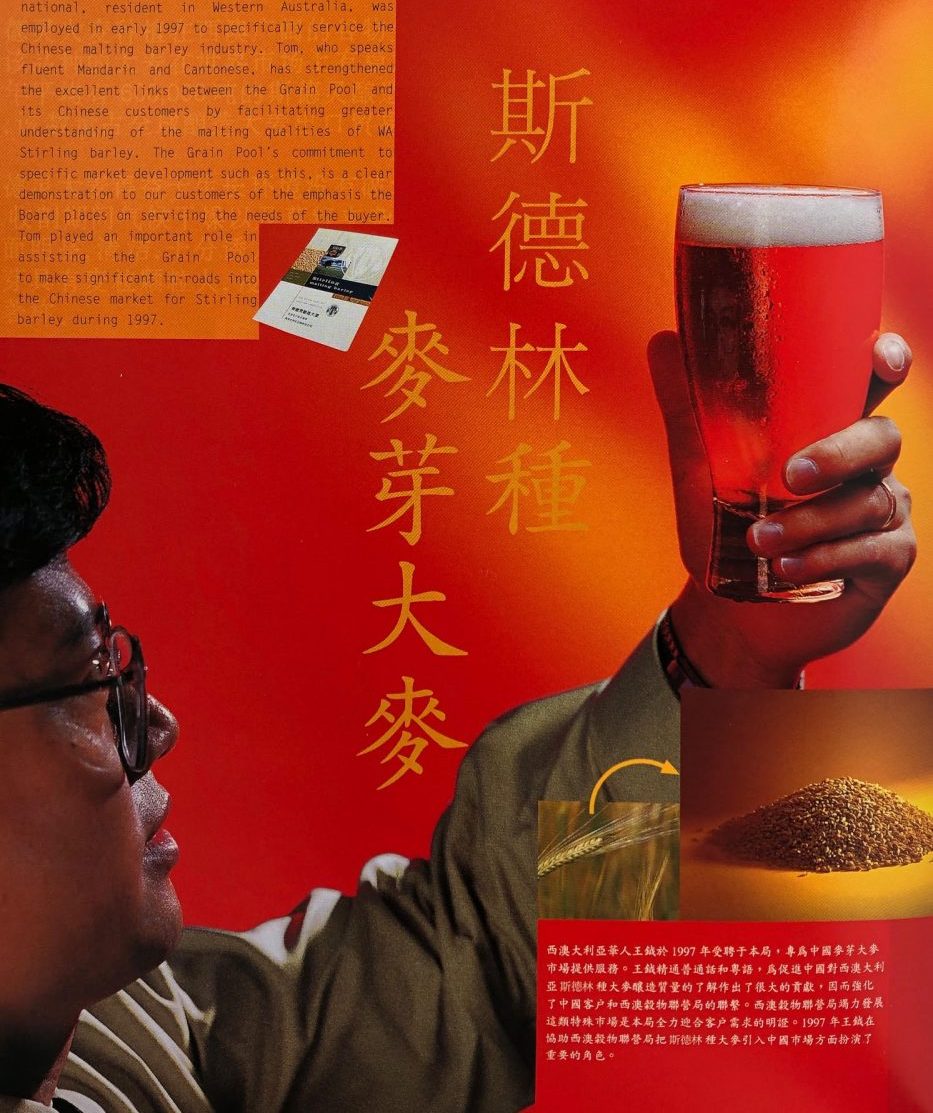

Heady days. Excellent links between Western Australian supplier, GPWA, and China’s malting barley industry were strengthened in the 1990s. Source: GPWA 75 years.

AUSTRALIAN malting barley technical specialists played a big part in establishing and shaping the Chinese brewing industry of today.

They vied with European and Canadian suppliers to nourish a barely existent China malting sector, hungry for knowledge and keen to build modern industrial maltings to slake the country’s emerging thirst for beer.

For a long time, the beer was pretty ordinary, but it got better.

Hand in hand new state-owned breweries and maltings sprang up in major centres all along China’s coastline conveniently consuming foreign origin barley from vessels discharging in nearby ports.

They efficiently converted barley to malt to beer close to centres of population but a long haul from China’s cereal growing regions to the west and north.

That coexistence between customer and grain supplier matured in the 1990s and has grown ever since.

China’s introduction today of tariffs on Australian barley will give some headaches to the Chinese drinker, brewer and maltster as the transition to the new normal will be met by hiccups along the way.

Preferred supplier

Australia’s barley crop is harvested in hot, rapidly drying conditions, and it comes to the market in bulk lines of consistent quality which gives it an advantage over smaller producing origins.

Geared for export, Australian farms have the natural advantage of delivering to processors near-perfect low-moisture grain with low levels of mycotoxins.

Australia can supply uniform, clean and bright grain, attributes which are of intrinsic value to industrial processors.

The investment in malting plants around the world in four decades has been driven by profitability of businesses making malt for brewing.

Chinese State-owned plants came on line in the mid-1990s, taking their cue from what major maltsters were doing in other parts of the world.

They were companies like Cargill, Malteurop, Soufflet and Weissheimer.

Australia’s barley, along with Canadian and French, gave China the ideal leg-up into modern malting.

While brewers in North America, Europe and much of Asia had little flexibility about where to source inputs, China had suppliers from around the world happy to consult in exchange for the chance of establishing business.

While China sourced some barley locally, international suppliers provided nearly all from Australia, France and Canada.

Processing efficiency

The reason Australian barley became the main input was because it was geographically nearby, value for money and worked efficiently in the new malting plants.

Batch times define how long it takes to turn barley into malt.

In decades past, a malthouse could produce roughly 35 batches a year.

Australia’s maltsters Joe White Maltings and Barrett Burston by the 1990s could turn 50 batches a year, and their efficiencies were what Chinese state-owned joint-ventures like Supertime wanted to mimic.

Australia’s then marketing boards, the legislated barley suppliers to Joe White and Barrett Burston, helped them do it.

Aside from intrinsic energy efficiency which underlies any malting plant in both the steeping and kilning phases, Australia’s unequalled pursuit of quality in its grain export is the driver of decades of relationships with its customers.

Quality starts with the barley breeder, and through the grower’s expertise, and the support of the bulk handler, enables traders to offer malting barley which provides unrivalled efficiency to maltsters.

Australia can only hope the quality of its barley, and the relationships it has fostered with Chinese maltsters, will speak for themselves in reducing or eliminating the tariffs.

New horizons

Degrees of change always affect markets.

Peak beer has probably been met in China, as in much of the rest of the world. That’s life.

India will expand as a destination, but Grain Central was told it would never match China because its cultural norms are quite different.

Vietnam and African nations will yield growth in beer consumption over time, but none will be as colossal as what the world has seen since the mid-1980s in China.

Grain Central stories are available on our website.

If you want to receive our free daily cropping news straight to your inbox – Click here

Nice article.

I well remember post Tianeman Square when Australian barley boards rushed back to China to develop markets, against the advice of Australian Government bureaucrats. The technical support we provided as well as assurances of supply helped grow our market share pushing out the superior (?) Canadian variety Harrington. We assisted them to develop malting barley purchase specifications which would deliver them the barley they needed to produce large quantities of beer of consistent quality . Sadly malting (?) barley, along with all Australian and world grain, has been commoditised and its now all about price and sales in the short term. Where is the market development now? Quality has just become something to blend down to. Ye reap what ye sow!

Thanks for your insights Simon. While commerce of course is the driver, its success is measured by long-term relationships between people.