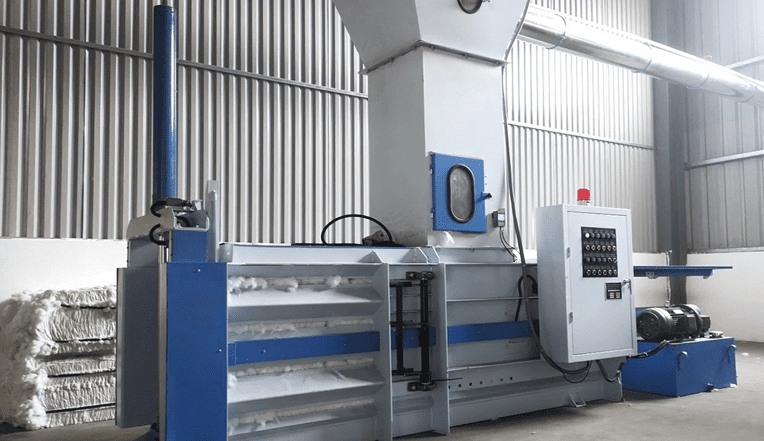

Smart Shirts is a subsidiary of Zhejiang Sunrise Garment Group, the new owner of Gundaline, a large-scale Riverina cotton property. Photo: Smart Shirts

THE SALE of large-scale cropping property, Gundaline, to Zhejiang Sunrise Garment Group (Sunrise) has sparked hope in the cotton industry that Australia may again be an attractive source of the raw material for Chinese mills.

It could also be a pointer for a renewed investment from Chinese entities into Australian cropping and agricultural land.

Via its subsidiary Ausuntech Pty Ltd, the Chinese-based firm purchased Gundaline for $121.25 million from Dutch investment firm, Optifarm.

The transaction received approval from Australia’s Foreign Investment Review Board in December.

Located at Carrathool in southern New South Wales, the 14,915ha property features 6000ha of flood irrigation and can produce around 30,000 bales of cotton per annum.

Sunrise produces textiles and garments for brands, mainly in the United States, Japan and Europe.

Its operations include all facets of the textile-making process from spinning, dyeing and printing to cutting and sewing, and have supplied fabric and garments to premium brands such as Polo Ralph Lauren and L.L. Bean.

Itochu link

With a 22.5pc share, Sunrise’s second largest shareholder is Itochu Corporation, a leading Japanese trading house with historic links to Australia’s cotton and wool industries, and an involvement with textiles that dates back to its foundations in the 1850s.

From the 1960s to the early 2000s, Itochu was the largest buyer of Australian wool, and has been a volume buyer of Australian cotton for its own and other mills.

Itochu has also had investments with Chinese textile manufacturer Shandong Ruyi, including a short-term ownership of The LYCRA Company as based in the US.

Shandong Ruyi was formerly the majority shareholder in south-west Queensland cotton growing and ginning operation, Cubbie Station, as part of a move towards vertical integration.

In a statement to the Shanghai Stock Exchange on December 8, Sunrise said it viewed Gundaline as a reliable source of high-quality cotton.

“Since the beginning of 2021, the prices of cotton and yarn…which are the main raw materials of the company, have fluctuated significantly,” the statement said.

“At the same time, the long production cycle of the company’s products and the relative lag in procurement have also put certain cost pressure on the company.

“The transaction can provide the company with raw materials of stable quality and controlled cost, and further strength[en] the company’s integrated industrial chain layout to better provide customers with high quality and stable garment, fabric and yarn products with traceability.”

Are China-Australia relations improving?

Hopes exist in the Australian cotton industry that the Gundaline transaction could signify a wider thawing of relations between the two countries.

Exports of Australian raw cotton to China have taken a significant dive since 2019 when the country was the largest importer, procuring almost 300,000t.

This intake dropped to 81,000t in 2020 and 37,000t in 2021.

ACSA director Roger Tomkins.

Australian Cotton Shippers Association (ACSA) director and former chairman Roger Tomkins said he believed the sale is an encouraging development.

“It may signify a further thawing in the political relationship between Australia and China,” Mr Tomkins said.

“We hope that we can improve our relationship to where Australian cotton is no longer in a soft ban with China.

“It looks promising for this year.

“I don’t think we will be back to where we were, but it is improving.”

Flow-on to other commodities

Former Australia-China Business Council Agribusiness Working Group chair and Victorian branch vice president, Barry White, said the Gundaline sale was an encouraging sign that more investment could follow, and not just in cotton.

“I think this is a pretty good indication that things might be starting to improve, and that China does see Australia again as a potentially important partner in terms of investment in the agricultural sector,” Mr White said.

“At the end of the day, China is going to remain and is already a major customer of Australia’s, particularly in agricultural commodities.

“This should be regarded as a positive move, and hopefully we should start to see further projects follow on from…this specific proposal.”

Return of Chinese capital

The transaction has also sparked speculation that more than just the cotton industry could see further investment from Chinese entities.

The sale of Gundaline is the first major movement by a Chinese firm in Australian cropping land since Shandong Ruyi sold out of Cubbie Station in February 2022.

After initially purchasing an 80pc share in 2012, Ruyi sold 49pc to Macquarie in 2019 before fully divesting from the operation.

It is believed Ruyi still owns wool trader and processor Lempriere Wool and Victorian sheep property, Larundel Estate.

Ruyi was only of several Chinese owned firms which invested in the cropping industry around 10 years ago.

Also in about 2012, the Chinese property developer Shanghai Zhingfu owned Kimberley Agricultural Investment began developing Ord River irrigation country in Western Australia for cotton and other crops.

Chinese firm Orient Agriculture purchased a large-scale cropping property near Goondiwindi in 2015, and Union Agriculture bought up several mixed aggregations across NSW in around 2016-18.

There has been little Chinese investment in cropping properties or even agriculture in general since this period.

Sales of recent cropping properties by Chinese investors, including Cubbie Station, have hit the news in recent years.

These include the Liverpool Plains mixed farming portfolio of Shenhua Watermark Coal which sold to multiple buyers in January.

According to FIRB data, China was the sixth largest investor in agriculture, forestry and fishery in 2021-22 with $235M worth of investment proposals out of $8.5B total.

In comparison, China was the largest source of investment in 2016-17 with $2.2B.

Sustainability, traceability credentials

The demand from consumers and brands to have textiles with Environment, Social and Governance (ESG) credentials and traceability from farm to store is believed to be a major factor behind the Gundaline transaction.

Many of Sunrise’s subsidiaries, including most notably Hong Kong-based Smart Shirts Limited, promote sustainability initiatives.

Smart Shirts, merged with Sunrise in 2011 and has production facilities in Sri Lanka, Cambodia, Vietnam and mainland China.

On its website, Smart Shirts promotes a focus on ESG from reducing carbon emissions and water use and its ability to source sustainable fibres.

Sourcing cotton from an Australian farm could leverage the global reputation of local cotton as a sustainable fibre and make use of a rising level of traceability services and systems.

Smart Shirts lists one of its ESG credentials as being an in-house recycled cotton manufacturing system with the ability to regenerate old garments and waste cotton scraps into fibre made of recycled cotton. Photo: Smart Shirts

Mr Tomkins said producing cotton that can be accurately traced from farm to garment is still a developing industry.

He said issues arise when a merchant ships hundreds or thousands of bales from multiple properties in one transaction.

He said, similar to current large-scale farmers which sell directly to manufacturers, sourcing cotton from one farm would streamline the shipping process and make tracing the raw material easier and more credible.

“The problem we have got is as a consumer, is we want to know, but there are so many steps in between the cotton merchant and the consumer,” Mr Tomkins said.

“With blending and a few other processes with spinning and weaving, it makes it a lot harder to trace.

“The likes of the large farmers who have been selling directly are much better equipped to show traceability.”

Mr Tomkins said Australian cotton has a global reputation for being environmentally and socially sustainable, which manufacturers can use to promote their end product.

“We believe that we can prove that we do have sustainable cotton.

“If you compare our yields, water use efficiency, less chemical usable, fair work practices, we are head and shoulders above most other cotton exporting nations.

“It is a matter to be able to…be able to sell our message globally.

“It is something the industry has been working on and it is definitely coming to a head.”

In recent years some manufacturers, such as, have shown an increased provenance of their cotton.

NOTE: An earlier version of this story incorrectly stated Itochu as being the major shareholder with a 42pc share.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY