The Wallenius Wilhelmsen vessel Nabucco called at the company’s MIRRAT RoRo terminal on its maiden voyage earlier this year. Photo: Port of Melbourne

AN UPTICK in imports of agricultural machinery in roll-on/roll-off, or RoRo, is helping to alleviate the supply-chain issues being felt by dealers and growers across Australia.

The increased incidence of RoRo for agricultural machinery was mentioned by Wallenius Wilhelmsen senior vice president Oceania logistics services Kim Buøy in his presentation at the Tractor & Machinery Association conference held in Melbourne on July 20.

Responding to questions by Grain Central after the event, Mr Buøy said there was no indication that more larger tractors and combine harvesters were being shipped to Australia RoRo as fully assembled units.

“What is, however, evident is that there are more smaller units being shipped RoRo or as finished units, as a result of some shippers finding it difficult to secure space for containers,” Mr Buøy said.

He said the uptick on smaller ag units using RoRo was being seen on all routes, as shippers and importers looked for alternatives to containerised freight.

While many more container vessels service Australia than RoRo, Mr Buøy said ag, mining and construction machines can sometimes find a fit in the lower decks with clearance up to 6 metres, while passenger vehicles occupy the upper decks with a maximum height of 2.2m.

“It’s probably fair to say that traditionally, agriculture, mining and construction, would get more priority due to freight rates and vessel optimisation.”

This appears set to continue for at least the next 12 months as manufacturers of passenger vehicles look to fill a backlog of orders, and Mr Buøy said shipping carriers wanted to maximise cargo intake.

“It does not make any sense to load low cargoes, i.e. passenger vehicles, in decks designed for high and heavy cargoes such as large tractors and combine harvesters.

“Due to the extreme pressure that container shipping is under, there is a lot of cargoes that have traditionally been shipped in containers that are now been shipped by other types of shipping such as RoRo.

Mr Buøy said most analytics point to shipping delays and supply shortages easing in the closing months of this year, but elevated shipping rates are expected to continue well into 2023.

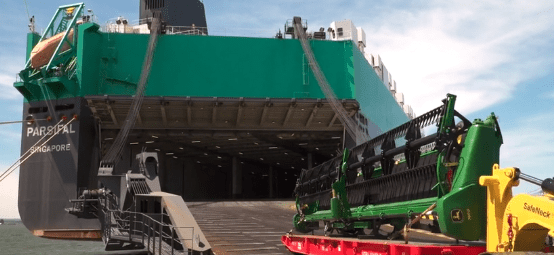

An increase in the use of RoRo vessels to carry agricultural and other machinery is being seen globally. Photo: Wallenius Wilhelmsen

Supply chain major issue

The TMA event included presentations from National Farmers Federation president Tony Maher, Costa Group’s agtech and innovation commercial manager Jesse Reader, Westpac senior economist Justin Smirk and Agriview managing director Alan Kirsten, as well as Mr Buøy.

TMA executive director Gary Northover said the program attracted 220 attendees, all grateful for a chance to get together after COVID disruptions in 2020 and 2021.

“A first-class line-up of the industry’s top representatives were on hand to deliver detailed presentations analysing some of the key issues we are currently all dealing with,” TMA executive director Gary Northover said of the 2022 TMA event.

The supply chain is a big one.

“It’s the wave that keeps hitting the beach,” Mr Northover said post conference.

“If you wanted to order a tractor, you wouldn’t see it for 12 months, and big ones tend to be slower than small ones; that’s become a bit of a common theme around the place.”

“Dealers have been ordering constantly for two years now, and farmers generally have been compromising on what comes in.”

CNH Industrial is the parent of Case IH, and with growing volatility of container availability and cost surge experienced over the past few years in global shipping, CNH Industrial Australia has expanded its scope of utilising RoRo vessels.

“Rather than using just for over-sized machines that traditionally would not fit into the container-shipping model, we’ve sought to further utilise global RoRo services for a larger range of equipment,” said CNH Industrial Head of Transport Logistics AU/NZ Bruno Quintela said.

“Higher costs, port congestions, imbalance and uncertainty in global container movements are all contributing factors that have led to many companies looking to RoRo as an alternative solution for the short- to medium-term.

“RoRo has also suffered some constraints during the last few years but with fixed sailings and far fewer ports of calls, it has meant the impact has been considerably less in terms of global trade.

“As the container industry stabilises, the point at which market rates settle will dictate if RoRo will be a sustainable long-term solution, but in the current market it plays a vital role in keeping equipment moving.

Port of Melbourne (table 1) has shown a slight increase in RoRo ag imports in the year to June 30, and a bigger one in tonnes.

| FY21 | FY22 | per cent change | |

| Units | 1,742 | 1,792 | 2.9 |

| Revenue tonnes | 85,088 | 96,007 | 12.88 |

Table 1: Port of Melbourne agricultural machinery imports.

This indicates more larger equipment coming in via RoRo.

Fremantle and Melbourne are believed to be Australia’s biggest ports of entry for agricultural machinery.

HAVE YOUR SAY