A cargo of wheat loads at CBH’s Kwinana terminal. Photo: CBH Group

GRAIN Trade Australia has raised concerns over the Federal Government Department of Agriculture, Fisheries and Forestry’s proposal to lift cost recovery charges on the sector by 25 percent in 2025-26.

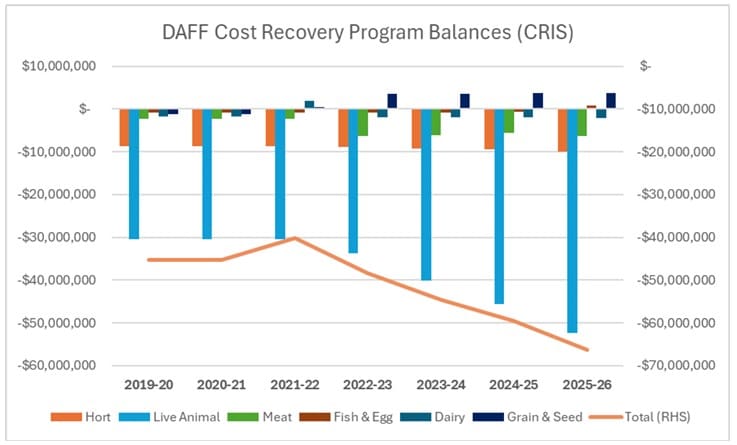

DAFF budgets show the grains and seeds industry component has posted budget surpluses for the past four years.

This is in contrast to other agricultural sectors that have run consistent deficits, requiring the government to draw on its reserves to make up the difference.

DAFF opened consultation on the draft 2025-26 grain and plant products exports cost recovery implementation statement (CRIS) on May 6.

It closed on May 18 with a total of seven respondents.

Under the Australian Government Cost Recovery policy, regulators are required to recover some or all of the costs to deliver services, unless otherwise specified.

Introduced on 1 July 2021, the agricultural export cost recovery system established fees and charges designed to offset DAFF’s forecast costs for delivering its services.

The bulk of the department’s regulatory costs stem from employee-related expenses, with external suppliers and IT system support making up other significant outlays.

For permit and assessment-based activities, complexity is the main cost driver, dictating the time and effort required to deliver a regulatory outcome.

Budget surpluses

In 2023-24 costs, meat exports had a deficit of $18.2M while live animals returned a negative result of $6.8M.

In contrast, funds raised from grain exports came in at $16.4M for 2023-24, $2M more than DAFF expenditures of $14.4M.

The sector’s plan also recorded surpluses for 2022-23 and 2021-22 of approximately $3.09M and $1.57M respectively.

Grains is one of the few sectors to report consistent surpluses, with the meat and live animal export arrangements seeing the largest budget deficits.

DAFF has supplemented the cost-recovery arrangements for meat and live animal exports for all years since 2021, as well as chipping in for dairy, non-prescribed goods, fish, and egg exports.

According to DAFF documents, this shortfall was “supplemented” from “appropriation as part of the Securing the future of agricultural trade budget measure”.

Proposed cost increases

In the draft 2025-26 CRIS, DAFF is proposing to increase revenues from grain and seed exports by 25pc, or $4M.

In a letter sent to the DAFF secretariat, GTA chief executive officer Pat O’Shannassy questioned why an increase of this magnitude was necessary.

“Reports at recent [Grain and Plant Products Export Industry Consultative Committee] meetings and in this 2025-26 CRIS indicate an annual cost for DAFF expenses for the grains sector of $18M, an increase of 25pc (reported in this CRIS as mainly a result of a 19pc increase in labour),” Mr O’Shannassy wrote.

“This $18M cost is compared to the 2 prior year actual DAFF expenses of $14M.

“This increase in labour cost would seem to be greater than the CPI type of pay increase across the Public Service.”

He said this increase had “has been questioned extensively at GPPEICC meetings and industry still have not received an adequate explanation from DAFF”.

“It is also somewhat counter intuitive that the grain sector that has been building reserves across large production seasons, is now being hit with [export cost recovery] cost increases in smaller production seasons when demand for service will be lower.”

Transparency concerns

Mr O’Shannassy said while GTA supported the cost-recovery principle, it held a “strong view” that the mechanism “must adhere to Government policy objectives, including the key principles of transparency and the provision of cost-effective services”.

He referred to the grains sector having a positive reserve balance, while most other industries were in the negative.

He said, given “the reported parlous state of DAFF’s finances over recent years,” GTA remained “concerned the [export cost recovery] is not well managed, and funds are not efficiently utilised”.

“GTA is also concerned the grain [export cost recovery] may potentially receive a disproportionate cost allocation for services received relative to other commodity sectors.

“An example is the disproportionate allocation of costs to grain ECR that occurred with the allocation of Ag Counsellor costs at the end of FY2023-24.”

Mr O’Shannassy said there were concerns GTA members could “be negatively impacted due to the negative reserve balances of the other agricultural sectors”, such as if broad cost-cutting measures were introduced due to budget shortfalls.

The finalised 2025-26 CRIS for grains and seeds is expected to be published on July 1 and be implemented from that date.

HAVE YOUR SAY