Elders announced it secured a deal to acquire Delta Agribusiness in November last year.

THE AUSTRALIAN Competition and Consumer Commission has raised preliminary concerns over Elders Limited’s proposed acquisition of Delta Agribusiness, warning the deal could significantly reduce competition in rural merchandise and agronomy services across multiple states.

In a statement of issues published today, the ACCC said its preliminary view was that competition risks were heightened in several local markets, including north-west Victoria, South Australia’s Murray-Mallee, and Western Australia’s Northern and Central Wheatbelt, and Great Southern.

The competition watchdog had no initial concerns with potential competition issues in the supply of livestock agency services or supply of rural real estate services or financial services.

ACCC deputy chair Mick Keogh said Elders and Delta overlap in the supply of retail and wholesale rural merchandise and agronomy services, as well as in several local markets, which has the potential to have a negative impact on farmers.

“We have preliminary concerns that the proposed acquisition may lead to higher prices or reduced quality in the supply of rural merchandise without an independent Delta competing with Elders following this proposed acquisition,” Mr Keogh said.

“We are continuing to investigate how closely Elders and Delta retail stores compete with each other, and the extent to which larger retail chains and smaller retailers, or smaller chains, are likely to compete with Elders if the proposed acquisition were to proceed.

“A key issue we are testing is the extent to which having a chain of retail stores assists Delta to compete with Elders more effectively than smaller retailers, both in individual local markets, and across a broader geographic area.”

Key regions of concern

Elders announced it has entered into an agreement to acquire Delta Agribusiness for $475 million in November.

Delta provides rural products and advisory services to customers in New South Wales, Queensland, Victoria, SA, and WA.

The acquisition will add Delta’s network of 68 locations and approximately 40 independent wholesale customers to Elders’ existing portfolio.

All of Delta’s wholesale customers are located in WA.

Other larger rural merchandise chains in Australia which compete with Delta and Elders include Nutrien, with over 380 stores; AGnVET, at 70 stores; and Muirs, with 42 stores.

In the regions flagged by the ACCC as likely to see competition concerns – Albany, Dalwallinu, Hyden and Manypeaks in WA, Tintinara in SA, and Ouyen in Victoria – Elders stores are located within 50km of Delta Agribusiness outlets, with only one other multi-category rural retailer operating within that radius.

The ACCC also named other regional centres where the acquisition could impact competition due to the lack of via alternatives, namely: Brookton, Gnowangerup, Kalannie and Wellstead in WA; Warooka in SA; Donald, Nullawil and St Arnaud in Victoria; and Ardlethan, Caragabal, Coonamble, Cowra and Dubbo in NSW.

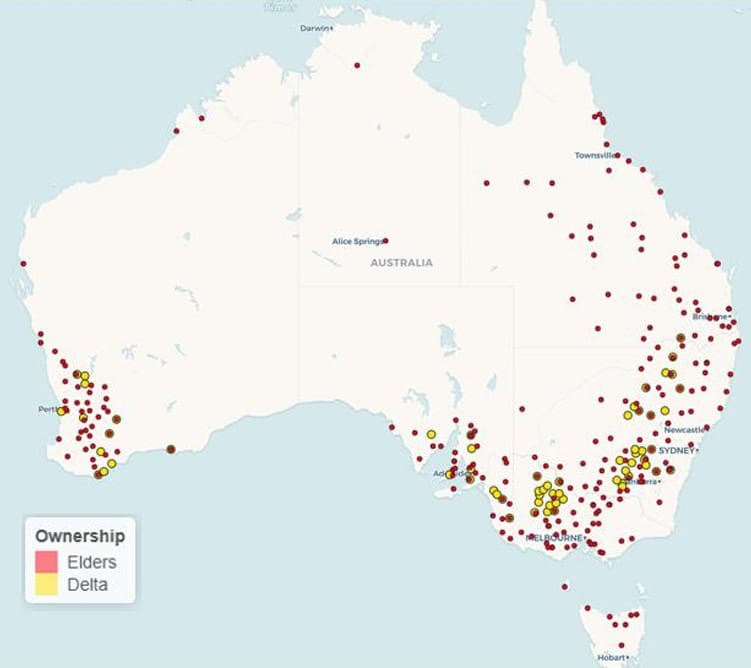

Map showing all Delta and Elders rural merchandise retail stores. Source: ACCC

The ACCC is also considering whether the proposed acquisition would reduce competition at the wholesale level in WA, or whether alternative suppliers would be able to compete effectively with Elders, should it acquire Delta.

In this market, Delta has 41 affiliated independent stores, while Elders has seven as owner of AIRR and Nutrien-owned CRT also has seven.

The ACCC also raised broader concerns about the wider impacts of the potential duopoloy which could result from Elders’ acquisition of Delta.

It cited that together, the companies would have 310 retail stores across Australia, comparable only to Nutrien at more than 380 stores, with the next-largest rural merchandise retailer, being AGnVet with approximately 70 retail stores across Vic and NSW.

“Is there something about big chains like Elders and Nutrien that can source more cheaply generic chemicals, put a house brand on them and be able to out-compete independents?” Mr Keogh said.

He said this is one of the issues the ACCC will investigate further in the coming months.

Potential remedies

If the ACCC’s initial findings are upheld following further investigation and public consultation, Elders may choose to offer undertakings or remedies to address competition concerns and secure regulatory approval for the proposed acquisition.

Last year, Louis Dreyfus Company opted to divest from several ventures to address the ACCC’s concerns surrounding its purchase of Namoi Cotton.

Mr Keogh said divestment was one option which could resolve these potential issues.

“If the parties come to us with a legally enforceable undertaking, for example, to divest particular stores, or divest part of the business or divest some of the things they do then we can take that into consideration.

“It’s up to the parties to put those to us.”

He said another option could be “behavioural undertakings,” where a company agrees to certain commitments aimed at preserving market competition that might otherwise be diminished by a merger.

“They’re more difficult for us because…the ability to monitor them is pretty limited.”

Mr Keogh said companies in some cases opt to dispute the findings in court, which has the power to resolve potential competition issues.

“Should Elders choose to…they can have the court make a judgement and that’s entirely possible as well.”

The ACCC invites submissions in response to the statement of issues by June 12.

The final report on the proposed acquisition is due to be published on August 21.

Elders response

In a statement lodged to the ASX, Elders said it and Delta would “continue to engage constructively with the ACCC to address the issues expressed” in the initial document.

“Elders remains confident that the transaction will bring benefits to local agricultural markets through the expansion of price-competitive private label options, increased technical expertise and greater product and service offerings for farmers,” the statement said.

“Elders is assessing the impact of the ACCC’s process on the transaction timetable and will provide a further update as and when required.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY