The harvest team finishes up at Viridis Ag’s property, The Grange, south of Geraldton. Photo: Levis MacKenzie

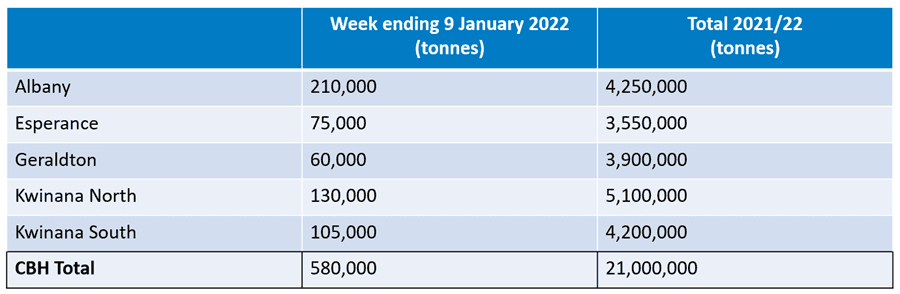

DELIVERIES from the record-breaking Western Australian crop have slowed in the past week, and intake has hit 21 million tonnes (Mt), according to CBH Groups final report for 2021-22 harvest.

While many growers have now finished harvest and more sites have closed for the season, CBH Group acting chief operations officer Mick Daw said there was still more grain still to be delivered, especially in the Albany Zone.

“We have faced many challenges this year from natural disasters, to labour and skill shortages, COVID-19 related restrictions and everything else in between.”

“However, one of the greatest surprises for CBH and our grower members has been this years’ record harvest, of which we have received a staggering 21Mt to date.”

“Preparing our supply chain and network to receive, handle and outload this bumper crop has been a key focus.

“This year we built and added 2.3Mt of emergency storage at 33 sites in our network, which is 10 per cent of our total storage capacity, mobilised and operational within months.”

“While there could be another 400,000t to be delivered, we are staying focused on getting the remaining crop in safely and efficiently, cleaning up sites and transitioning to out-loading.”

“I would like to thank and congratulate our grower members for their hard work and patience, and thank our employees and contractors for their massive effort in helping us safely receive this bumper crop.”

Wheat, barley prices ease

Grain markets last week continued to drift lower with APW1 prices falling below $360 per tonne free in store (FIS) Kwinana for the first time in three months, and feed barley prices dropping to $260/t FIS Kwinana, the lowest in six months.

CBH said the lower values were caused by a combination of lack of international interest, with most buyers still on holiday, and a general softening in markets with no news to move markets either way.

Grower selling has also slowed because of the softer market, and because many are on holiday and not expected to resume selling of large volumes until later in the month.

Canola markets recovered during the week, closing at $865/t FIS Kwinana on the back of some short covering as the trade positioned itself against existing shipping commitments.

Market are continuing to watch the impact of the Omicron COVID variant, and the possible impact to supply chains and demand.

With the significant increase in cases in Australia, there may be some impact to agricultural supply chains.

Following is a summary of conditions by zone:

Only an estimated 200,000t is expected to be delivered to the CBH network from the zone’s record crop, and most primary sites remain open as harvest winds down.

Cranbrook and Mirambeena will be the last country sites to close, while the Albany Grain Terminal will continue to receive late deliveries of most grains.

Esperance Zone

A handful of sites remain open in the zone to receive final tonnages.

Grain is coming in from on-farm silo bags at a steady pace. with a high number still to be emptied around the zone for delivery to port or open receival sites.

Highlights for the 2021-22 harvest included eight out of 13 sites breaking daily receival records, and 10 of the 13 sites having their biggest ever season.

The zone shipping total for October-December was almost 700,000t.

Geraldton Zone

The zone has had some last-minute tonnage trickle, and is now all but finished.

This season has seen many sites break all-time and daily receival records, and Mingenew received 643,460t for harvest, an all-time country receival record outside of the four ports.

Kwinana North Zone

With less than 50,000t estimated to be delivered, only five or six sites will still be open with most closing at the end of this week.

Key highlights for the season included receiving a record harvest for the zone and many site and daily records.

Kwinana South Zone

Daily receivals are declining quickly, with less than 50,000t expected to be delivered to the 10 sites remaining open across the zone.

Source: CBH Group

HAVE YOUR SAY