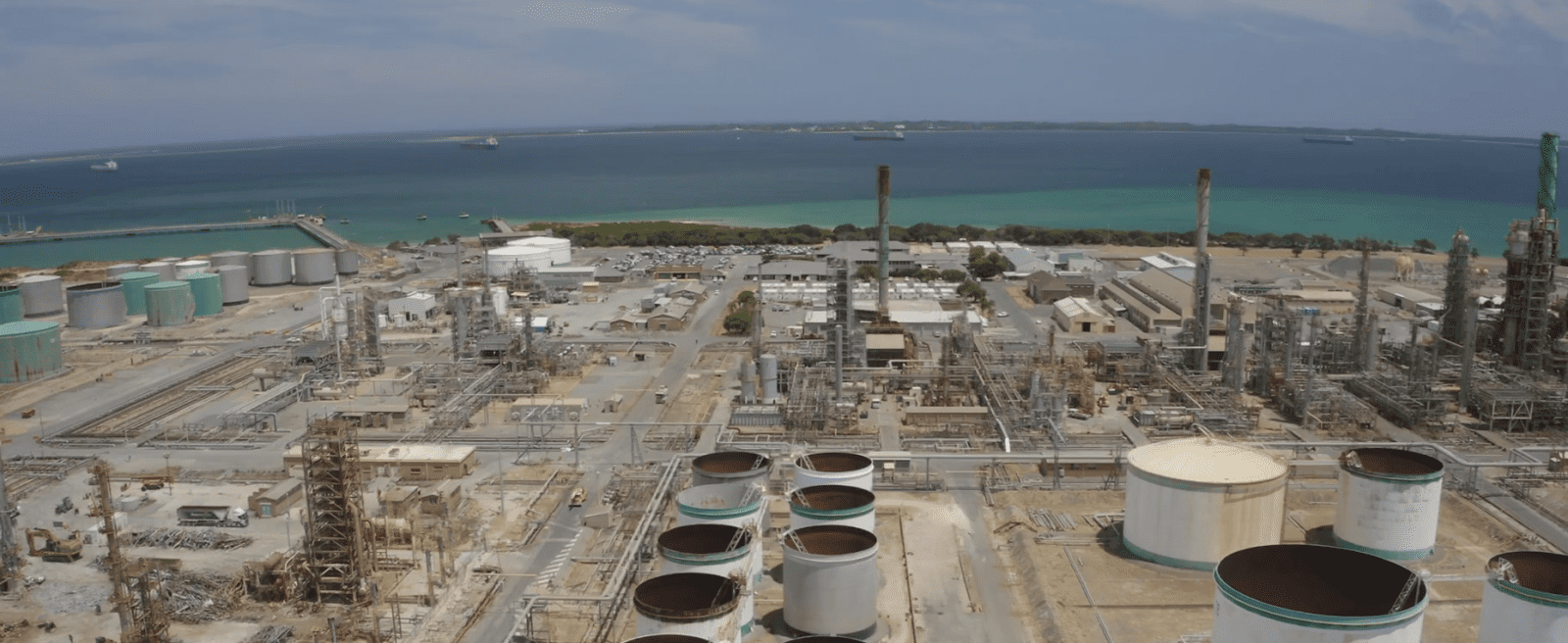

BP has operated at Kwinana since 1955, and has plans to repurpose the site into a renewable energy hub. Image: BP Australia

THAT WESTERN Australia is one of the world’s major canola exporters and has a an annual crush capacity of little more than 100,000 tonnes is one of the wonders of global underinvestment in agriculture.

From Australia’s record 2022-23 canola year when 8.3 million tonnes (Mt) was harvested, WA produced 4.3Mt, with more than 4Mt shipped, mostly to European crushers supplying their local biodiesel market.

To redress the undersupply of crushing capacity, a new crush facility appears likely to be built at BP’s Kwinana site to provide a value-add for WA canola growers and a carbon positive for the London-based energy giant.

The question remains: Who will BP’s partner be in the project, and is there another project in the wind?

Recent media speculation states CBH and BP will partner up, but the parties are yet to confirm or deny.

“BP is talking to multiple parties about a crushing facility in Western Australia, but due to the nature of those discussions we are unable to comment further,” a BP spokesperson advised Grain Central.

Unofficial short list shapes up

Going by some statements made within and outside sessions at the GRDC Update in Perth last week, WA grower cooperative CBH is the short-priced favourite.

It is already a major exporter of WA canola to Europe, and is WA’s biggest bulk handler by far with formidable infrastructure and supply-chain efficiencies.

Speaking in separate sessions at the Perth event, CBH sustainability lead Jane Wardle pointed to the logic of WA producing biofuel rather than exporting the raw material for it.

“WA has got a really good opportunity to create its own biofuel market,” Ms Wardle said.

“I think every grower in the room would think that was great instead of exporting our grain to Europe.”

When asked if any news was forthcoming, a CBH spokesperson said recent global and local investments in the expanding biofuel industry in response to government and corporate sustainability mandates have occurred.

“(This) has increased the global demand for vegetable oils as a critical feedstock for biofuels like sustainable aviation fuel and renewable diesel,” the CBH spokesperson said.

“As a reliable and substantial provider of canola, WA growers are well-placed to serve this growing market either internationally or domestically if there is local investment in biofuel processing.”

“WA grain growers are already a large provider of canola into international export markets where a significant portion of the canola is crushed for oil and meal.”

“In line with our purpose to create sustainable value for WA growers, CBH is open to considering opportunities that provide growers with market optionality that utilises our supply chain.”

GrainCorp is another frontrunner.

It is Australia’s largest canola crusher, and imports, exports and trades vegetable oil.

GrainCorp already has a footprint in WA canola with its crushing plant at Pinjarra, south of Perth, and last year announced WA was the preferred location for a new crushing plant which with an approximate capacity of 750,000-1Mt.

A 2020 WA Government report says the Pinjarra facility had been crushing 65,000t of canola a year to produce 25,000t of oil for export, with meal sold into the stockfeed sector.

WA’s only other volume canola crusher is Alba Edible Oils, which owns and operates the Aus Oils plant at Kojonup.

An offshore partner for BP at Kwinana, or in a separate venture, cannot be ruled out.

Global heavyweight Bunge is a possibility.

It is already involved with gas giant Chevron, and both the US-based companies this week gave their final investment approval for a new joint-venture crushing plant to be built in Destrehan, Louisiana.

Canola looks set to expand south in the US as a potential winter crop grown for biofuel. Photo: Corteva

Expected to be operational in 2026, the plant is part of the Bunge Chevron Ag Renewables venture, and canola is listed as one of its potential feedstocks.

Back in WA, Bunge already owns a terminal at Bunbury, south of Kwinana, as well as up-country sites at Arthur River and Kukerin; it is now also the parent of South Australia’s major bulk handler, Viterra.

Chevron is also known in WA, not least for being a major presence in the state’s offshore gas industry.

In August last year, Chevron announced its investment in Carbon Sync, a soil-carbon sequestration pilot project involving up to 80,000ha of WA’s cropping and grazing region.

In the US, Bunge and Chevron are also investing in canola hybrids alongside Corteva to produce oil with a lower-carbon profile.

Nod from WA watchdog

On January 2, WA’s Environmental Protection Authority recommended approval for BP’s Kwinana Renewable Fuels Project, subject to strict conditions.

In a release from the WA EPA, its chair Matthew Tonts said BP’s proposal to redevelop its existing hydrocarbon refining and production infrastructure would facilitate the processing of vegetable oils, animal fats and other biowaste products to process up to 1600 cubic metres of biofuel feedstock per day.

“Using a previously disturbed footprint within an industrial area means no clearing of vegetation is required,” Professor Tonts said.

“The proponent’s site selection leverages the use of existing pipeline, jetty and tank infrastructure for new operations.”

Professor Tonts said a detailed environmental assessment was required to determine the extent of the proposal’s impact on climate change from greenhouse gas emissions.

On its website, BP Australia states its vision for the Kwinana Energy Hub is to produce sustainable aviation fuel for a new biorefinery, as well as producing green hydrogen.

BP has operated at Kwinana since 1955, and its fuel refinery operations there ceased in 2021.

Ahead of the proposed redevelopment, BP’s Kwinana site is operating as an import terminal.

Industry commentators say fuel companies, BP included, would like to see a mandate from the Federal Government to incentivise production of biofuel, and/or an offtake agreement from an airline or similar volume user before they commit to building in WA.

For a national perspective on canola crushing in Australia, click here.

Grain Central: Get our free news straight to your inbox – Click here

A German engineering company built a biofuel plant for an Aussie company in Darwin Wharf. Capacity was around to process 150000t/year plus pharmaglycerine. The error was that Malaysian Palm Oil was used as feedstock, which caused fallout of sediments and therefore could not be used in as fuel. But in Germany and other places canola oil was used as feedstock. No problems at all with that feedstock as there are numerous plants like that in Germany.

Why did that company (Natural Fuels) try to Use Palm Oil instead of Canola, which is plentiful available in Australia. Perhaps the plant in Darwin can be relocated to Perth.

Thanks for that interesting insight. Australia imports palm oil to use in animal rations, including some feedlots, and for human food. I believe it’s much cheaper than canola oil. It would have been a very expensive exercise to get canola from southern Australia to Darwin to crush, and I guess the build would have been a value-add for the importer of palm kernel. Liz Wells, editor.