Dry sowing in the Esperance zone last week. Photo: Tim Starcevich

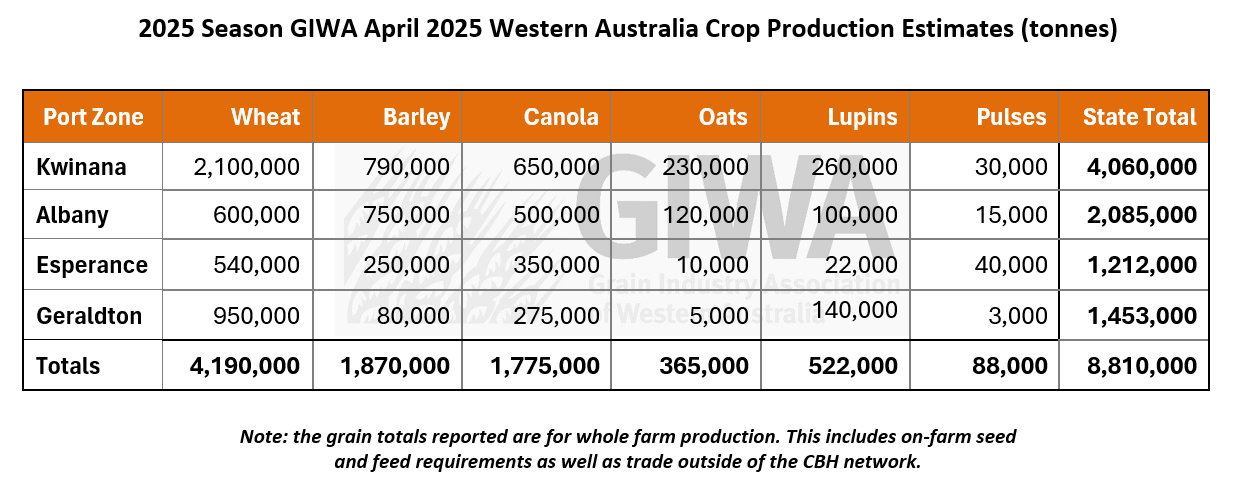

WESTERN Australia is forecast to plant 8.81 million hectares of winter crop, according to the initial estimate from the Grain Industry Association of WA released today.

The figure stated in GIWA’s first crop report for 2025-26 compares with 8.6Mha forecast in April last year for the 2024-25 crop.

GIWA crop report author Michael Lamond said several rainfall events in recent weeks in WA’s southern regions have allowed seeders to start rolling with confidence that emerging crops will get through a dry spell on available sub-soil moisture.

“In the north of the state it’s a different story, with soil profiles dry down to 80cm,” Mr Lamond said.

In central regions, rain has been patchy, and Mr Lamond said some growers were sowing canola into moisture, and others have sown canola dry in the hope of decent rain over the next 10 days.

He said growers have adopted a more cautious approach to sowing as last year’s difficult start for many is still fresh on their minds.

“In the past few years, canola planting would have been under way given the rain that has fallen in many areas, and dry seeding would have started where there has been none, but many growers consider the very warm soil temperatures and lack of sub-soil moisture too much of a risk this year.”

At 22.42 million tonnes, WA’s 2024-25 was the third-biggest ever, and came from a wheat area up by around 500,000ha from 2023-24, while barley was up by about 400,000ha, and canola fell by around 250,000ha.

“There was a large area of fallow sown to cereals in 2024 which is not available for plantings in 2025.”

Mr Lamond said the eventual splits on these three main crops will be determined over the next month.

“Whilst there is likely to be an increase in canola plantings, at the moment this will only occur if the rain showers we have been having over the last couple of weeks in the southern regions continue and the rainfall picks up in the northern regions of the state.

“Otherwise, growers will drop the break crops for the more secure cereals and drop more area out to fallow, as occurred in 2023.”

Mr Lamond said total area sown could easily hit 9Mha, similar to last year, with canola pushing well over the 1.8Mha mark if it rains.

“If it is dry and warm in May as forecast, crop area could drop back to 8.5Mha, as it was in 2023.”

Oats, GM canola growing

Mr Lamond said the sustained price spread between GM, or CAG, and non-GM canola has seen the demand for Clearfield canola and Hybrid TT seed increase this year.

“CAG canola deliveries across the state from the 2024 growing season exceeded 70 percent for the first time and this seems to have hit a demand-driven price point where growers are making variety decisions based on this discount.

“Previously, the yield and weed control advantage has negated any discounts in price.”

WA’s oat area increased sharply last year, with much of the expansion occurring in non-traditional oat growing areas.

“Total oat area in the state increased by 38pc from 2023 to 2024, with oat area harvested for grain up more than this due to a greater proportion of oat plantings in the very dry 2023 growing season being cut for hay.”

Mr Lamond said oat plantings intended for grain were likely to increase again this year due to strong early prices for milling oats.

“The oat area in this report refers to total oat plantings, noting the area destined for grain is usually in the 40-60pc range of total planted area.

Mr Lamond said lupin area was expected to increase in the northern half of the state if it rains in the next month.

“With limited markets for the grain and profitability very sensitive to price, it is unlikely the area will increase to any large extent.”

Mr Lamond said there has been statewide interest in pulses in the last few years and with reasonable yields of lentil, field pea and chickpeas recently, there are more plantings intended in 2025.

Source: GIWA

Further detail on crop conditions in individual WA port zones can be found as part of the full report on the GIWA website.

HAVE YOUR SAY