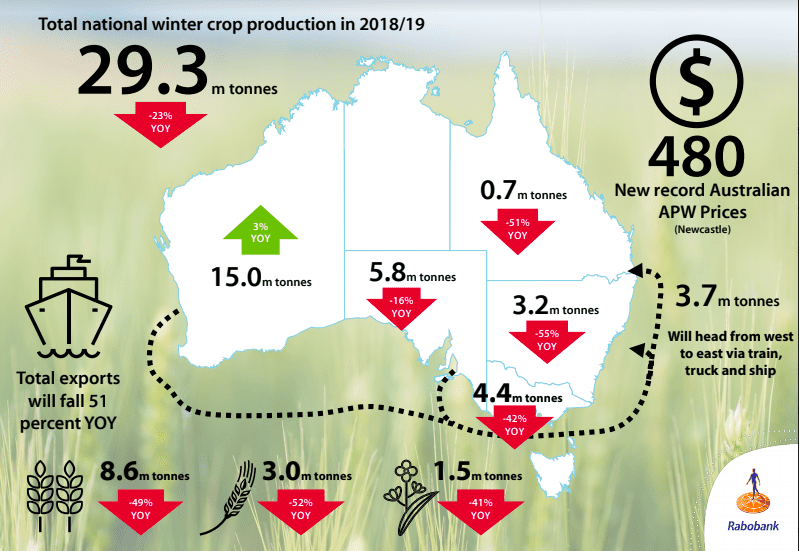

WESTERN Australia will be the saviour of Australia’s grain supply this year for local and offshore trade, according to Rabobank’s latest winter crop production report.

The report said if it wasn’t for WA’s promising harvest prospects, Australia would be facing its lowest winter crop in 20 years.

However as headers commence harvest, the 2018 winter crop Australia-wide is now expected to be lowest in 10 years.

In spite of late frosts WA is set to grow 52 per cent of the national crop.

Running on empty

The east coast grain balance is running on empty, according to the report, following the combination of below-average winter crop harvest volumes in 2017/18 and a now-extended period of elevated livestock feed demand which will only be exacerbated by the projected 23 per cent decline in the 2018 winter harvest.

