Strong domestic and export demand has lifted values for barley. Photo: Barrett Burston Malting

THE REMOVAL of tariffs on Australian barley by Chinese authorities has seen barley prices trend higher since the start of August, according to NAB’s September Rural Commodities Wrap released today.

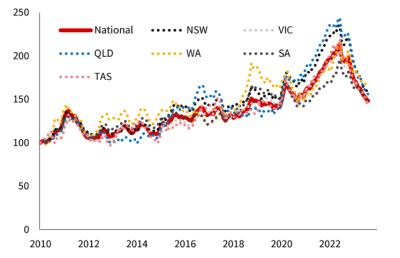

The NAB Rural Commodities Index fell 1.6 percent in August and is now 30.7pc lower compared to when Australian rural commodity prices peaked in June 2022.

The key drivers of the decline in the index in August were cattle, down by 5.4pc month on month, while vegetables dropped 6.4pc, and lamb fell 11.2pc.

In contrast, feed barley prices have increased to now be up to $340 per tonne, compared with $294/t at the same time last month.

El Niño impacts

NAB senior economist Gerard Burg said while the Bureau of Meteorology has not yet declared an El Niño event, its El Niño alert remains, and it anticipates it will develop in spring.

NAB Rural Commodities Index featuring national and state data. January 2010 = 100. Source: NAB

“This is likely to result in hotter and drier conditions across eastern and northern Australia, negatively impacting a range of key agricultural regions,” Mr Burg said.

“Dry conditions due to the emerging El Niño have impacted cattle and trade lamb prices and are expected to substantially impact crop yields.

“Despite a marginal upward revision, the ABARES’ September forecasts still expect winter-crop production to fall by almost 34pc in 2023-24, down from record highs in 2022-23.

“Australian wheat prices continued to broadly track sideways in August, having settled at around $400/t since late 2022.

“Canola prices edged up above $700/t in mid-August, before dropping back below this level in early September.”

Cotton prices have continued to trend higher since pushing above $700/bale in mid-July.

While still well below the peaks of early 2022, prices are strong from a long-run perspective.

Weaker cotton production in 2023-24 will be driven by reduced dryland planting.

Fertiliser costs up

Fertiliser prices in August somewhat reversed the downward trend that they have exhibited since September 2022.

The NAB index rose 8.1pc month on month, driven by a strong uptick in the price of DAP.

While prices are well down from the peaks that followed Russia’s invasion of Ukraine, they remain above long-term trends.

Comparatively high energy prices are likely to see this recent trend persist.

The softening trend for the Australian dollar that started in mid-July continued across August and into early September, dropping below US64 cents, reflecting a stronger US dollar and weaker sentiment around China.

NAB now forecasts the AUD will end 2023 at US66c but trending higher across 2024.

Source: NAB

HAVE YOUR SAY