Farm Services Consultant Chris Smith checks on the early establishment of Pioneer canola hybrid 43Y92CL near Goolgowi in south-west NSW. Photo: Pioneer Seeds Aus

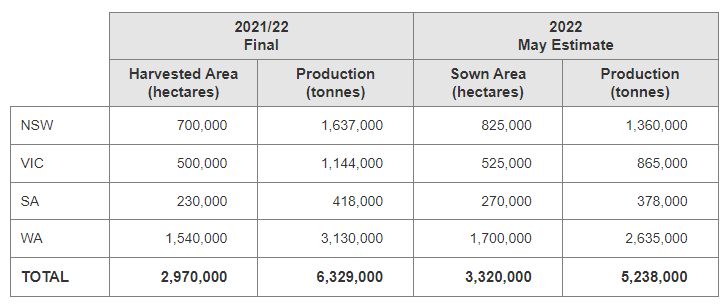

THE AUSTRALIAN Oilseeds Federation (AOF) has forecast a 2022-23 canola area nat 3.3 million hectares (Mha) to produce 5.2M tonnes.

The area is mostly planted, and represents an aggregate increase of 12 per cent on the amount planted last year.

Optimism in growing conditions and continuing firm prices across many districts are key drivers for this rise in area sown.

A strong start to new season plantings has been realised with timely rainfall across many districts in New South Wales, Victoria and Western Australia in the first three months of 2022.

South Australia is the exception, with most canola-growing regions still waiting for a general autumn break.

Across the east coast, favourable seasonal conditions may continue into mid to late-winter, with a weakening La Niña persisting longer than previously forecast.

Canola 2021/22 harvested area and production alongside 2022 May estimates. Source: AOF, Industry Estimates, GIWA; NSW DPI; DEDJTR (Vic)

New South Wales

Timely autumn rainfall across large parts of NSW and high canola prices has seen planned canola seeding up an estimated 10‑15pc on last year, with around 80pc sown by the end of April.

However, saturated paddocks preventing access and a lack of first choice varieties due to seed shortages have been commonly experienced across the state.

Establishment of some dual-purpose crops has been patchy due to a dry March, while mice are impacting some areas with higher stubble loads.

Soils have typically tested medium to low nitrogen throughout the profile, however, many growers are moderating nitrogen application at sowing due to high prices.

Low nitrogen availability and weaker varieties are likely to limit yield potential.

Insect pressure with establishment has not been an issue for most growers.

Looking ahead, winter waterlogging is a risk especially in the central west, with already wet seedbeds and La Niña persisting into winter.

Victoria

Victoria has experienced a similarly strong start to the season as NSW.

Soil moisture is good to excellent through the Mallee, Wimmera, North Coast and North East due to timely Easter rainfall of 30‑70 millimetres.

Winter waterlogging is a risk in the North-East, particularly east of Cobram.

The South-West is the exception with a drier profile and lower recorded rainfall.

Much of the state has been sown as of the end of April, with total cropped area up at least 5pc on 2021‑22.

As with NSW, Victorian growers are balancing the risk of high nitrogen application at high cost with high yield potential.

With urea prices exceeding $1,500 per tonne, some growers are reluctant to apply sufficient urea to realise maximum yield potential.

South Australia

Much of SA, in contrast to NSW and Victoria, is still very dry except for the upper Eyre Peninsula, which received up to 1 inch on Anzac day.

Some areas received isolated falls in January and February, but the Mid North, Lower EP, Mallee and South-East remain dry.

Recent rain has generally fallen outside canola growing districts, forcing many growers to dry-sow.

Total area is up approximately 10‑20pc on last year, with consistent canola growers dedicating most of their landholdings to canola rotation.

The price of nitrogen is a concern for many growers, some of whom may leave out nitrogen application later in the season depending on conditions.

Western Australia

In Western Australia, many growers in the Geraldton zone capitalised on good rainfall from ex Tropical Cyclone Charlotte in late March, sowing in the last days of March and into early April.

Widespread rain in early April prompted further seeding, especially in the eastern low rainfall zone.

The western medium rainfall zone has seen drier conditions and later sowing.

Overall, 20‑30pc of paddocks were sown dry, while total area is up around 10pc on last year.

Growers are generally less concerned about current fertiliser prices and are applying nitrogen based on yield potential.

Many growers also purchased a fair proportion of nitrogen prior to the large price jumps.

Rain cuts soybeans

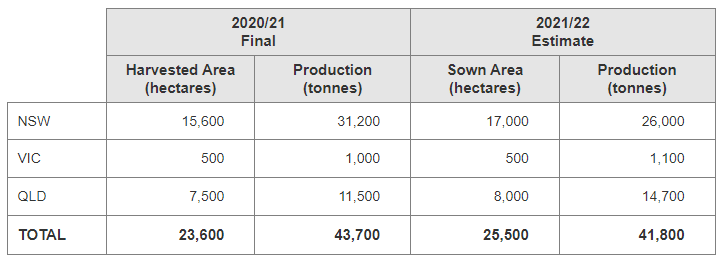

The season started strongly with solid planting in the traditional Northern Rivers and Queensland cane district and expanded planting into the NSW Tablelands, MIA and northern Victorian irrigated areas.

In total, around 25,000 hectares is estimated to have been planted for the season.

Although soybean hectares were up on 2020/21, the production is set to be down due to rain events. Source: ABARES, AOF

Unfortunately, the “rain bomb” events and resultant extensive flooding during March on the NSW Northern Rivers severely impacted many soybean crops, with significant crop losses and quality downgrades.

Heavy rain in May on Queensland’s Atherton Tablelands and in the Burdekin/Mackay area also impacted crops and ability to harvest.

Consequently, what was projected to be possibly a 60,000t soybean crop has been reduced to 40‑45,000t which will be sufficient for domestic demand, but leave little surplus for export markets.

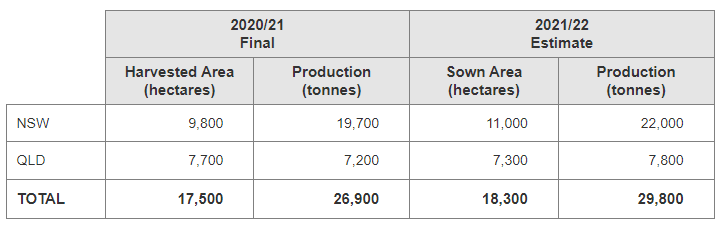

Sunflower hectares up

The 2021/22 season saw what has become the ‘new normal’ area planted of 15‑20,000ha, versus the previous decade with 20-30,000ha planted.

Pleasingly, growing interest in the Riverina has seen the emergence of irrigated sunflower crops, with up to 1‑1,500ha planted in this region, providing an economical crush volume of more than 5,000t.

Increases in NSW interest has seen a minor jump in forecast sunflower production in 2021/22. Source: ABARES, AOF

The Ukraine war has triggered a massive increase in sunflower interest as global prices for seed and oil hit unprecedented levels.

Seed production companies (Barenbrug and S&W) are maximising hybrid seed production for the coming season to meet the strong demand.

To support the strong interest in sunflowers the Sunflower Committee of the AOF is organising grower workshops for Central Queensland and the Riverina for mid-year aimed at building capability among growers and advisors.

Correspondingly, some canola crushers are assessing their technical capabilities to process sunflower seeds, given there is expected to be 7‑10,000 Ha (10‑15,000t) of high oleic sunflowers planted this season.

Source: Australian Oilseeds Federation

HAVE YOUR SAY