The US remains the world’s biggest exporter of sorghum to China. Photo: Kansas Sorghum

AUSTRALIA is forecast to export 1.4 million tonnes (Mt) sorghum in the year to February 2022, according to the latest Grain: World Markets and Trade report from the USDA’s Foreign Agricultural Service released overnight in conjunction with USDA’s monthly World Agricultural Supply and Demand Estimates.

The report said in the past, Australian sorghum was exported to a wide range of destinations, but since China entered the sorghum market in earnest in 2013-14, most of it has sold to China.

“Despite the ongoing trade dispute between the two countries that has halted the flow of Australian barley to China, bilateral sorghum trade remains strong,” the report said.

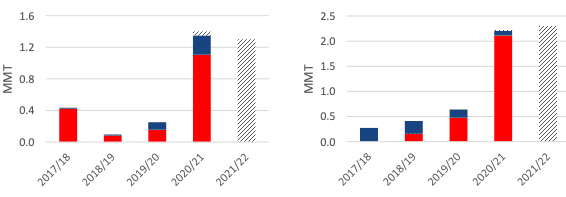

Figure 1: Sorghum exports from Australia (left) and Argentina (right) to China, indicated in red, and to the rest of the world, in blue, in million tonnes. Source: USDA

Argentina is experiencing a similar boom, and after several years of annual sorghum exports below 1Mt, exports in its marketing year which also ends next month are now forecast at 2.2Mt, more than triple the tonnage shipped in the year to February 2021.

“As the world’s largest sorghum importer, China is also the primary destination for Argentina’s sorghum this year.”

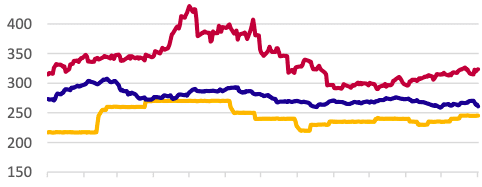

“Despite the strong performances of both Australia and Argentina, the United States remains the world’s top exporter of sorghum and is the top supplier to China.

“However, with US prices higher than its competitors, China is diversifying its suppliers.

“If 2020-21 is any indication, if China is willing to buy, Australia and Argentina are ready to sell.”

In the year to September 2022, China is forecast to import a record 10.3Mt of sorghum, up from 8.7Mt in 2020-21 and 3.7Mt in 2019-20.

For the year to September 2022, US sorghum exports are seen at 8Mt, down 300,000t from USDA’s December estimate, but well up from 7.1Mt shipped in 2020-21.

Figure 2: Export prices in US dollars per tonne of US sorghum ballooned in 2021 (red line) compared with Australian (blue line) and Argentine (yellow line), which may have steered importers to favour the cheaper origins. US$/t. Source: IGC via USDA FAS

Barley exports steady

USDA has left its forecast for Australian barley exports in the year to September 2022 at 8.5Mt from a 13Mt crop, and estimates for other major global exporters are also unchanged from December figures.

These leave the estimate for Argentina’s barley exports at 3.5Mt, 1Mt above the 2020-21 total, Canada at 1.5Mt, down 2Mt from 2020-21, and the EU at 7.3Mt versus 8.6Mt in 2020-21.

The estimate for Russian barley exports is steady at 7.3Mt, down from 8.6Mt in 2020-21, and Ukraine at 6Mt is 1Mt above the 2020-21 shipments.

WASDE cuts soybeans

In its commentary, Lachstock Consulting described the January WASDE report as moderately bearish for wheat, neutral for corn and slightly bullish on soybeans.

“Global cuts to Brazil and Argentina are sending a signal,” Lachstock said.

USDA has cut its estimate for the Argentine crop by 3Mt to 46.5Mt, and Brazil is down 5Mt from the December figure to 139Mt.

On corn, the Brazil estimate is down 3Mt to 115Mt, and Argentina’s corn crop has been cut by 500,000t to 54Mt.

USDA’s estimate for global wheat production in the year to September 2022 is up 700,000t to 778.6Mt, with increases coming in Argentina, up 500,000t to 20.5Mt, and the EU, up 200,000t to 138.9Mt.

The USDA estimate for Australia’s 2021-22 wheat crop is unchanged at 34Mt, and exports are also seen as steady at 25.5Mt.

China’s estimated wheat imports are unchanged at 9.5Mt, while the forecast for Russian wheat exports at 35Mt is down 1Mt from December.

“US wheat production and ending stocks (were) higher than expected, with exports pulled back given the sluggish pace,” Lachstock said.

Source: USDA

HAVE YOUR SAY