IN THE 2019/20 marketing year, China accounted for just over 22 per cent of total world cotton production, of which 86pc was produced in Xinjiang province, according to the United States Department of Agriculture (USDA).

In its latest cotton trade report, the USDA said China exported only a small amount of cotton lint, half-of-one-percent of production.

In its latest cotton trade report, the USDA said China exported only a small amount of cotton lint, half-of-one-percent of production.

Other than some minor exports to North Korea, most remaining exports are re-exports of foreign cotton from consignment warehouses.

In addition, China is the world’s largest importer of cotton. This provides China with a supply of cotton normally greater than one-third of world use and nearly 40pc larger than India.

Roughly 70pc of the cotton spun into yarn in China originated in Xinjiang Province; imported cotton accounted for just over 20pc, and cotton grown in the inland areas of China the remainder.

While Xinjiang supplied much of the cotton spun, it is estimated that only 20pc of the spinning activity takes place in Xinjiang.

While most the cotton spun in Xinjiang was grown in the region, both imported cotton and cotton from the inland areas are also spun in the region.

Vietnam connection

China is a top-10 importer of cotton yarn, with Vietnam being the largest supplier providing nearly half of China’s imports.

Vietnam relies almost solely on imported cotton for its cotton spinning sector, and exports over half of yarn production to China.

The US supplied over half of Vietnam’s cotton import last season; in fact, US exports to Vietnam were more than 50pc greater than US domestic use and over three-quarters as large as US cotton exports to China.

Yarn exports

China is also a top exporter of cotton yarn along with India, Pakistan, Vietnam and Uzbekistan.

The vast majority of China’s yarn exports would be Xinjiang cotton, as much of the yarn produced with imported cotton is destined for further processing within China.

China’s top markets are Vietnam, Pakistan, and Bangladesh, which are major suppliers of textile and apparel for the US.

China reports cotton fabric exports to over 120 countries, accounting for around one-third of global trade. Roughly three-quarters of fabric exports are likely of Xinjiang cotton.

Bangladesh, Vietnam, and the Philippines are the top markets for China’s fabric. The US is the largest destination for exports of textiles and apparel for Vietnam and the Philippines, and second behind the European Union for Bangladesh.

2020/21 outlook

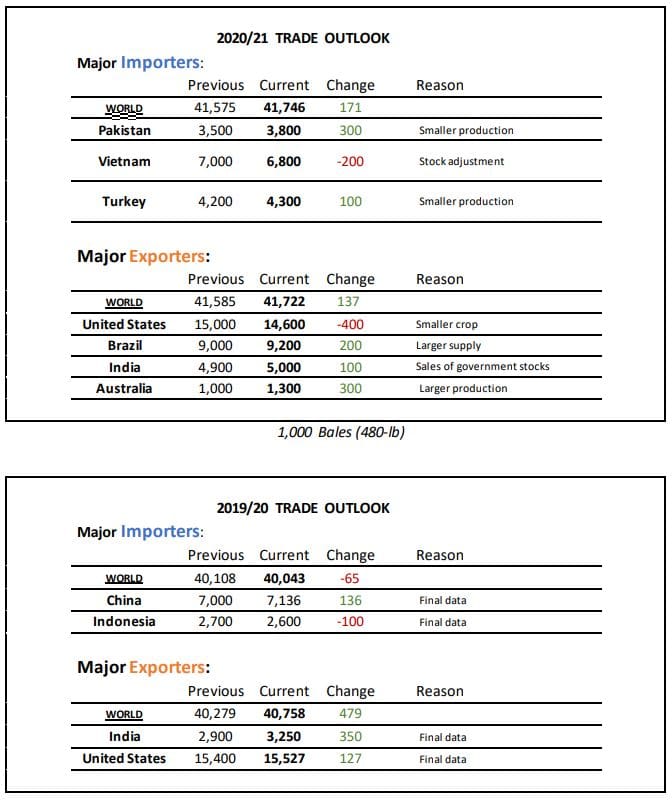

For 2020/21, the USDA’s September forecast for the global cotton trade shows lower use, beginning and ending stocks, higher production and trade.

Production is raised in China, India, and Australia, partially offset by declines in Pakistan and Turkey. Consumption is lowered slightly, with declines in Mexico and Brazil.

Global trade is slightly higher. The US forecast shows lower production, exports, use, and ending stocks. Yield is projected at a record.

Source: USDA

HAVE YOUR SAY