CHINA’s resurgent demand and lower global barley production are driving prices to their highest point in nearly three years.

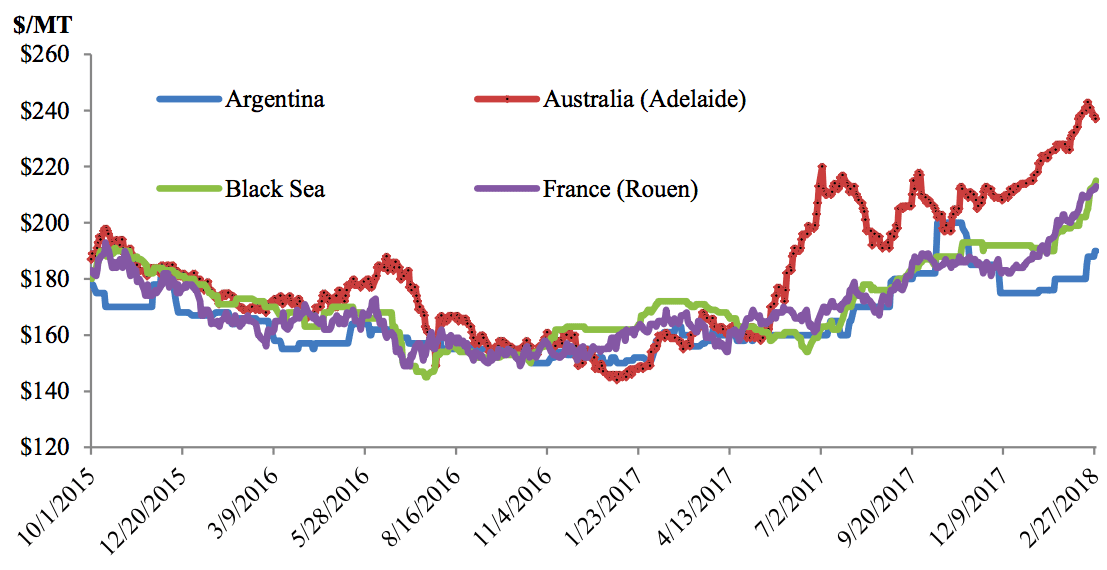

FOB (free on board) feed barley price quotes from four key export origins (Source: USDA)

Demand has particularly surged in the Chinese province of Guangdong (the origin for half of China’s imports) where imported barley is used as a profitable energy component relative to other feedstuffs.

Robust malting demand in interior provinces has also contributed to resilient imports.

In addition to China, Saudi Arabia’s relatively inelastic demand and the lowest projected global stocks in more than 30 years are also driving prices upward.

Saudi Arabia, typically the world’s largest barley importer, is expected to continue its strong presence by accounting for nearly a third of world imports this year.

Happy combination

China’s imports began to surge at the start of 2017/18 with low global prices, as a record Australian barley crop drove prices downward (see last year’s report here).

The combination of Australia’s record 2016/17 crop and a free trade agreement with China (effective December 2015) made the feedstuff a lucrative import.

Since that period, however, Western Australia’s March FOB prices for barley have surged almost $80/tonne (while wheat climbed $50/t).

Even so, China’s imports are raised this month as its demand has shown little signs of waning but are still forecast lower than last year amid tighter global supplies.

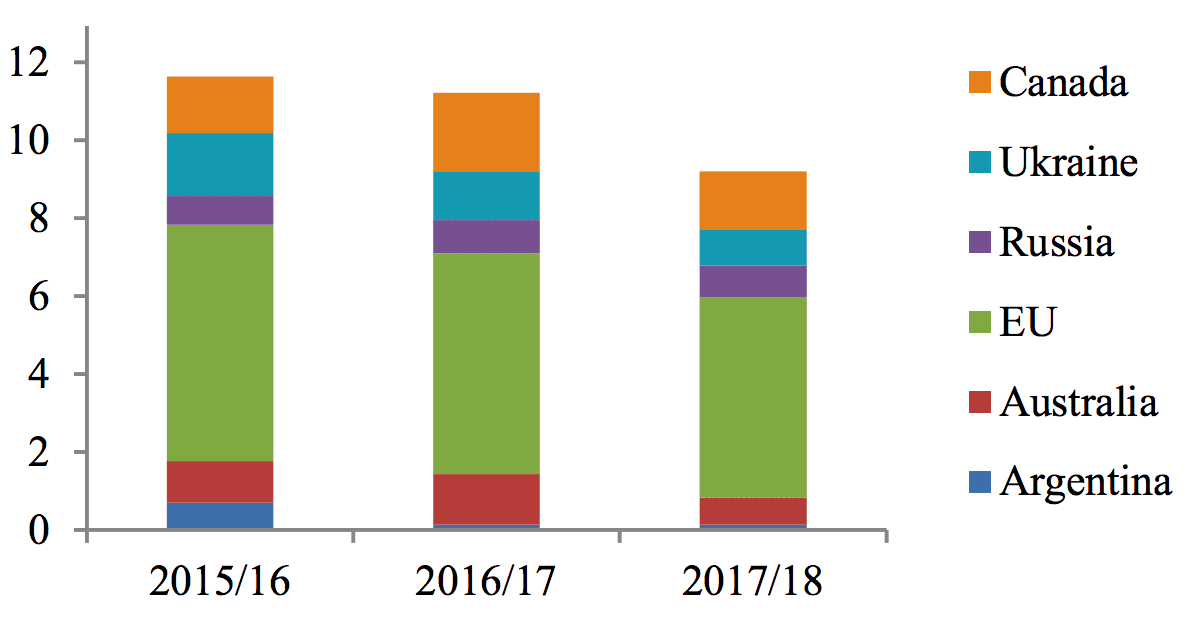

Barley stocks (million tonnes) at major export origins down by one-fifth (Source: USDA)

As a result of robust global demand and lower world production, ending stocks in all major exporting countries are projected down by year’s end.

Current projections have global stocks down more than a third compared to two years ago.

China’s resurging presence has greatly influenced barley prices since last year, even as they fail to deter its robust imports.

Source: USDA

HAVE YOUR SAY