Barley in the Victorian Wimmera goes into on-farm storage last harvest. Growers now have an expanded number of platforms on which to trade on-farm grain in addition to their normal avenues through traders, brokers, and consumers. Photo: Matt Rohde

ONLINE trading platforms for grain and hay are growing in scope and number, and providing a handy adjunct to the person-to-person services offered by traders and brokers.

The platforms are growing in number and sophistication, with AgVantage Commodities, Regulator Markets, and Feed Central’s augmented Local Ag sites in recent months joining the long-established Clear Grain Exchange (CGX) and Farm Tender.

With buyers and sellers needing to register with each platform, they also play their part in minimising counterparty risk.

However, the ability of traders and brokers to specialise in one or more commodities, and understand a particular market’s needs, means platforms are enhancing rather than threatening to replace the vital roles they play.

Grain Industry Association of Victoria president and Kelly Grains trader Jeremy Swincer said online platforms can help with discovery of price, and options at price points, particularly in markets like this current drought one.

“As a trader, a cash broker brings what you want; when you’re looking at a platform, you can be looking at everything,” Mr Swincer said.

As livestock producers in South Australia, Victoria and southern New South Wales empty their own hay sheds, and close-to-home options dwindle, the platforms are offering clarity on specifications, and secure payment.

“If it’s a farmer looking for feed who doesn’t have regular contacts, I’d assume it would be more valuable to them; if they need to get started, it’s a good place to start.”

While bulk handlers can offer growers bids for warehoused grain, Mr Swincer said online platforms where growers set their own offers, directly or through grower brokers, can bring another dimension to the market.

“They’ve certainly got their place.”

“If you want to get in touch with growers you don’t know, they can be useful.”

Clear Grain Exchange

CGX, which now includes the igrainX platform to incorporate grain stored on farm, traded 3.3 million tonnes of grain in the past 12 months.

CGX managing director Nathan Cattle said persistent dry conditions in many parts of Australia have seen buyers search further afield for grain, and widen the grain quality they will consider.

“For growers, this can make determining what your grain is worth a little harder than normal given the natural movement of grain isn’t towards port this year, but rather priced to attract grain towards domestic end-user locations so grain doesn’t leave Australia,” Mr Cattle said.

“This ensures all buyers can see the grain offered for sale, crunch their numbers and try to buy it and pull the grain in what-ever direction is necessary to service domestic demand.

“The best price could come from a multitude of directions as domestic buyers reach for grain.”

Mr Cattle said CGX and igrainX have made it easier for buyers to find grain, and growers to find buyers with the highest demand for their grain, while protecting the counterparties involved in each trade.

“It also provides price data points for the broader market to understand where things are trading and what grain is worth.”

LocalAg

Feed Central was launched by Tim Ford in 2002, founded on demand for a national quality-tested fodder marketplace.

In January, Feed Central expanded its online platform with LocalAg.

“It has the option for buyers and sellers of machinery, livestock, and grain, as well as hay, with an online chat function for people to talk directly to negotiate a deal that suits both parties,” LocalAg’s Warwick-based national sales manager David Clothier said.

The geographical spread of LocalAg’s buyers and sellers means the platform is playing a part in getting fodder to buyers, sometimes across one or two state borders.

“We appreciate how desperate people are; the supply is getting squeezed tightly.

“There’s product moving from Queensland down to Vic and SA as we speak.”

Mr Clothier said corn straw and rice straw as “nearly a last resort” for roughage were being offered out of the Riverina as local reserves of higher-quality hay dwindled, and LocalAg was a good place for the market to find out what was in demand and what was available.

“People are living on the platform.”

Farm Tender

Farm Tender started in 2011, making it the original multi-category platform for Australian agriculture.

From his base in northern Victoria, Farm Tender principal Dwain Duxson said dry or drought conditions in Vic, southern NSW, and SA have those with livestock looking to fill a feed gap likely to last until spring, when pastures are expected to jump away.

“There’s a lot of innovation going on,” Mr Duxson said.

“Supply is depleted, and people are looking at corn straw, rice straw, and cereal straw.”

“It’s coming from anywhere and everywhere; there’s no shortage of innovation coming from the buyers’ and sellers’ side.”

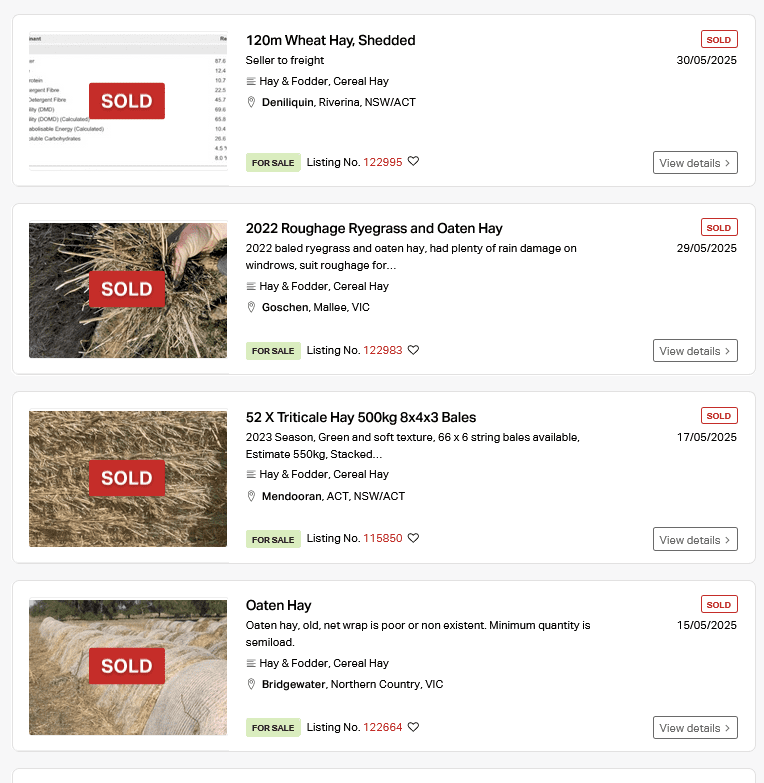

Platforms including Farm Tender have shifted a far greater amount of hay than normal for this time of year from north to south as dry conditions bite. Image: Farm Tender

Aside from straw baled from irrigated crops which normally has negligible value, hay cut from thriving native and introduced species in western Qld was also finding homes in the dusty south.

“We’re seeing some cutting of grass happening around Winton and Longreach, and from the Northern Territory as well going into SA.

“What we’re seeing in the hay job is it’s coming out of the north and heading south.”

Mr Duxson said some milk and meat-processing companies were actively involved in helping their suppliers source inputs, and lambing now taking place was pumping up demand from the sheep sector.

Mr Duxson said farmers with feed mixers or hammermills were best placed to make use of lower-grade straw by being able to supplement it in the ration with inputs of higher nutritional value such as barley and lupins.

Regulator Markets

The latest new business to appear as a platform is Regulator Markets, an independent initiative of Sudima Australia general manager trading and operations Angus Knight.

“It’s a platform that brings together that traditional cash market with new technology…for all industry participants,” Mr Knight said.

Regulator Markets director Angus Knight.

Launched in January, it trades cereals, pulses, and related products including soybean meal and almond hulls.

Mr Knight said Regulator Markets’ key point of difference was its ability to offer participation in track, delivered container terminal (DCT), and free-on-truck as well as warehouse and delivered markets.

“We can bring every trade type into the platform.”

“It also allows farmers, buyers, sellers, and brokers to use the system; we’re not trying to exclude the traditional broker.”

Mr Knight said Regulator Markets has the potential to allow two brokers to trade with each other.

“We see that would really… improve liquidity and make the system more efficient.”

It also includes a mapping function, to show where trading activity is hot, and where it is not.

Mr Knight said the platform gave bidders the ability to “iceberg” an order by putting up, for example, a bid for 2000t when they might be seeking multiples of that.

The platform is aimed at trade-to-trade busines, and does not cater for volumes as small as truckloads.

AgVantage Commodities

Long-established Narrabri-based brokerage AgVantage Commodities has recently upgraded its offering to include an online function which displays bids, offers, and trades.

AgVantage director Steve Dalton said it covers cotton lint as well as cottonseed, plus grains, pulses, and canola, and has been many months in the making,

“The reason I went down that road was to digitise the service we currently offer,” Mr Dalton said.

“We’re trying to increase our offering to the buyer and the seller, and scale into more regions.”

Still in its prototype phase, the platform enables direct trades through the online function.

“There is an automated process, but it’s not a platform we’ve built to set and forget.”

“There’s going to be very much a human element.”

Mr Dalton said this would come from him and his colleague Brendon Warnock actively helping to bring listed bids and offers together through phone calls, emails, and messages.

Big bulk handlers in there too

Major bulk handlers, namely Viterra in SA and into western Vic, GrainCorp in the eastern states, and CBH in Western Australia, also have online trading platforms that enable owners of warehoused grain to access bids.

Viterra’s platform is Ezigrain, which assists grower and buyer customers manage their stock within the network.

“Recently Ezigrain has expanded to support the delivery process at sites during harvest to streamline deliveries and save growers’ time,” a Viterra spokespersons said.

“Through Ezigrain, growers can view their delivery, warehouse and transaction information, and access live prices from the more than 45 buyers in the Viterra network.

“Buyers can publish site based prices all year round and are most active during the harvest period when the majority of selling takes place.”

As dry or drought conditions grip much of SA, Viterra said it has experienced increasing demand for barley for livestock feed, is supporting producers to access available stock.

“We are out-turning on behalf of buyers and growers with stock remaining in warehouse. Viterra is also selling barley from multiple sites where we are the owner of stock.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY