The Snapshot

- Price risk management is important for both producers and buyers of grain to ensure that adverse movements in price do not impact them.

- One of the tools available to the industry is futures.

- Producers in Australia underutilise these.

- Many different exchanges can be used to hedge wheat, both in Australia and overseas.

- CBOT wheat is the most commonly referred to.

- The contracts with the highest correlation to Kwinana wheat are Matif, CBOT and ASX.

- It is important to use data to make better decisions whilst remembering that correlations can change based on local conditions.

The Detail

Price risk management is crucial to both sellers and buyers of grain. If you are a seller you want to protect against prices falling, and vice versa for buyers.

There are many ways to protect from price risk, and one of them is through the use of futures contracts. These tools are generally underutilised by Australian producers but are a valuable resource.

Where do you start?

There are numerous futures exchanges and contracts around the world which could feasibly be used for hedging wheat.

The most commonly referred to exchange globally is CBOT and locally ASX.

There are however others which are available.

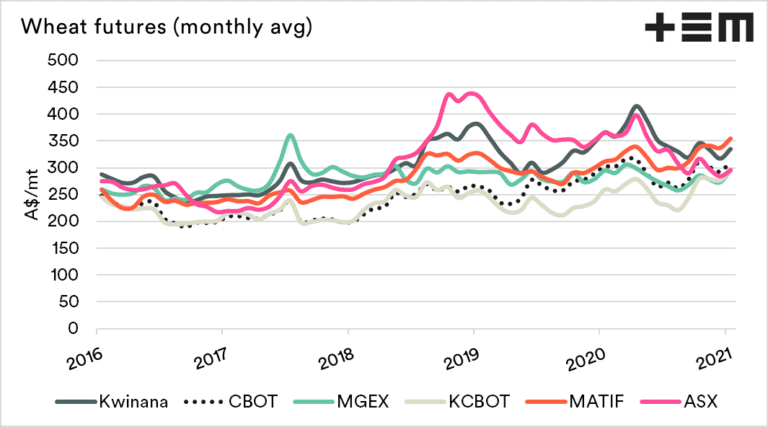

Figure 1 below, albeit messy, shows the price of Kwinana APW against a selection of contracts since 2016.

Figure 1.

We can see from this chart that whilst there is a spread between each of the contracts, they tend to follow a general pattern. There will be times when some contracts blow our compared to others, due to local factors.

In the case of ASX in 2018 to mid-2020, it was trading higher than the other futures contracts due to the Australian drought.

Correlations

Old adages that apply in hedging correlation do not equal causation and past performance is not an indicator of future performance.

That being said, it is always worthwhile looking into the data to see which hedging tools have traditional had the strongest correlation.

If the hedging tool has a strong correlation, it is more likely to relate to your own price risk.

There is no point protecting price risk with a product which moves in the opposite direction to your own local pricing.

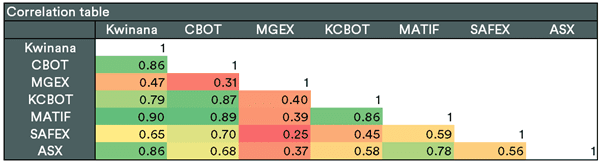

Figure 2 below shows the correlations between the Kwinana price and a selection of futures contracts. I have chosen Kwinana APW at random for this article, but happy to provide the same table for other regions on request (or follow our twitter).

A correlation of 1 implies a perfect relationship, with 0 being no relationship. The top 3 contracts which correlate with the Kwinana APW are:

- Matif (French wheat contract) at 0.9

- CBOT at 0.86

- ASX at 0.856

All in all, these three contracts are pretty close to one another, and based on the previous five years have followed one another quite closely.

Figure 2.

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

HAVE YOUR SAY