US SOYBEAN export prices had suffered a 20 per cent (pc) decline over the past year and the painful trend would likely continue, according to USDA.

In its Oilseeds World Markets and Trade report published last week USDA said in years ahead the knock on effects, from African Swine Fever (ASF) in China where pig population had dropped 20pc this year, would be a game changer.

China, the worlds largest manufacturer and consumer of soybean meal and oil, produces 30pc of world output, i.e. around 70 million tons (Mt) and 15Mt of each.

In recent years China’s domestic production of soybeans at under 60Mt had not been keeping pace with demand which lifted sharply in 2016, to 98.42Mt, and has since declined around 10pc towards pre-2016 import levels.

As a consequence of China’s pull-back in import demand, large global supplies will continue to pressure soybean prices; a situation that will likely continue as the industry adjusts to ASF.

“This is a far cry from the market dynamics produces experienced since the mid-2000s and will require adjustment by produces to remain profitable in a lower priced market,” the report said.

Soybean stock rising, China sales lagging

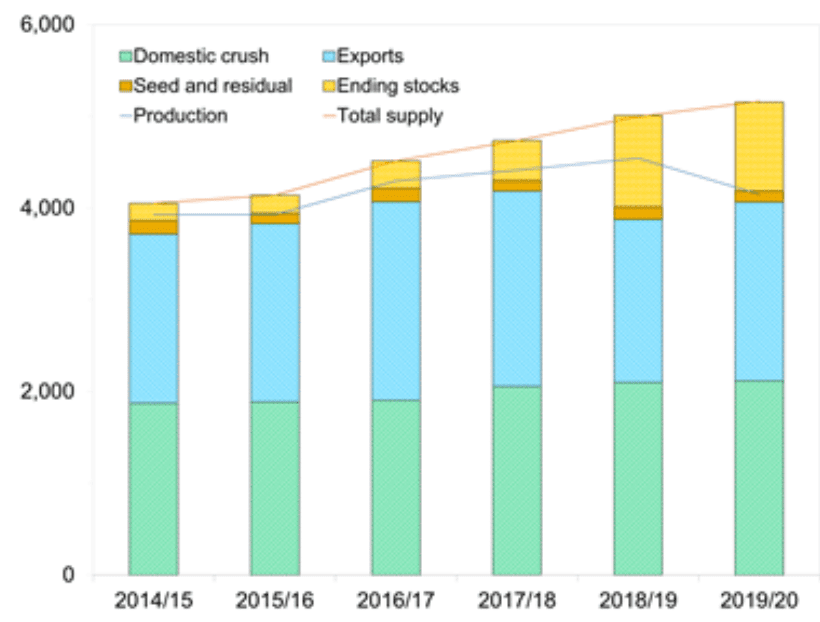

US producers face the prospect of limited opportunity for any appreciable drawdown in soybean stocks.

Large US soybean stock (top, yellow, bar) will persist despite recovery in domestic crush demand. Million bushels. Source USDA

At 2 May 2019, US current crop soybean export commitments to China were 13.3Mt compared with 28.7Mt a year earlier. That gap was partly bridged by shipments to the rest of the world being 20Mt, almost 6Mt above the previous year-to-date. Total US export commitments at 2 May were 45Mt compared to 55.1Mt a year earlier.

Oilseed consumption strong globally

While soybeans account for 60pc of global oilseed production, global oilseed consumption (e.g. soybean, rapeseed, sunflowerseed, peanut, cottonseed, palm kernel and copra) is expected to rise 2pc in 2019/20, similar to the rise in 2018/19 but below the 3.3pc average annual growth seen in the preceding five years.

Low oilseed prices and the expected increase in meat production, driven in part by stronger demand for meat imports by China will partially offset the expected decline in demand for protein meals there.

Source: USDA

HAVE YOUR SAY