Increased stocks of wheat and coarse grains are expected to push prices lower in 2016-17, according to ABARES’ latest quarterly commodity report released yesterday.

The reverse situation – lower stocks and higher prices – is expected for oilseeds and cotton.

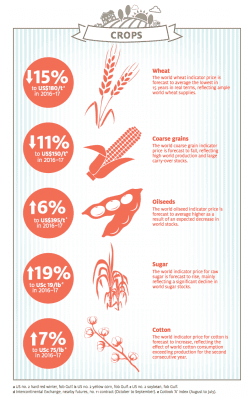

The headline forecasts for key cropping commodities are captured in the graphic below (click on chart to view in larger format).

The full September Quarter commodities forecast with far greater detail can be viewed at this link

Snapshots of key forecasts from the report include:

Wheat

World wheat prices are set to average 15 percent lower in 2016-17.

ABARES expects the world wheat indicator price to average US$180 a tonne in 2016−17, compared with US$211 a tonne in 2015−16.

World wheat production is tipped to grow by one percent to 743 million tonnes in 2016−17.

This is based on forecast record average yields, particularly in the USA, Kazakhstan, Russian Federation and Ukraine, which ABARES believes will more than offset a reduced planted area.

Australian wheat production and export volumes are forecast to rise in 2016−17, but the value of exports is set to remain largely unchanged because of lower export prices.

Coarse Grains

World coarse grain indicator prices are forecast to fall in 2016–17, reflecting strong growth in world production and large carry-over stocks.

The world coarse grain indicator price (US no. 2 yellow corn, fob Gulf) is forecast to average 11 per cent lower in 2016–17 at US$150 a tonne.

The world indicator price for barley (France feed barley, fob Rouen) is forecast to average 12 per cent lower at US$152 a tonne.

World trade in coarse grains is forecast to rise in 2016–17, reflecting a significant increase in corn exports.

Australian coarse grain production is forecast to increase in 2016–17, reflecting higher barley and oats production.

Demand for coarse grains is forecast to increase in 2016–17, but the large volume of carry-over stocks and continued strong production are expected to result in lower world prices.

Sorghum

Grain sorghum production in Australia is forecast to fall by 5 per cent in 2016–17 to 1.9 million tonnes.

The area planted to grain sorghum is forecast to fall by 7 per cent in 2016–17 to 631 000 hectares. Some of the area that was planted to grain sorghum in 2015–16 is expected to be planted to dryland cotton in 2016–17 as a result of higher expected returns from producing cotton.

Grain sorghum prices were around 30 per cent lower in August 2016, compared with August 2015.

Oilseeds

World oilseed and canola indicator prices are forecast to average higher in 2016–17 as a result of an expected decrease in world stocks.

World oilseed production is set to rise, but is expected to remain about four million tonnes short of anticipated consumption.

World oilseed closing stocks are forecast to fall to a three-year low of 79 million tonnes in 2016–17, with canola stocks forecast to fall to their lowest in nine years.

The world oilseed indicator price (US no. 2 soybean, fob Gulf) is forecast to rise by 6 per cent in 2016–17 to average US$395 tonne. This outlook reflects a second year of lower world closing stocks.

Declining 2015–16 carry-over stocks in major South American exporting countries and growing world oilseed import demand are likely to support higher oilseed prices.

The world canola indicator price (Europe Rapeseed, fob Hamburg) is forecast to rise by 2 per cent in 2016–17 to average US$424 a tonne, largely because of forecast lower world supply. Higher import demand from the European Union is expected to be a significant factor in supporting higher average prices during 2016–17. However, this will be partially offset by lower import demand from China.

Cotton

The world indicator price for cotton is forecast to increase by around 7 per cent to average US75 cents a pound in 2016–17, supported by relatively tight world cotton supplies for the second consecutive year.

Although world cotton production is forecast to increase in 2016–17, it is expected to again be lower than world consumption, resulting in a further decline in stocks.

The return to Australian cotton growers at the gin-gate is forecast to increase by 8 per cent in 2016–17 to average $554 a bale, mainly reflecting forecast higher world cotton prices.

Australian cotton exports are forecast to rise by 30 per cent in 2016–17 to 691 000 tonnes, reflecting strong international demand and increased production in 2015–16 and 2016–17

Currency

ABARES assumes the Australian dollar will average US 73 cents in 2016-17, unchanged from 2015-16 and down from US 84 cents in 2014-15.

Crop export earnings

Australian export earnings for wheat and coarse grains are expected to remain largely unchanged (higher volume and lower unit value) while strong rises in export earnings in 2016–17 are forecast for sugar (up 21 per cent), cotton (up 40 per cent) and canola (up 43 per cent). These increases are expected to be partially offset by decreased export earnings for chickpeas (down 32 percent). Overall export earnings for crops are forecast to rise to around $22.9 billion in 2016–17, from an estimated $22.6 billion in 2015–16.

Source: ABARES. To view full report click here

HAVE YOUR SAY