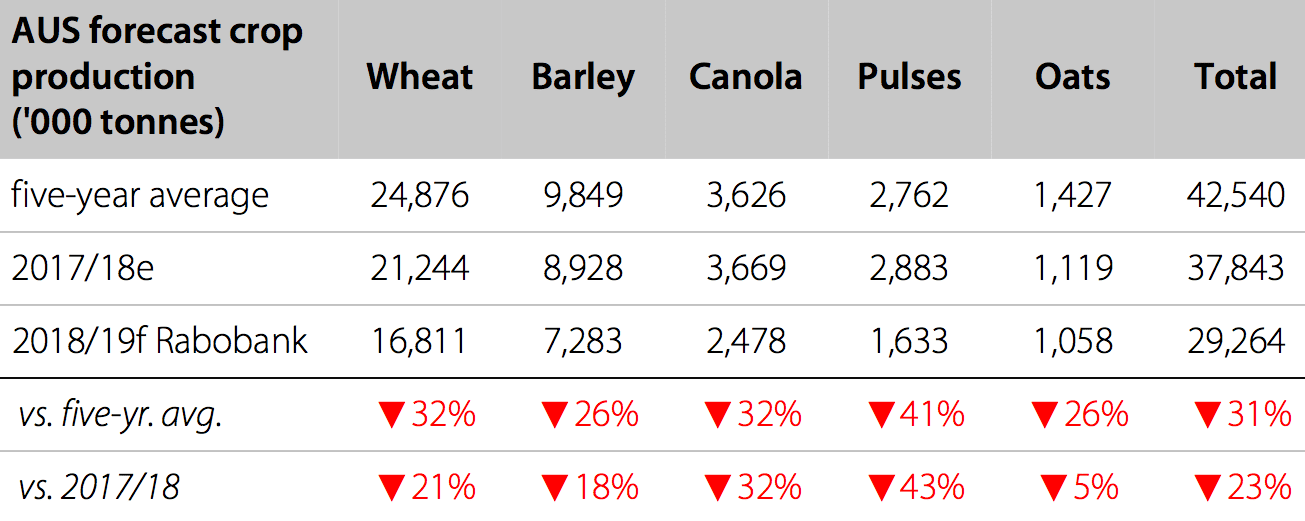

Australia crop production forecast shows the national wheat crop in 2018 one third smaller than the five year average. Canola would be smaller by a similar proportion, while many pulse crops were not even planted cutting pulse crop potential by 41pc from the 5-yr average. Source: ABARES, Rabobank 2018 (Click to enlarge image)

Rabobank forecast total Australian grain exports down approximately 50pc on last year, at 13.9 million tonnes (Mt). Wheat exports are predicted to decline almost 50pc on last year, to 8.6Mt – the lowest export volume since 2007. Barley exports are set to be down 48pc on last year at 3Mt, while Australia looks set to export just 1.5Mt of canola, 41pc lower than 2017/18.

Rabobank predicts wheat exports from Australia will be 8.6 million tonnes (Mt), the lowest since 2007. Its barley export forecast totals 3Mt and canola 1.5Mt, down 52pc and 41pc respectively on 2017/18. (Click to enlarge image)

Previous years of severe drought in 2002/03, 2006/07 and 2007/08 were worse than this year. 2018/19 is likely to produce Australia’s fourth lowest winter crop in the past 20 seasons.

Domestic growth cuts export availability

Report co-author, Rabobank agricultural analyst Wes Lefroy said record high prices for cereals and canola had been reached at all major ports, driven by the local supply deficit, and were at record basis levels over international prices.

The reduced harvest, combined with strong local demand and prices, also has significant implications for Australia’s export markets, with grains exports to be severely curtailed in 2018/19.

“The hit to Australia’s export capacity is certainly one of the big concerns emanating from the reduced harvest outlook,” Mr Lefroy said.

“This will severely pressure our market share in crucial markets in South East Asia, certainly in 2018/19, but also placing our competitors, such as the Black Sea and Argentina, in the box seat to get a greater stronghold on these markets into the future.”

Pulses hit hardest, canola scarce

Pulse production has been hardest hit in this year’s winter crop downgrade, down 43pc on last season and 41pc below the five-year average at 1.6Mt.

Mr Lefroy said this was the result of a combination of lower planted areas, due to pulse prices coming down from record highs seen in 2016 and 2017 and poorer seasonal conditions.

“Queensland and northern New South Wales, which are home to Australia’s chickpea production, have also been the worst-affected drought regions, so yields will also be well down,” he said.

Canola production is also significantly impacted, expected to be down 32pc on last year and also 32pc lower than the five-year average, at 2.5Mt.

Basis prices strong, cash prices remain elevated

Canola’s rapidly-declining crop prospects and increasingly scarce supplies have taken domestic canola prices to decade highs across the east coast.

Australian grain prices are forecast to remain high well into 2019.

Mr Lefroy said the increasingly tight east coast feed balance had also taken wheat and barley prices progressively higher nationally in 2018.

“Wheat basis is at decade highs across the east coast and SA, while ‘domestic’ exports of grain to the east have taken WA basis to seven-year highs,” he said.

“Grain and train shipments from SA and WA are expected to continue well into 2019.”

Mr Lefroy said Australian cereal grain prices were expected to stay at current elevated levels, with any softening before November 2019 likely to be minimal and dependent on either a good autumn break or summer crop prospects, neither of which is currently on the radar.

The report, titled Australian 2018/19 winter crop production outlook, “Running on Empty” was compiled by the RaboResearch food and agribusiness grains and oilseeds sector team and jointly written by Wes Lefroy and Cheryl Kalisch Gordon.

Source: Rabobank

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY