The Australian cotton industry has sold almost all of its over 5 million bale crop from 2023-24. Photo: Australian Cotton

AUSTRALIA’S bumper 2023-24 cotton crop is nearly fully sold, with strong global demand despite persistent ongoing economic headwinds in some markets.

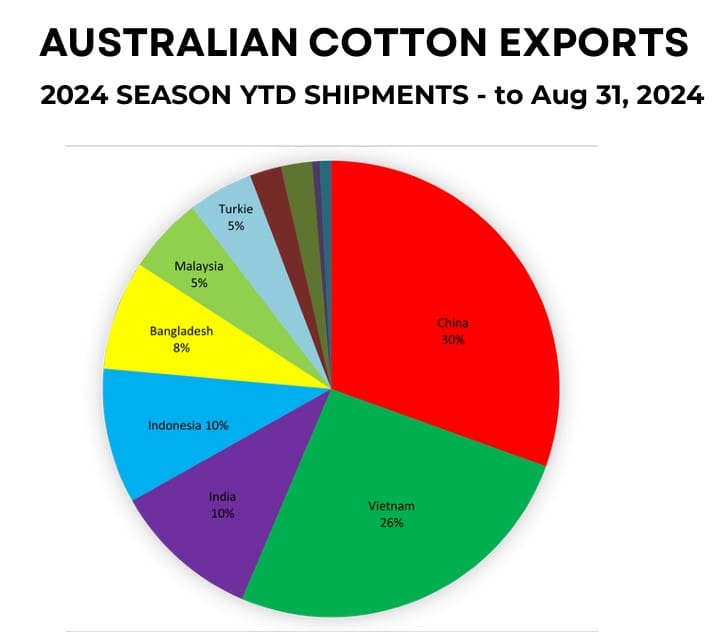

China has returned as a key market for Australian cotton, taking a 30-percent share as of August 31, followed by Vietnam, India, Indonesia, and Bangladesh.

According to Cotton Australia’s data platform, the 2023-24 season yielded just over 5.1 million bales, one of the largest on record.

Australian Cotton Shippers Association chief executive officer Jules Willis said it was a great achievement for the industry to successfully move more than 5 million bales from another near-record crop year.

“The cotton merchants have managed to sell most of our product during a season where Australia’s usual quality parameters were affected by wet weather at harvest, impacting colour and grade for a significant proportion of the crop,” Ms Willis told Grain Central.

“There still remains a small volume of product going through the gin, and there’s continued interest from buyers.”

Ms Willis said she expected the unsold cotton “to continue to be shipped over the November-March period”.

China returns as key market

China’s return as a significant buyer is notable, though its market share is now about half of what it was in 2019 prior to the soft ban period.

Despite China’s softened demand due to economic conditions, Australian exports to the country remains strong.

Ms Willis said the continued uptake of Australian cotton in other markets reflects the success of market diversification efforts made during China’s soft-ban period.

“Australian cotton’s high quality continues to drive demand, even amidst shifting economic conditions and decreased global consumption of cotton-based fashion and homewares.”

Source: Australian Cotton Shippers Association

Indian market prospects

As well as reestablishing engagement within the Chinese market, Ms Willis said ACSA was considering its role in assisting the Australian Government’s negotiations with India.

Australia signed an Economic Cooperation and Trade Agreement with India in 2022 and is now working on a more comprehensive agreement – the Comprehensive Economic Cooperation Agreement, or CECA.

Currently, Australia can export 51,000 tonnes of cotton into India tariff free, with shipments beyond this incurring an 11pc import tariff.

Figures show India imported just over 61,000t of Australian cotton in 2023, with around 10,000t attracting the 11pc tariff.

Ms Willis said given India’s distance from Australia compared to other cotton markets, such as Indonesia and China, shipping costs were also a factor for buyers.

“The shipping costs into India can be four times the price going into China.”

She said these were “standard” considerations with international trade, but adding an 11pc tariff makes it more challenging.

“We are committed to playing a role in supporting [the government] with their FTA [CECA] negotiations and we are engaging with the Government and industry to identify ways we can contribute to the bilateral relationships and help drive our two-way trade.”

ACSA strategic direction update

Ms Willis took up the role as ACSA’s inaugural CEO in July and is leading efforts to launch a new strategic plan for the association.

The plan will be released next month and will provide a framework for the Association’s work over the coming five years.

She said the plan will focus on three key strategic pillars, including: industry leadership and advocacy; communication and engagement, and marketing and promotion.

“It will provide direction around the work we’re doing to ensure Australian cotton stays ahead of its competitors, with an emphasis on collaboration, strong leadership, and enhanced representation across the industry”.

Ms Willis said the plan will guide engagement across the Australian cotton value chain as well as with government agencies, international markets, consumers and other global cotton associations.

“We want to ensure people are aware of Australian cotton and it remains top of mind amongst our buyers.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY