Protein Industries Canada program manager Lisa Campbell addresses IRC in Sydney this week.

A PROJECT involving two global companies, Corteva and Bunge, and Canadian ingredients manufacturer Botaneco is looking to introduce a canola meal with a protein profile to rival that of soymeal to the Canadian stockfeed market.

It was just one project outlined by Protein Industries Canada program manager Lisa Campbell in her address to the International Rapeseed Congress held in Sydney this week which ran through some of the highs and lows of value-adding in Canada.

The sector is being supported by the Canadian Government through PIC as the investment arm for one of five Global Innovation Clusters, and supported projects must contain at least one Canadian company, and a minimum of three companies all up.

Ms Campbell said the Botaneco, Bunge and Corteva project is the initial PIC fund’s largest canola initiative, and seeks primarily to produce a meal to displace imported soymeal in poultry and pig rations.

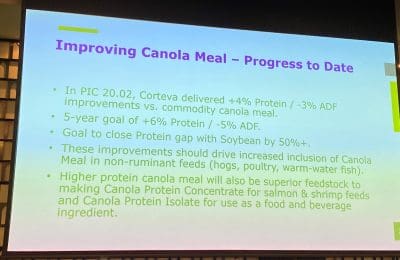

“Corteva is working to create a hybrid canola seed with increased protein content and less fibre,” Ms Campbell said.

“Corteva is looking to close that gap between canola meal and soymeal.”

Protein Industries Canada has invested in a project with Corteva, Bunge and Botaneco which aims to increase demand for canola meal for stockfeed and human-consumption.

Corteva is the project’s lead partner, and is looking to bring the project to scale, hence the involvement of Bunge.

“They can’t bring this to scale in Canada unless our large Canadian crush companies can use it.”

The project aims to ultimately offer to the stockfeed sector a canola meal of around 44 percent protein, only just behind soymeal on 46pc, and well ahead of currently available canola meal at 37pc.

Through Botaneco, the project also aims to put canola meal featuring the ProPound trait into human-consumption products.

Success not assured

Ms Campbell said Canada was well positioned to capitalise on growing global demand generally for plant protein, as evidenced by strong sales in plant-based milks and snackfoods.

“There, however, have been a lot of speed bumps.”

Ms Campbell said the mothballing earlier this year of Merit Functional Foods showed the slump in demand for meat alternatives, with Merit Functional Foods Canada’s major casualty.

“They got a big spike during COVID and then a crash,” she said of the alternative meat sector.

“That area is struggling and looking for new innovation.”

Ms Campbell said Merit’s customer base was in Canada and across the US, and the plant’s closure has had ramifications in the supply chain.

“It’s left a gap.”

Merit was also producing plant protein made from field peas, which along with lentils and canola, are Canada’s main rotational crop for cereal producers.

“When Merit was running, the canola protein was the most in-demand ingredient.”

Another PIC-supported project involves two western Canadian companies, AGT Food and Ingredients, a long-time producer of split pulses and pulse flour, and Federated Co-operatives Ltd, as well as ulivit, pronounced “You-live-it”, a high-end Canadian manufacturer of plant-based foods.

The project builds on an AGT-FCL joint venture announced early last year which is building a canola-crushing facility in western Canada to produce biofuel, and further value-add ingredients for human and animal markets.

PIC is also investing in projects which have potential to boost the value-add for Canada’s pea crops, but Ms Campbell was clear in pointing out some drawbacks for pulses.

For peas, it is primarily the greenish tinge which is generally not desirable in human-consumption products, and for soy it is primarily some allergic risk.

Ms Campbell said canola’s diverse geographic spread and the size of its footprint in Canada made it a preferred option for plant protein because of its greater ability to weather adverse seasons when compared with oats and pulses.

“Canola’s value first and foremost is its land base.”

HAVE YOUR SAY