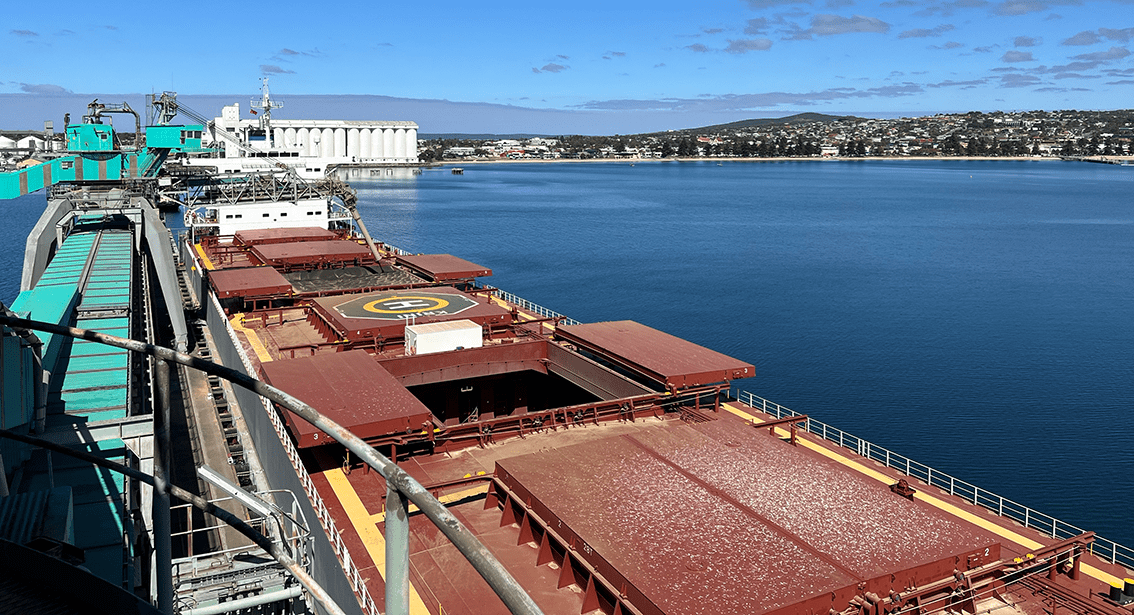

The Krini loads canola at Viterra’s Port Lincoln terminal in March 2024 ahead of its departure for the UAE. Photo: Viterra

AUSTRALIA’S grain-marketing season concluded at the end of September, and with last week’s release of that month’s export data by the Australian Bureau of Statistics came the twelfth and final chapter of the nation’s 2023-24 grain-export dossier.

While analysis of the data reveals a sharp decrease in export volumes compared to the record 2022-23 season, it did not come as a surprise after 2023 harvest volumes were down dramatically year on year due to drought, especially in Western Australia and New South Wales, the nation’s top producing states.

While analysis of the data reveals a sharp decrease in export volumes compared to the record 2022-23 season, it did not come as a surprise after 2023 harvest volumes were down dramatically year on year due to drought, especially in Western Australia and New South Wales, the nation’s top producing states.

Total exports of the top four commodities – wheat, barley, canola, and sorghum – fell 24.9 percent, or 11.88 million tonnes (Mt), to 35.88Mt collectively. The program was behind from the get-go, with shipments in the first quarter of the marketing year falling by 19.1pc compared to the previous corresponding period. Exports in the subsequent three quarters were down 20.7pc, 30.5pc and 30pc respectively.

Barley

The importance of, and reliance on, China as a destination for Australian grains stood out in the 2023-24 data. China collectively accounted for 33pc of all bulk and container exports of the top four commodities, up from 21.8pc in the 2022-23 marketing year, and 22pc the season prior.

From a monthly perspective, the biggest shipping month across the four commodities was January, with a total of 4.08Mt, compared to March of the previous season when 5.4Mt was exported. In fact, January was the only month above the 4Mt threshold in the 2023-24 export matrix, compared to the entire December-to-May period in the 2022-23 marketing year.

However, the decline in export volume in 2023-24 was restricted to wheat and sorghum only. Canola shipments were almost exactly the same as the previous season, and barley staged a dramatic China-led export recovery after Beijing dropped the exorbitant import tariffs on Australian barley in early August last year.

Total barley exports in 2023-24 finished at 7.91Mt by the end of September, 830,000t or 11.7pc higher season on season. December was the peak month, with a record 1.29Mt shipped, eclipsing the previous record of 1.26Mt set in March 2017. While WA shipped the biggest volume, it did fall from 4.36Mt in 2022-23 to 4Mt last season. This decrease was almost entirely nullified by an increase of 310,000t in South Australia to 1.98Mt. The shining light was Victoria, where a huge harvest last year saw barley shipments jump by 91.6pc to 1.88Mt.

Unlike the previous three seasons, barley exports in 2023-24 were dominated by China, with 6.13Mt or 77.5pc of the shipped volume discharged at a myriad of the nation’s bulk ports and container terminals. The program to China was also heavily front-ended, with 68.8pc in the first half of the season and 31.2pc in the last six months. With the rise of China came the fall of Saudi Arabia, exports to which fell from 1.83Mt in 2022-23 to zero last season, emphasising its position as a market of last resort for Australian barley exporters.

Japan was the second-biggest barley destination in 2023-24 at 870,000t or 11pc of the annual volume. The third-biggest customer at 220,000t, or 2.8pc of sales, was Mexico, a market nurtured in recent years as a consistent and vital buyer of Australian malting barley.

Wheat

Wheat exports for the season totalled 19.75Mt, a 37.8pc fall from 31.77Mt a season earlier. In volume terms, the biggest casualty was WA, where shipments came to just 8.4Mt compared to 13.14Mt in 2022-23. Exports out of NSW fell from 5.38Mt to 2.24Mt, and Queensland and SA volumes were 1.86Mt and 1.89Mt lower respectively. Victorian wheat shipments were only 390,000t lower than the previous season after a record wheat harvest at the end of last year boosted the state’s exportable surplus.

While less dominant than in barley, China was still the top wheat export destination, receiving 19pc of total shipments. However, at 3.76Mt, Chinese purchases in 2023-24 were just 49.5pc of the previous season, as lacklustre domestic demand eroded import volumes. The program to China dropped off dramatically in the last half of the year, with less than 20,000t exported in the last quarter, all in containers.

Indonesia was the second-biggest wheat customer last season at 3.24Mt, or 16.4pc of the total, and The Philippines took the bottom step on the podium at 2.35Mt or 11.9pc. The next four in finishing order were Yemen, Japan, South Korea, and Vietnam, with 7.8pc, 6.1pc, 6pc and 6pc of total sales respectively.

Canola

With canola exports unchanged, the primary destination for Australian seed remained the European Union, although shipments did fall from 3.2Mt or 52pc of 2022-23 sales, to 2.47Mt or 40.2pc of 2023-24 sales. The three other primary destinations were Japan with 1.33Mt, or 21.6pc of total canola exports, the United Arab Emirates with 770,000t, or 12.5pc, and Pakistan with 660,000t, or 10.8pc. WA remained the key export hub, accounting for 52pc of the nation’s canola shipments. The national program was spread relatively evenly across the entire marketing season, highlighting the tightening global balance sheet.

Sorghum

Sorghum exports from October 2023 to September 2024 were 18pc, or 680,000t lower than the previous corresponding period, primarily due to a drop in demand from China. However, the dominance of China as a proportion of the total program increased from 86.2pc to 93.9pc season on season. Shipments out of NSW were down by less than 100,000t, but the Qld program suffered to the tune of 600,000t compared to the 2022-23 export task.

Notable pulses

Other Australian grain exports of note in the 2023-24 marketing year were 1.51Mt of lentils, with India and Bangladesh the primary destinations, 500,000t chickpeas, with Bangladesh and Pakistan the main buyers, 430,000t lupins with sales to The Netherlands and South Korea accounting for almost 80pc of the program, and 300,000t oats, 77.4pc of which was marked as destination China.

HAVE YOUR SAY