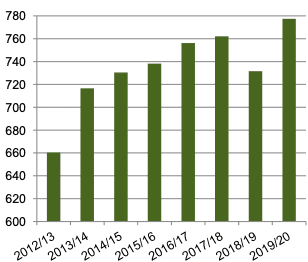

AS NORTHERN hemisphere crops near the start of their harvest in late May and June, the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) have generated a global wheat production forecast of a record 777 million tonnes (Mt) – 46Mt greater than the previous year – which will recharge coffers depleted by last year’s smaller crops.

The greatest turnaround in wheat production forecasts in 2019-20 among major exporters will occur in the EU, where a 17Mt increase is forecast, and Australia, Canada, Russia and Ukraine are all expected to harvest 3-5Mt more wheat this year than in 2018-19.

USDA forecasts Australia’s new-crop wheat production at 22.5Mt, up from 17.3Mt in the 2018-19 marketing year.

The increase in production will lead in 2019-20 to higher trade, consumption and stocks, all of which were cut in 2018-19 by below-trend world crops, moves which drove prices higher over most of the marketing year.

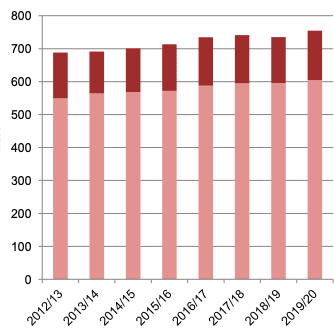

While global consumption is projected at a record 755Mt in 2019-20, the figure, for the sixth time in seven years, will be smaller than production.

Consumption for food, seed and industrial uses has continued its uptrend, attributed in some parts of the world to population growth, better nutrition, and elsewhere to changing tastes and preferences.

Consumers continue to move toward a more wheat-based diet with rising incomes and increased urbanisation.

The quantity of wheat consumed for feed, plus residual, shown in the top section of Graph 2, usually depends on price relationships between feed wheat and other grains, but is also affected by losses which occur in years of abundant supply; the higher figure this year is partly explained by expectations of higher losses at various stages of the marketing chain.

Graph 2: Lower sections of bars depict FSI (food, seed and industrial use) and upper sections depict feed use. Units are million tonnes. Source: USDA

Higher China stocks

Global stocks forecast by the WASDE May report for the end of the 2019-20 marketing year at 292Mt are projected to be up about 17Mt from the previous year.

China will account for 6Mt of the increase in stock, and is forecast to account for around half of global wheat stocks, although the tonnage is generally unavailable to the world market.

Stock in the major exporting countries collectively is projected to be 13 per cent higher than last year, rebounding from a five-year low.

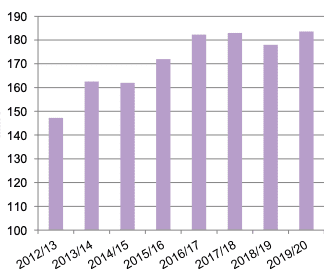

Trade up

Global trade is forecast to rise by 3pc in 2019-20 to 184Mt.

Rising population and changing tastes and preferences in sub-Saharan Africa are expected to lead to import growth, while higher feed use in Southeast Asia, along with continued trends in dietary changes, will also contribute to the lift.

Of the wheat trading partners particularly relevant to Australia, USDA predicts The Philippines’ imports will be unchanged at a record 7Mt, and some other key Australian markets will increase their import requirements in 2019-20.

| Country | Tonnes increase | Total imports |

|---|---|---|

| Indonesia | 500,000 | 11.5Mt |

| Japan | 100,000 | 5.9Mt |

| Korea | 100,000 | 4.1Mt |

| Malaysia | 100,000 | 1.8Mt |

| Vietnam | 500,000 | 4.5Mt |

| Yemen | 100,000 | 3.3Mt |

Table 1: Forecast increase and total imports in selected markets. Source: USDA

Source: USDA

HAVE YOUR SAY