DWINDLING prospects for Australia’s milling wheat crop throughout September caused a surge in the ASX Eastern Australia Wheat futures January 2018 contract price in a breakaway from the downtrend in the benchmark CBOT contract.

The ASX’s Eastern Australian contract also saw volume of trade and open interest escalate over the month to offset a tightening of supply in the physical market.

“When the January contract price was at A$272/t on September 19, we saw open interest peak at 16,665 contracts; it has come back a bit since then,” Bell Commodities, client advisor, Bob White said.

Dry the driver

Mr White said ASX trading from May to late August was generally dominated by the direction of US wheat prices in Chicago, which initially reacted to the scare on high-protein wheat caused by a lack of moisture for the crop in the US mid-west.

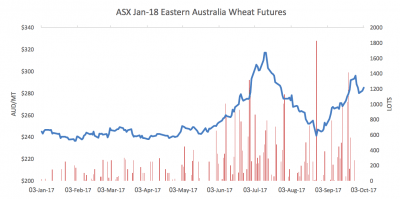

“We had a huge run up to $317/t in the ASX January ‘18 contract (see chart 1, blue line) and from there, the market collapsed right back to almost $240/t, but this was all in tandem with the US.

“In late August, as it became evident that our spring was becoming drier, we started to run our own race.”

Chart 1 below shows ASX Eastern Australia wheat futures price and volume traded.

Chart 1; Blue line, price, red columns, number of lots (20t each) traded per day, data ASX.

Spread opportunity

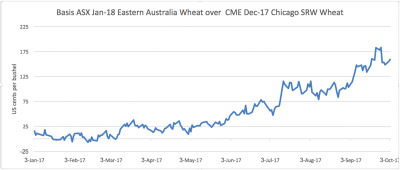

Domestic wheat prices in Australia today sit higher than a world benchmark, for example the December Chicago wheat contract.

This reflects basis, in this case the difference between the US wheat futures market and the Australian market, and Mr White said he thought the ASX Eastern Australia Wheat Jan-18 contract could again test $300/t.

Get our free daily cropping news straight to your inbox – Click here

ASX manager commodities sales, Kristen Hopkins, said ASX futures contracts are a way for growers to lock in margins, and possibly add to margins from domestic and international basis spreads.

“Australia’s weather market and the prospects for our new crop are certainly reflected in the spread between Chicago wheat futures and ASX wheat futures, which is presently in the upper percentiles of the spread.”

Mr Hopkins said it’s useful for growers to be aware of the spread and how they could potentially use futures to get exposure to it.

He said growers typically access futures through marketing advisors, or through swaps within their banking relationships.

Strong basis

A grain marketing consultant told Grain Central that Australian wheat premiums in Queensland recently had shown a very strong basis at 20-50 per cent higher than premiums in the drought seasons of 2002/03 and 2007/08.

Admittedly, Chicago futures prices have been depressed; the world has seen 2017 as a year of relatively high global production, with Black Sea countries’ wheat crops again nudged records.

This year has certainly been one of high world stocks, and Chicago wheat futures prices declined when northern hemisphere production concerns were eventually allayed.

Chart 2 below shows the Eastern Australia basis over Chicago wheat.

Chart 2, data ASX

ASX Eastern Australia wheat a newcomer

ASX’s Eastern Australia wheat contract (code WM) was launched at the end of 2015.

It is deliverable to Queensland, NSW and Victoria road/rail sites up country, basis the port zones of Brisbane, Newcastle, Port Kembla, Melbourne and Geelong.

Even though it can theoretically be delivered it into the Brisbane port zone via up-country sites, those delivering against the contract would be unlikely to do so because margins could be improved by delivering lower-priced wheat from further south, as reflected by ASX pricing.

“If you were long, you would expect to receive the lowest-priced grain in the delivery area, which in this instance is further south, whereas in 2016, the lowest-priced grain on the east coast would have been Brisbane,” Mr Hopkins said.

“The choice of going to delivery is with either party, the long or the short.

“You can certainly go to delivery, a portion of our futures do go to physical delivery, but a lot of people close out their position and take a position in the physical market. That is what usually happens.

“The choice of delivery helps our convergence and our correlation with physical markets.”

It’s a seasonal thing

According to Bob White, ASX activity is seasonal.

“It is the January contract and the following March contract that attracts the interest.

“It’s not surprising to see the volumes pick up as we get into the growing season, and as ideas develop about production and yields; it prompts people to trade.

This year, values of around A$240/t appeared to resonate with end-users.

Mr White said during times of market or weather uncertainty, when bids and offers in the physical are too far apart to allow trades to happen, it’s possible the futures market can be a catalyst.

“Occasionally we get price discovery first on ASX and then the track market lights up,” Mr White said.

“Much of the activity comes from the independent merchants and trading desks who see opportunities to improve their returns and maybe trade basis.

HAVE YOUR SAY