WITH recent reports forecasting diesel prices to move off their long-term lows and future price rises to exceed inflation, how exposed is cotton to these price increases?

According to the interim findings from the 2017 Australian Cotton Comparative Analysis (compiled by Boyce Chartered Accountants, with support from CRDC), per hectare growing costs increased last season, in what is a consistent upward trend for Australian cotton growers.

Given diesel prices during this period were historically low in present value terms, any input price increase is likely to affect a grower’s bottom line.

Cotton’s exposure:

A survey of four international energy research agencies revealed the growing demand for liquid fuels in populous Asian economies could result in the real price of oil increasing by between two and four per cent per year (over and above inflation) to 2040.

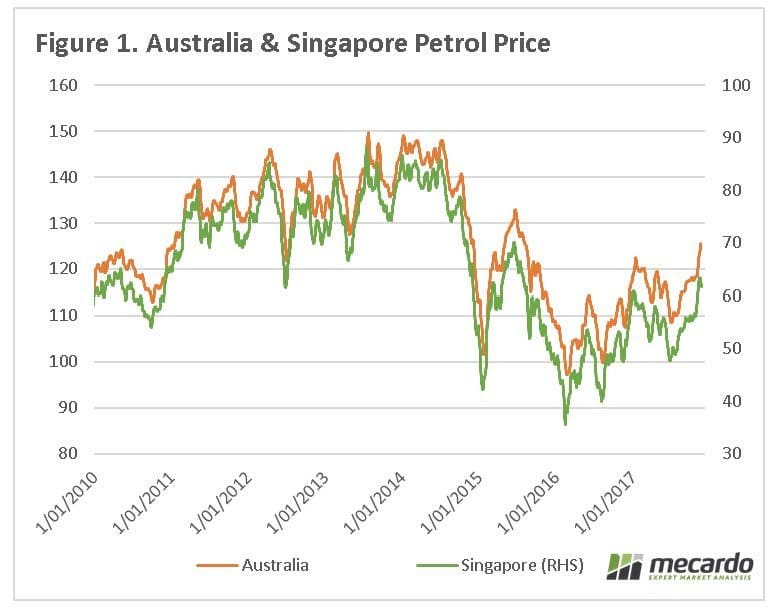

With reduced oil refining capacity, Australia’s economy is almost entirely reliant on imported liquid petroleum products to power agricultural equipment. An analysis completed by MECARDO (see Figure 1) shows the correlation between international and Australian pricing and also indicates an upward trend in nominal fuel prices since 2016.

Cotton gross margins:

Cotton gross margins:

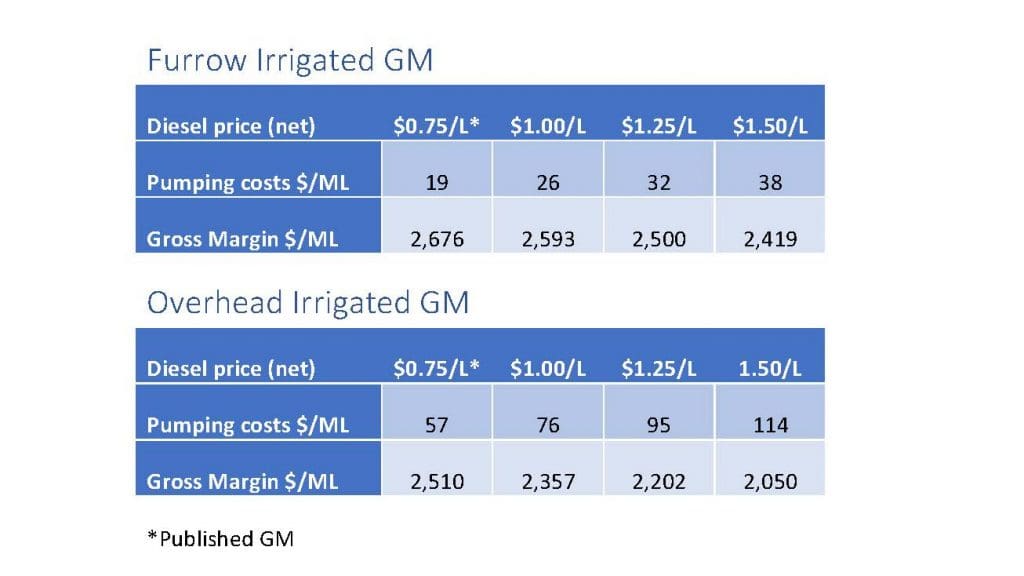

The contribution of diesel fuel to the cost of field operations and irrigation was assessed for the recently released CottonInfo 2017-18 cotton gross margin series. The gross margin budgets were analysed to better understand risk exposure and sensitivity to price fluctuations of diesel.

Looking at diesel use for irrigation in the furrow irrigated budget, priced at $0.75/litre farm (net of taxes and rebates) and assuming the water is lifted twice from a river, $19 of the $50/megalitre is attributed to diesel use (the other costs are fees $17/ML and maintenance $14/ML).

The more energy consumed on farm, the higher the exposure to price increases. In the gross margin budgets, total irrigation costs account for 15 per cent of variable costs for furrow irrigation and 20pc in overhead irrigation.

When the price of diesel is doubled (close to those prices experienced mid-2008), the furrow irrigated gross margin is reduced by 10pc and the overhead irrigated gross margin is reduced by 18pc.

Energy intensive bores powered by diesel are even further exposed to price rises.

This article first appeared in CottonInfo’s e-newsletter: https://www.cottoninfo.com.au/cottoninfo-e-newsletter

This article first appeared in CottonInfo’s e-newsletter: https://www.cottoninfo.com.au/cottoninfo-e-newsletter

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY