.

USDA forecasts expect a modest rise in soybean stocks this month.

Brazil’s soybean harvest progress is strong, ahead of last year. Meanwhile, protests in the Amazon are blocking key soybean export routes, disrupting about $30 million in daily trade.

Macro – Financial markets remain in disarray, driven by the Trump administration’s aggressive tariff policies and the escalating US-China trade dispute. Equities, bonds, and commodities are all experiencing extreme volatility, with the VIX, a measure of market volatility, hitting pandemic-era levels. The S&P 500 briefly rallied on rumors of a tariff delay, only to fall again as threats intensified.

Trump’s latest move includes a 50pc tariff hike if China does not withdraw retaliatory duties. Markets have lost trillions in value, but Trump maintains that the long-term result will be “historic,” with claims of massive investment inflows.

The US administration is considering support for farmers through the Commodity Credit Corporation, although concrete plans remain vague.

Meanwhile, the European Commission has proposed retaliatory tariffs on a broad array of US goods, including soybeans. China is also taking steps to fortify its agricultural industry through oilseed expansion and biotech initiatives, while tightening controls on rare earth exports in retaliation.

Every headline — from potential tariff pauses to increased duties — is followed by contradictory information, adding to uncertainty. Analysts and traders alike are struggling to navigate a fluid, unstable narrative where market sentiment is being whiplashed by politics as much as fundamentals.

Australia

A strong start to the week across the country with a 60c Aussie dollar working bids higher. In Western Australia, new-crop canola made it to A$865/t with GM at $760/t. Wheat was improved to be bid $380/t for both new and current crop, with barley up around $10 to be bid $367/t.

In the east, there was a strong move up for barley bids, up $8 with track bids around $333, coupled with a busy morning of barley trading on Clear to start the week. Canola was stronger with current-crop bid at $785 and new crop at $815, and wheat was improved with bids around $345 for current crop and new crop at $374.

New-crop faba bean bids are around $550-$560/t delivered Geelong/Melbourne, with current-crop bids still around $640, with an increase expected in bean hectares through central and northern NSW with ideal planting conditions.

Delivered barley bids are around $360/t into Geelong as a strong export program continues, coupled with feed demand.

HAVE YOUR SAY