CHINA’s move to slap an 80 per cent tariff on imports of Australian barley will have a significant impact on the marketing and export of Australia’s second largest crop.

Barley industry at a glance:

- Barley is Australia’s second-biggest winter cereal by area and volume, after wheat

- In 2019-20, Australia produced 15.2 million tonnes (Mt) of wheat, 8.9Mt of barley, and 2.3Mt of canola

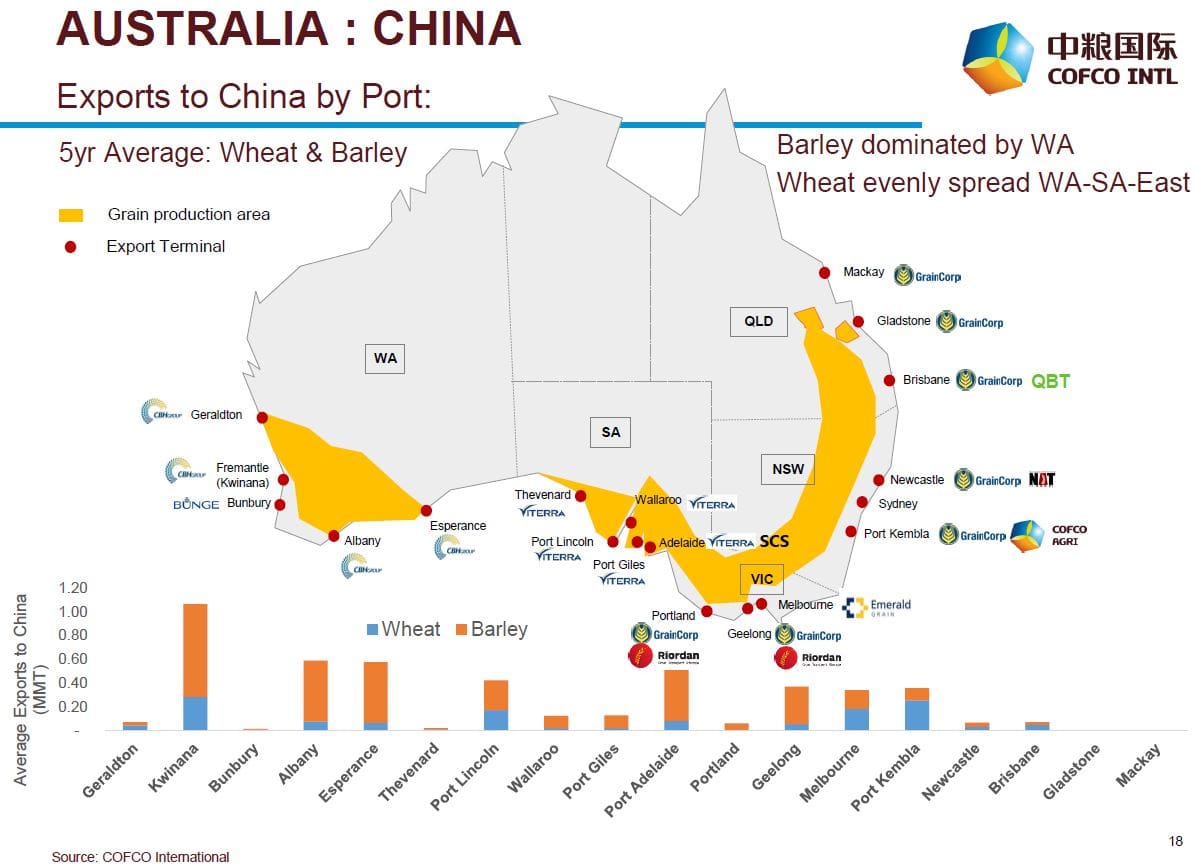

- In 2019-20, (which was impacted by drought in eastern Australia), Western Australia produced 3.7Mt of barley, South Australia 1.9Mt, Victoria 2.5Mt, New South Wales 700,000t, Queensland 60,000t.

- The main exporting states are WA and SA where domestic demand for malting and feed barley is considerably smaller than in the eastern states

- Planting of this season’s barley crop is well underway

- It is estimated Australian growers will plant 4.5 million hectares (Mha) of barley this season with potential to produce at least 9Mt

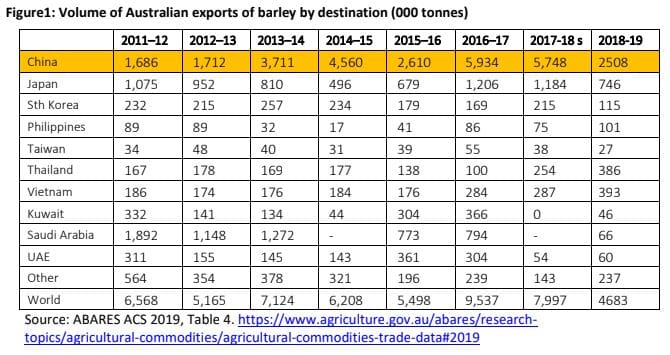

- China is Australia’s largest barley export market

- Australia is the largest supplier of barley to China

- Between 2015 and 2018, China imported, on average, 4.6Mt or A$1.3 billion of Australian barley accounting for over 70pc of Australia’s barley exports

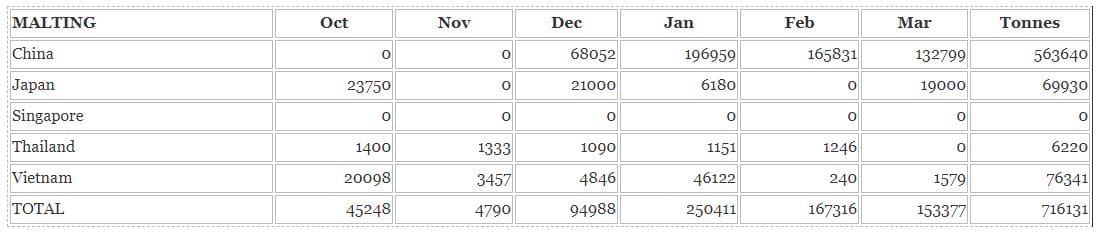

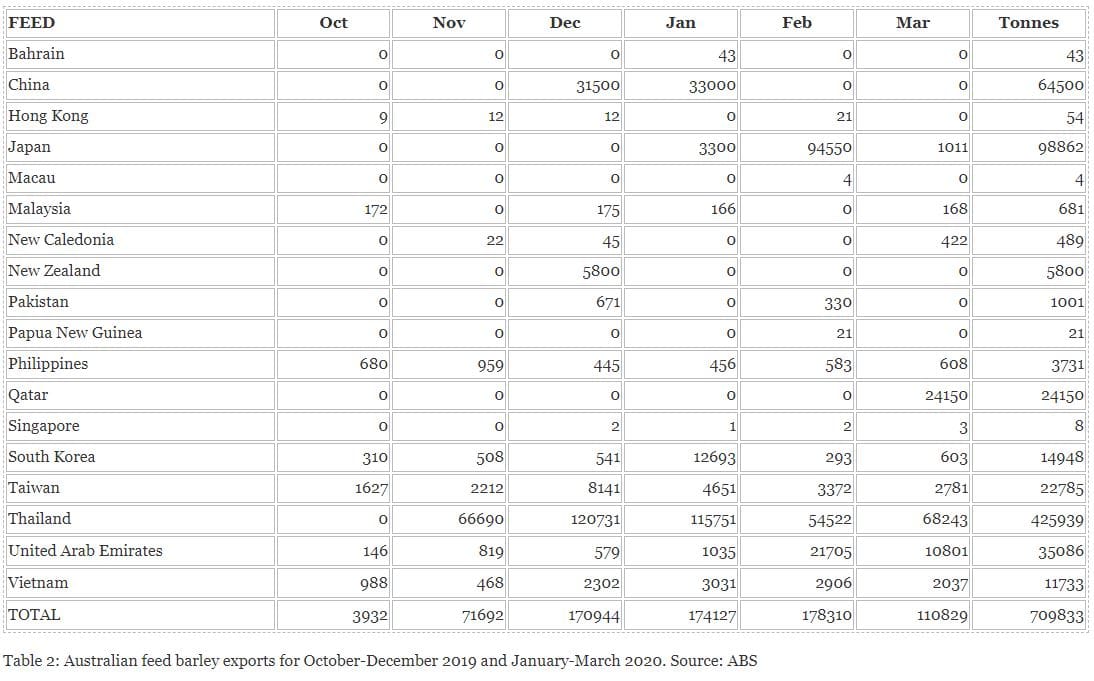

- Between 1 December, 2019, and 31 March, 2020, Australia shipped 666,092t of malting barley and 634,210t of feed barley to China, almost half of Australia’s barley export shipments which totalled 1.3Mt.

- Projections about Australian barley exports in the current crop year put sales to China at 1.5Mt, compared with around 4Mt in an average year of Australian production.

Table 1: Australian malting barley exports for October-December 2019 and January-March 2020. Source: ABS

Sources: ABARES, ABS, GTA, COFCO

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY