A CBH cargo of malting barley bound for Mexico loads in January at the cooperative’s Albany terminal. Photo: Nic Duncan

THE LACK of Australian barley access to China dealt a heavy blow to the Australian grains industry, but there is a silver lining explained, in part, by China’s rapidly expanding appetite for feedgrain helping lift the global complex.

Lyndon Mickel

Following imposition of a tariff on Australian barley in May last year the Australian grain industry, aided by strong feedgrain demand, is now adjusting to damaged malting barley exports.

Along with discussions around the malting and brewing industries’ move to sustainability, it was one of the themes introduced by Grain Industry Association of Western Australia (GIWA) barley council chair Lyndon Mickel at the annual barley forum held in Perth on Monday.

Corn imbalance

CBH Group’s barley trading manager Drew Robertson, who oversees one of the world’s biggest barley export programs, was among the forum presenters.

“Probably since the middle of last year demand from China has really been driving global grain markets across the board,” Mr Robertson said.

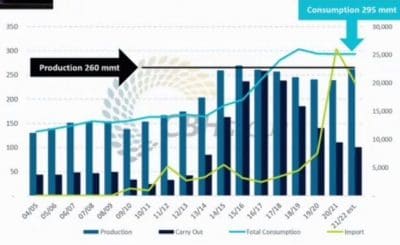

Pointing to China’s structural imbalance on domestic supply and demand, Mr Robertson said China’s own production of corn has plateaued at around 260 million tonnes (Mt), but consumption sits at around 295Mt.

The deficit for two years at least has been filled partly by corn imports and partly by stock drawdown, severely cutting its carryout (Chart 1).

Chart 1. Corn in China. Carryout declines (navy vertical bars)left axis million tonnes. Imports rise (chartreuse line) right axis, thousand tonnes. Data sources assembled by CBH.

“Substitution and imports are the short-term levers China can pull to try to resolve the imbalance.

“Longer term, you would have to assume that China would try to increase production again.

“Over time, this isn’t a short-term solution, you would think there would be some significant investment to try to improve corn yields.”

The yield of corn in China is reported to be about 60 per cent of US yields, 75pc of Argentinian yields, and similar to Ukrainian corn yield, and has great potential to increase.

Feed/malting spread narrows

Australia went from being a high-priced source of malting barley, ranking alongside that of Canada, to the cheapest malting barley, according to Boortmalt Asia Pacific regional merchandising manager Simon Robertson.

“The impact locally is that we have seen the premium for malting barley dissipate.

Malting barley prices fell, but feed prices also lifted, narrowing the feed/malting spread.

“The underlying feed demand for barley and the feed demand particularly out of China, recovering from African Swine Flu is taking a huge amount of corn, barley and wheat now for feed (and) has been the driver for supporting feed prices.”

Need to diversify

The Australian Export Grains Innovation Centre (AEGIC) is involved in identifying and building markets for Australian grain

“We are needing to understand how consumers are shaping demand, globally,” AEGIC chief executive officer Richard Simonaitis told the forum.

Richard Simonaitis

“Individual people make individual decisions about what they consume, what they choose to put into their mouth.

“The aggregation of those decisions becomes demand.

“China was our biggest barley market…it is a massive shaper of demand.”

While existing alternative malting barley markets could show growth, Mr Simonaitis said it would likely be modest.

“For malt, there is no single market that can soak up the malting capacity that China has, at 5.4Mt annually; the rest of the world is only about 3.5Mt.”

Mr Simonaitis pointed to the future of feed and malting barley being best served by AEGIC sharing with customers all technical aspects of Australian barley, consulting on the economic modelling of how it transfers value to them.

When an educated buyer and informed seller meet in the market you achieve market symmetry and achieve the best price outcome.

When AEGIC has done the groundwork, as has occurred in India, trade will follow when market circumstances have cleared the few remaining hurdles.

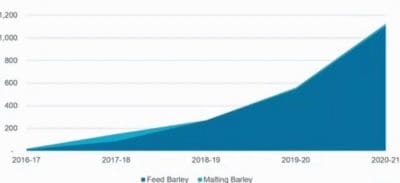

Price and favourable market circumstance have allowed Australian feed barley to supply Middle Eastern customers again, and new trade has flourished in Southeast Asia (Chart 2).

Chart 2. Australian barley export trade opportunities with Thailand have flourished. Thousand tonnes. Click to expand. Source: AEGIC

“Thailand has risen from nothing to about a million tonnes.

“We thought Vietnam would be slow; it’s over 400,000t this year.

“The Philippines is just starting to switch on.

“There are huge volumes of feed barley traded through South-east Asia and North Asia, and with the right technical support and fundamentals ,we should be able to sustain our participation in those markets for a long time.”

South America and Africa also represent malting barley opportunity, for which Mr Simonaitis acknowledged funding from the federal government’s Agricultural Trade and Market Access Cooperation (ATMAC) Program.

HAVE YOUR SAY