THE gross value of Australian farm production is forecast to fall almost 9 per cent to $58 billion in 2017–18, primarily reflecting a decline in crop production, according to the ‘Agricultural Commodities, September quarter 2017 report’.

ABARES chief commodity analyst, Peter Gooday, said the outlook had been affected by mixed seasonal conditions.

ABARES chief commodity analyst, Peter Gooday, said the outlook had been affected by mixed seasonal conditions.

“The fall in the total value of farm production is driven by a forecast decline of 39 per cent in total winter crop production, as yields fall from the record highs achieved last year,” Mr Gooday said.

“This is around the 10-year average for winter crops to 2015–16, but there is substantial variation in crop prospects across the country.”

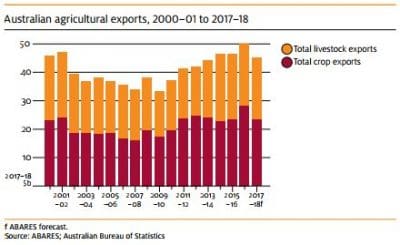

Farm export earnings are also expected to fall from the highs of last year to be 7 per cent lower at a forecast $45 billion in 2017–18.

“The forecast decline is driven by a 16 per cent decrease in export earnings for crops to $23 billion, reflecting lower forecast production.” Mr Gooday said.

Dry winter impacts on crops

Total winter crop production is forecast to decline 39pc as a result of an expected fall in yields from the record highs achieved in 2016–17.

The outlook has been affected by drier and warmer than average seasonal conditions through June and July.

Timely rainfall across southern Australia in August improved soil moisture levels and enhanced the outlook for crops and pasture growth.

However, these rainfall events are likely to have arrived too late to benefit winter crop production in the north-west cropping region in New South Wales, the south-west cropping region in Queensland and the northern cropping region in Western Australia.

Fall in crop exports

A forecast fall in crop export volumes, particularly wheat and barley, is the principal driver behind the 16pc forecast decline in the total value of crop exports in 2017–18.

Prices for cereal grains are forecast to remain historically low in 2017–18.

Lower global supplies of coarse grains and reduced production of high-quality wheat in the United States are expected to provide modest support to prices.

Export earnings for crops are forecast to decrease in 2017–18 for wheat (down 16pc), coarse grains (down 23pc), sugar (down 12pc), canola (down 45pc) and chickpeas (down 57pc).

Partly offsetting these decreases are forecast increases for wine (up 6pc) and cotton (up 19pc).

Wheat

- The world wheat indicator price is forecast to increase by 9 per cent in 2017−18, driven by a decline in high-quality milling wheat supplies.

- Exportable wheat supplies are expected to decrease in some major exporting countries but remain historically high.

- Australian wheat production is forecast to fall to 22 million tonnes in 2017–18.

Coarse grains

- World coarse grain prices are forecast to increase in 2017–18 but remain historically low, reflecting plentiful world grain stocks.

- World coarse grain production is forecast to fall by 4 per cent in 2017–18.

- World consumption is forecast to reach a new record in response to low prices.

- Australian coarse grain production and exports to fall in 2017–18.

Oilseeds

- World oilseed prices are forecast to fall in 2017–18 because of high carry-over stocks and forecast high production.

- Global oilseed production is forecast to remain at record highs, driven by increased plantings.

- Australian canola production is forecast to fall in 2017–18 due to unfavourable growing conditions.

Cotton

- World cotton prices are forecast to fall by 3 per cent due to supply growing faster than demand.

- Higher production of and strong import demand for high-quality cotton are expected to support growth in Australian cotton exports in 2017–18.

- Returns to Australian cotton growers are forecast to fall in 2017–18, reflecting lower world prices.

Sugar

- World raw sugar prices are forecast to fall by 24 per cent in 2017–18 as a result of increased world supplies.

- Returns to Australian cane growers are forecast to average around $44 a tonne of cane cut for crushing in 2017–18.

- Australian sugar production is forecast to remain largely unchanged in 2017–18 despite a fall in cane production.

Prices

Source: ABARES

HAVE YOUR SAY