Cotton bales being loaded and headed to the warehouse, ready for container packing and export to global markets. Photo: ACSA

GINNING of Australia’s 2024-25 cotton crop has reached the 25-percent mark, with the industry now forecasting production to hit 5.4 million bales.

Early signs point to mixed quality, with southern regions reporting excellent results, while northern growers are facing some downgrades after untimely rain during harvest.

Australian Cotton Shippers Association chair Cliff White told industry members during an end-of-season review webinar on Wednesday that estimated total crop production had continued to climb in recent weeks.

“Despite some less than favourable weather, the yields have been extremely encouraging in the vicinity of 13-14 bales per hectare,” Mr White said.

He said about 90pc had been harvested, with around two-thirds predicted to come from New South Wales, one-third from Queensland and four percent from northern Australia.

“Things are starting to move,and hopefully will really pick up in the next few weeks in terms of shipments and movement of product to market.”

Quality mixed

ACSA vice chairman and ADM Trading cotton manager Australia Arthur Spellson said the crop “had an excellent growing season” overall, despite some isolated establishment challenges due to little rainfall at planting time.

“Some of the crop was planted last year without sufficient water to see it right through, but likely most of those farmers got some top-up water and the crop basically got everything that it needed in terms of water and a lot of good sunshine and heat,” Mr Spellson said.

He said the warm and dry conditions in January and February impacted the quality of dryland crops – about 10pc of the total production – with reports of shorter fibre lengths.

Mr Spellson said the “dream season” was following by a “relatively bad finish” for many growers in northern NSW and southern Qld, with rain in April just before picking resulting in major colour impacts.

He said the extent of damage depended on crop growth stage, with fields ready for harvest suffering the most downgrades, while those yet to be defoliated experienced minimal or no issues.

“Certainly, the cotton that was open and ready when the rain was received, we are seeing some colour downgrade there…but it’s a little bit too early to tell.

“Further north, we’re seeing basically all the colours of the rainbow, and some colours that I think most people haven’t really seen in the Australian industry.”

He said there were reports of colour classed as 71 – ‘good ordinary’ just above the ‘below grade’ category; 52 – low middling and lightly spotted; and 42 – strict low middling and lightly spotted.

Thanks to a dry finish, Mr Spellson said the southern valleys have seen excellent quality, many higher than the ‘middling’ 31 designation.

He said strength has also been positive overall, with 88pc of the crop coming in at 37 staple and longer, with 36 considered the base grade.

“We have a good percentage around nearly 20pc in, what I would call, the premium category, 39-40 staple”.

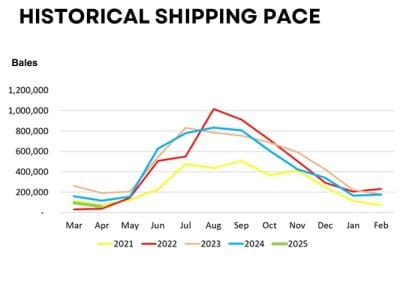

The pace of cotton shipments comparing years 2021-2025. Source: ACSA June newsletter

Near-term buying dominates

Ginning and classing are expected to ramp up in coming weeks and months, with the process likely to continue until at least September.

According to ACSA’s historical shipping pace data, exports usually ramp up during May-June and peak from July-September.

Mr White said it was too early to tell how much of this season’s crop had been committed for export markets.

He said it was clear that macroeconomic factors were leading buyers to limit shipments to the near term.

“We’ve seen that the spinners around the world in every market are pretty much focused on nearby shipments given all the macro impacts on the markets, not just cotton.

“So people are obviously cautious with what they’re doing in terms of forward purchasing and I think all the shippers of Australian cotton have seen that.

“Most of the demand that we receive is for shipment in the next one or two months.”

Diverse export markets

Mr White said Australian cotton continued to attract interest from a diverse range of export markets and this was expected to continue.

These exports are still dominated by Australia’s traditional markets, with Vietnam, China, and Indonesia accounting for 22pc, 17pc and 14pc respectively of 2025-season shipments up to April 30.

However, Mr White said there were some significant movements in exports to the sub-continent, with Bangladesh and India becoming “important destinations for our cotton”.

According to the latest data to April 30, Bangladesh accounted for 19pc and India 16pc of shipments.

“It’s a very encouraging situation to see the sub-continent expanding as a major market for Australian cotton.

“Of course, the trade agreement we have with India has facilitated that expansion, but we are selling more than what is required under that trade agreement.”

Under the Australia–India Economic Cooperation and Trade Agreement, 51,000 tonnes of cotton can enter India tariff-free, a significant reduction from the previous 11pc tariff.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY