A canola crop at Cunderdin in the Kwinana South zone. Photo: Fulwood Grain Company

THE Grain Industry Association of Western Australia has released its July 2023 crop report today.

The 2023 Grain Season – Climate model predictions of a low decile rainfall year are yet to materialise for much of the state.

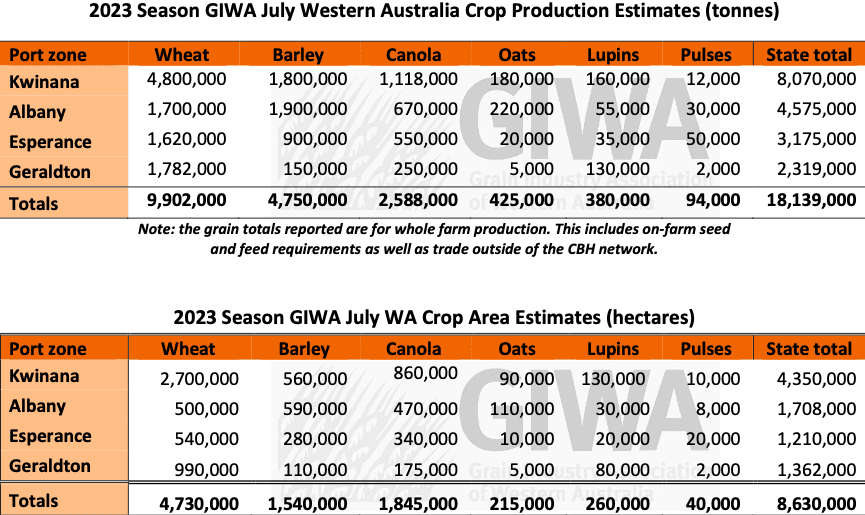

It’s difficult to imagine how a decile 2-3 rainfall year could produce 18 million tonnes of grain when Western Australia has only exceeded this level three previous times in history: 2016, 2021, and 2022. At this point in time, the WA grain crop could potentially reach the totals detailed below, although if the predicted dry spring eventuates, this will not be the case.

The northern and eastern fringes of the grainbelt are experiencing a very dry growing season, and while other areas of the state further west and south are still in good shape, rainfall in June has only been enough to sustain crop growth and there has been no topping up of the “bucket”.

Without substantial falls of rain in the back half of July and through to August, crops will fade quickly.

Good falls of rain at the start of June put the WA grain crop back on track for a good year for most areas, although total rainfall for June fell away with mostly light falls which just kept crops ticking along rather than powering ahead as was the case last year.

June was also very cold, and in terms of thermal time, it was the lowest in more than 30 years.

This has resulted in very slow crop growth, particularly for crops that emerged later.

Crop growth this year has been half the rate compared to the same period in 2022, where crops were growing at 1.5 leaves per week.

This is where the risk of achieving the current tonnage predictions lies; these later crops will be subject to a greater period of heat stress in the spring, which is something most areas haven’t experienced for several years and, without adequate reserves of sub-soil moisture, potential tonnage will sweat off very quickly.

The exception to this is the south coastal regions and the south-western fringes of the grain belt that are currently too wet, or have good levels of sub-soil moisture now.

The reduced area of crop planted in 2023, and the very dry areas in the northern and eastern fringes of the grain-growing regions, will likely restrict potential grain production from exceeding what is mentioned in this report.

It is unrealistic to expect those areas that have missed rainfall to date to contribute too much to WA’s total grain tonnage.

While the good areas of the state are in some cases as good as 2022, and total grain production in WA could be in the higher range historically, it is unlikely to get anywhere near the past two years.

Wheat area is back up to around 55 percent of the total crop area, replacing reduced plantings of both canola and lupins.

Barley area has increased slightly in the traditional barley belt in central regions of WA, although it continues to lose ground to wheat in the south.

Lupin area planted is the lowest for more than 30 years, and while the oat area planted is only down slightly from 2022, most will be destined for grain rather than hay.

Pulse area has declined slightly from 2022 and there is nothing on the horizon to suggest this will change too much in the future.

The majority of the decrease in crop area has gone to fallow in the low-rainfall areas of the state, as well as a slight increase in pasture area from growers carrying over more stock than normal heading into the winter.

With climate models stubbornly sticking to less rain rather than more rain for spring in WA, many growers have adopted a risk-averse approach to the season.

GIWA gratefully acknowledges the support of DPIRD, CBH, DAS and contributions from independent agricultural consultants and agronomists in the production of this report.

Source: GIWA

Further detail on crop conditions in individual WA port zones can be found on the GIWA website.

HAVE YOUR SAY